|

Strategic Tax Planning for Sustainable Growth |

This is a guest blog from Green Business Network member Longwave Financial.

Tax season is often a time of year that can bring complexity and stress to even the most spirted and seasoned entrepreneurs. Yet, amid the pressure and seemingly endless paperwork, there’s an opportunity to turn challenges into strategic advantages, especially for those committed to sustainability. There are specific strategies you can undertake to capture tax benefits in areas aligned with the values shared by your organization and stakeholders. Here’s a few tips to help your business pave the way towards a successful and socially responsible future.

Green Business Credits

Federal and local governments reward businesses actively engaged in sustainability through green tax credits. These incentives, designed to recognize eco-friendly initiatives, can be leveraged for investments in energy-efficient equipment, renewable energy projects, and green certifications. You can utilize these credits strategically to not only reduce your tax burden, but also underscore your dedication to socially responsible business practices.

Energy-Efficient Investments

The heartbeat of many businesses lies within their places of work. As a sustainable business, you can capitalize on the Investment Tax Credit (ITC) to capture potentially significant tax benefits, particularly for solar panels and other renewable energy practices such as LED lighting and even energy-efficient appliances. Beyond the immediate financial incentive, incorporating renewable energy projects into your business model can help position your organization as a leader in sustainability within your respective industry.

Home Office Deductions

It’s no secret the rise of remote and hybrid work environments is here to stay. These workplace settings have recently brought attention to home office tax deductions for the many out there who blur the lines between living rooms and headquarters. Designating a home office not only qualifies for tax benefits but also reduces the need for daily commuting, reducing the need for everyday transportation and potential carbon emissions.

Employee Incentives

Whether you’re in the process of building your dream team, or already have employees, you can foster a culture of sustainability by offering benefits for environmentally friendly commuting. Consider providing incentives such as public transportation passes or bicycle programs. Certain employer sponsored programs for green commuting can qualify for tax benefits for both you and your employees.

As sustainably focused principles become an integral part of everyday business operations, incorporating these strategies into your business’ tax planning is a natural progression. Leveraging the various tax incentives for green practices gives you a distinctive opportunity to weave your commitment to the planet into the financial picture of your organization. These strategies can help further lay the groundwork for a future where prosperity is measured not only in the bottom line, but also in the positive impact you have on the world.

Brennen Ramos is a financial advisor and CERTIFIED FINANCIAL PLANNER ™ Professional at Longwave Financial. He works with clients in the NY region as well as throughout the country. He lives in Harrison New York with his fiancé Taylor and his puppy Stella. Growing up in the Hudson Valley has made him an outdoors fan for life and when he’s not working, he’s hiking or fly fishing. If you have any questions or would like to know more, you can reach him directly at Brennen@longwavefinancial.com or connect with him on LI.

Securities and advisory services through Commonwealth Financial Network®, member FINRA/SIPC, a Registered Investment Adviser. Additional advisory services offered through Longwave Financial LLC are separate and unrelated to Commonwealth. Commonwealth Financial Network® and Longwave Financial do not provide legal or tax advice. You should consult a legal or tax professional regarding your individual situation.

420 Lexington Avenue, Suite 845 New York, NY 10170 212-279-9121

|

|

“CLIMATE VICTORY GARDENS” CAMPAIGN NEARS 25,000-GARDEN MILESTONE |

Green America Offering New Gardening Resources and Free Webinars to Welcome Spring.

WASHINGTON, DC – March 11, 2024 – As spring approaches, Green America’s Climate Victory Gardens campaign is offering new tools and information to help beginner and advanced gardeners gear up. Climate Victory Gardens help fight climate change through regenerative agriculture techniques, an approach to gardening that fosters healthy soil that can draw down carbon dioxide from the atmosphere. Restored soil can capture 25-60 tons of atmospheric carbon per acre.

Nearly 25,000 gardens already have been tracked on Green America’s interactive map. For new climate victory gardeners, Green America is holding a series of free webinars featuring Perla Sofia Curbelo-Santiago, Ocean Robbins and the TransPlanter Rafaela Crevoshay, and Ashlie Thomas “The Mocha Gardener.”

Emma Kriss, Food Campaigns Manager at Green America, said: “Climate Victory Gardens offer a rewarding way to support endangered pollinators, heal the planet by sequestering atmospheric carbon, and grow food that’s more nutritious than typical store-bought produce. They’re also a great way to seed cross-generational relationships. As a variety of factors continue to reshape the housing market and the economics of cohabitation, fostering conversations about climate victory gardens on shared spaces opens opportunities for parents, children, landlords and tenants to work together for the good of people and the planet.”

Green America’s Climate Victory Garden resources cover 10 carbon-capturing practices:

- Grow Edible Plants - Grow food, not just grass and ornamentals. This decreases your grocery bills, encourages seasonal eating, and helps you and your family establish a closer relationship with your food.

- Keep Soils Covered - Protecting soils is the first step to improving their health. Physically covering exposed ground in your garden decreases water needs, curbs erosion, maintains topsoil, and protects soil microbes.

- Compost - Organic materials combined with healthy microbes create a strong fertilizer. This reduces waste going to methane-releasing landfills (greenhouse gas), increases your soil quality, and improves nutrition levels in the foods you grow.

- Encourage Biodiversity, Above and Below Ground - Diverse plants support diverse soil communities and make for beautiful gardens. Biodiversity helps your garden grow nutritious food, create habitat and balanced ecosystems, and keeps pests in check.

- Plant Perennials - These crops reduce soil disturbance and save you time, because they do not need to be replanted each year. Perennials protect your garden from the elements, control weeds, and provide habitat.

- Ditch the Chemicals - Synthetic chemicals like herbicides, pesticides, and fertilizers kill beneficial organisms in the soil. Gardening chemical-free reduces your input costs, ensures safety for you and your family, and decreases pollution—from factory production to run off.

- Integrate Crops and Animals - Plants and animals evolved to coexist. Having animals in your garden or yard—like chickens, goats, or pigs—helps decrease pests and allows for natural fertilization. You may even get some eggs or milk out of the deal! If you can’t have animals, consider adding manure to your compost. Encourage pollinators and birds to enjoy your garden.

- Use People Power, Not Mechanization - Ditch the machines and use your hands! It’s hard work, but this helps reduce your dependency on fuel, decreases emissions, and lessens your costs. It eliminates the possibility of your soil being contaminated by spilled oil. And, you can build human relationships by asking for help from others.

- Rotate Plants and Crops - It’s important to move crops around in your garden and plant new varieties each season. This confuses pests, ensures soil nutrients stay balanced, and reduces your need for chemical inputs.

- Get to Know Your Garden - This goes beyond simply familiarizing yourself. Studying your garden helps you identify planting zones and determine how water, inputs, and other management can be applied most efficiently.

“As we learn more about the dangers of pesticides present on many fruits and vegetables we purchase at the grocery store, planting a Climate Victory Garden gives consumers a way to grow food they know is safe,” said Todd Larsen, Executive Co-Director of Green America. “And foods grown regeneratively are shown to have higher nutritional value as well.”

Climate Victory Gardens were inspired by the “Victory Gardens” campaigns during WWI and WWII that produced 40% of the fresh produce consumed in the U.S. at the time, and they empower Americans to grow gardens with regenerative agriculture techniques to help address the climate crisis. To add your own Climate Victory Garden to the map, visit: https://greenam.org/garden.

ABOUT GREEN AMERICA

Green America is the nation’s leading green economy organization. Founded in 1982, Green America provides the economic strategies, organizing power and practical tools for businesses and individuals to solve today’s social and environmental problems. http://www.GreenAmerica.org

MEDIA CONTACT: Max Karlin for Green America, (703) 276-3255, or mkarlin@hastingsgroupmedia.com.

|

|

Grants & Partnerships Director, Center for Sustainability Solutions |

Hours: 32 hours/week, flexible 4-day work week (full time)

Salary: $95,000-$105,000

Benefits: Excellent benefits package, including health insurance, dental and vision coverage, paid leave, socially responsible retirement plan, and a friendly and collaborative work environment with an option to work remotely.

Supervisor: Director of Development & Organizational Advancement

Organizational Background

Green America harnesses economic power – the strength of consumers, investors, businesses, and the marketplace – to create a socially just and environmentally sustainable society. Our niche is economic action, and we work to shift our economy to one that works for all people and our planet. Our economic strategies deploy solutions to our society’s most pressing problems – from climate change to social injustices.

We direct our efforts within three strategic hubs: 1) our Consumer & Corporate Engagement Programs where we activate individual consumers and investors to create change within corporations and economic systems; 2) our Green Business Network which was the first network of businesses in the US focusing on the triple bottom line of people, planet, and profit; and 3) our Center for Sustainability Solutions which brings together diverse stakeholders through Innovation Networks that aim to shift entire industries towards sustainability and solve for supply chain and other economic system issues that no one business or organization can solve alone. Active networks and key initiatives within the Center include the Soil & Climate Alliance, Soil & Climate Initiative, and Clean Electronics Production Network.

Job Duties and Responsibilities

We are searching for a dynamic senior level development professional with an entrepreneurial spirit and partnership development experience to join our team.

The Grants and Partnerships Director will play an essential role in supporting various programs and projects within Green America’s Center for Sustainability Solutions, with a primary focus on grants and partnerships management.

Responsibilities will span the entire spectrum of grants and partnerships management, from identifying new funding and partnership opportunities, to participating in the development of project concepts and plans, to submitting proposals and impact reports. Specific duties include:

- Lead the management, cultivation, and stewardship of the Center’s foundation supporters and partnerships, grow the pipeline for all revenue streams, and manage a portfolio of $3.5M+ in active grants

- In concert with the President & CEO and the Center’s senior staff, assist team with developing new programs and initiatives as relevant funding opportunities are identified, moving from basic concept to full plan and proposal

- Identify and build both the potential partnerships and program concepts that can attract new sources of funding

- Maintain and build on relationships with current funders via tailored outreach, program update meetings with Center staff, and impact reports

- Identify and work to develop relationships with prospective foundations, government funders, corporate donors, and other partners related to funding

- Ensure the timely submission of grant reports, financial updates, and renewal proposals for active funders

- Craft and submit grant proposals and letters of inquiry for new sources of foundation and corporate support to help meet or exceed the Center’s financial goals

- Attend Center and Development team meetings, lead fundraising-focused meetings, and serve as Center liaison to rest of Development Team

- Participate in cross-departmental teams [such as our Justice, Equity, Diversity & Inclusion (JEDI) team, May Retreat planning team, Holiday Party team, etc.] as time and interest allows.

Desired Skills and Experience

- You have an entrepreneurial and curious spirit.

- You thrive working with continuously evolving and growing programs that spawn new initiatives on a regular basis.

- You can play a leading role in program strategy discussions and develop detailed action plans and funding proposals.

- You have exemplary communications and interpersonal skills, and experience building long-term relationships with senior foundation executives, business leaders across a range of sectors, nonprofit allies, and other potential partners.

- You possess a Bachelor’s degree and 8+ years of foundation and corporate/business fundraising experience.

- You can demonstrate a track record of meeting 7-figure annual fundraising goals.

- You always meet deadlines, have strong project management skills, and possess competence in working with constituent relationship management software (Raiser’s Edge and Sales Force familiarity a plus).

- You can craft compelling, effective messaging for letters of inquiry, proposals, sponsorship requests, and progress reports.

- You possess funder research skills and the ability to effectively identify, segment, and prioritize prospective supporters.

- You are able and willing to travel: The position involves travel time of up to 25% for network meetings, conferences, meetings with funders, and other purposes.

- You have a passion for creating a more socially just and sustainable society, including personal interest and/or experience in Green America’s issue areas.

- Certified Fundraising Executive (CFRE) certification a plus.

How to Apply:

Send your resume, a cover letter, and a writing sample to: partnerships@greenamerica.org. Applications will be reviewed on a rolling basis until the position is filled.

**********************************************************************************

Green America is an equal opportunity employer. All qualified applicants will receive consideration for employment without discrimination regarding: actual or perceived race, color, religion, national origin, sex (including pregnancy, childbirth, related medical conditions, breastfeeding, or reproductive health disorders), age (18 years of age or older), marital status (including domestic partnership and parenthood), personal appearance, sexual orientation, gender identity or expression, family responsibilities, genetic information, disability, matriculation, political affiliation, citizenship status, credit information or any other characteristic protected by federal, state or local laws. Harassment on the basis of a protected characteristic is included as a form of discrimination and is strictly prohibited.

|

|

Filter Table Tests |

|

|

Green America 2022-23 Forms 990 and 990-T |

|

|

Green America FY22-23 Audited Financials |

|

|

Holding Corporations Accountable for Their Racial Justice Commitments |

Public discourse around the Black Lives Matter protests in 2020 put corporations in the spotlight for their failure to address systemic issues like workplace discrimination and racial inequities.

In response, many corporations came forward with public statements on anti-racism, pledging to fight discrimination and prejudice within and beyond their workforce. As a first step, AirBnB, Uber, TikTok, Amazon, Intel, Netflix, Peloton, and many other companies made donations to anti-racism-focused nonprofit organizations like Equal Justice Initiative and Minnesota Freedom Fund. They also made commitments to pursue anti-racist policies and increase diversity in the workplace.

Research shows that such commitments, if fully realized, would represent a boon for corporations. Diversity—racial, ethnic, ability, gender, and more—is linked to more creative and innovative workplaces. As You Sow’s November 2023 report, “Capturing the Diversity Benefit: Workplace Diversity Linked to Financial Performance” demonstrated that diverse management outperforms all-white management on eight key metrics related to companies’ financial health.

Workplace diversity also increases profit margins. In 2019, the Wall Street Journal found that the top 20 companies with the most diverse employee populations in the S&P 500 index had higher operating profit margins compared to the 20 least diverse companies.

Given both the ethical and financial reasons for companies to pursue greater workplace equity, how have US corporations performed on their diversity commitments?

While some companies have made progress, there is much to still be done. As You Sow’s September 2023 Racial Justice Scorecard evaluated companies on five key areas of their racial-justice efforts:

- publishing a prominent racial justice statement,

- corporate responsibility by the CEO and inclusion of diverse voices within the company,

- acknowledgement of systemic racism (and other key concepts related to racial justice),

- presence of a functioning diversity, equity, and inclusion (DEI) department, and

- collection and disclosure of DEI data.

The scorecard shows that improvements have not been consistent and most companies have provided limited disclosure of the steps they have taken. Across all sectors, As You Sow determined that utility and communications services companies were performing best, while the energy sector performed worst.

Overall, As You Sow found that most corporations studied were not taking an active stance on racial issues, either verbally or in practice. Alphabet, Citigroup, JPMorgan Chase, McDonald’s, and Nucor Corp. received the lowest possible scores for their operations having disproportionately negative effects on BIPOC communities.

Corporations can have outsized impacts on racial justice due to their size and influence. It’s important to pressure companies to adopt clear racial justice commitments, stick to them, and disclose their outcomes transparently.

If you own shares in a company that is lagging on racial justice, voting your proxies is an excellent way to exercise your voice on any racial justice or diversity measures that appear.

If you buy from a company or use their services, your voice as a customer matters as well. Consider contacting companies that need to hear about their customers' concerns about racial justice, and provide them with information about how making a commitment to workplace diversity is not only the right thing to do, but also can have a positive effect on their bottom line. Rally your faith group, school group, or neighborhood to demonstrate collective consumer power with companies that need to improve. Your voice can make a difference!

|

|

SEC Climate Disclosure Rule Falls Short |

Extreme weather events such as 10-foot blizzards in California and 70-degree days with overnight tornadoes in the Midwest – all in the past week -- demonstrate the fact that climate risk is financial risk.

That's why Green America was pleased to see the Securities and Exchange Commission take up a climate disclosure rule. Consumers, investors, and retirement savers have made it clear that under the current voluntary standards, public companies are not providing them with transparent, reliable, and comparable information on climate-related financial risks and opportunities.

Last year more than 15,000 Green America members and supporters signed our petition supporting the Securities and Exchange Commission’s draft rule requiring companies to disclose their carbon emissions.

Unfortunately, due to pressure from dark money front groups and fossil-fuel interests that oppose investing that includes environmental, social, and corporate governance (ESG) factors, the SEC’s original proposal has been so watered down that it could cause companies currently disclosing emissions to backslide.

Here are three areas where the final climate disclosure rule falls short:

Scope 3 emissions. While the proposed rule required disclosure of Scope 3 emissions (or emissions from the supply chain and customer use) when material, the final rule removes Scope 3 emissions altogether. This is problematic because Scope 3 makes up 70% of the average company’s greenhouse gas emissions at the root of the climate crisis – and up to 90% of emissions for fossil-fuel companies whose customers burn their products, and Wall Street banks that lend billions of dollars for fossil-fuel projects.

Scope 1 and 2 emissions. While the proposed rule required disclosure of Scope 1 (direct emissions from company operations) and Scope 2 (emissions associated with the purchase of energy) in all cases, the final rule requires this disclosure only if the company deems these emissions to be “material.” This ill-defined metric opens the door to endless greenwashing, which consumers and investors are already complaining about and which the climate disclosure rule was supposed to solve.

Who must disclose what and when. While the proposed rule required all publicly traded companies to disclose emissions, the final rule requires only large companies (known as large accelerated filers and accelerated filers) to disclose only Scope 1 and 2 emissions, and only if they deem these emissions material. Thousands of smaller companies are exempt -- and some companies that were issuing voluntary disclosures may cease doing so. Further, it requires financial reporting only for physical risk – the cost of extreme climate events – and not the risks to their business from the transition to a low-carbon economy. Finally, it phases these requirements in over time, with some reports not due for another 10 years.

It is unfortunate the SEC is bending to pressure from corporate interests to substantially weaken the climate disclosure rule. Legal experts have made it clear the SEC has the legal authority, granted by Congress in the 1930s, to require reliable and consistent disclosures that investors can use to compare companies, including disclosures of greenhouse gas emissions.

Opinion polls show American consumers and investors support strong and transparent climate disclosure requirements. A recent survey by Data for Progress and Unlocking America’s Future finds that two-thirds of voters -- including 80% of Democrats, 65% of Independents, and 55% of Republicans – support the strong SEC rule as originally proposed.

Finally, a weakened climate disclosure rule puts the United States out of step with other major global economies, including California, the European Union, Canada, Japan, India, China and Singapore -- all of which have climate disclosure rules that include Scope 3 emissions. Because the requirements in these jurisdictions affect the majority of U.S. companies, it makes no sense for the SEC to create a patchwork of regulations by significantly departing from the direction the rest of the world is going.

Due to all these shortcomings, the SEC’s final climate disclosure rule can only be seen as a first step to providing the transparent, reliable, and comparable information that consumers and investors deserve. We look forward to working with the SEC, investors, unions, retirement and pension fund managers, and other stakeholders to strengthen and improve the climate disclosure requirements in the future.

|

|

Green America’s New Verification Label: Regenerative Agriculture Hits the Grocery Aisle |

A groundbreaking label from Green America’s Soil & Climate Initiative (SCI) will soon arrive in grocery stores, and with it an inspiring vision of a thriving, sustainable future for our food system.

“The Soil and Climate Health Initiative Verified label represents a measurable commitment to farming systems that seek to restore the land that feeds us,” said Adam Kotin, Managing Director of the SCI.

Green America has been working toward this moment over the past three years, and is excited to announce the first products to successfully complete the independent verification process. These products are made using ingredients from farms with confirmed commitments to actions to implement regenerative agriculture—a farming approach that prioritizes healthy, living soil.

Farmers in the Soil Carbon Initiative are taking action to:

- Capture carbon in soils, helping the climate crisis

- Build biodiversity above and below ground

- Reduce the use of synthetic fertilizers, pesticides, and herbicides

- Improve water retention in soils

In order to earn verification, farms track soil health outcomes, use practices that protect and nourish the soil, and commit to continuous improvement.

PACHA, a buckwheat bread company based in Vista, California, uses sprouted buckwheat and sea salt with organic herbs and spices to make their vegan and gluten-free products. PACHA sources its buckwheat from verified regenerative farms for all four of their hearty Sourdough Bread products including Buckwheat Loaf, Garlic Rye, Cheesy Herb, and Buckwheat Buns.

“PACHA is dedicated to nourishing the health of people and our planet through regeneratively grown foods. We are so grateful for the farmers making changes to provide our buckwheat, and for SCI’s work that is making our mission a reality,” said Maddie Hamann, director of marketing and co-founder of PACHA.

Roots Chips, a family-run farm-to-bag potato chip company based in Aberdeen, Idaho uses simple and natural ingredients for its farm-fresh products. Roots Chips sources its potatoes from their very own SCI-Verified regenerative farms for all five of their savory kettle potato chip flavors including: sea salt, barbecue, purple sea salt, jalapeño, and sea salt and vinegar.

“The SCI team has developed an amazing regenerative framework for both farmers and brands that we are thrilled to be a part of. We look forward to this tremendous opportunity to work side by side in this initiative,” said Ladd Wahlen, CEO of Roots Chips and fourth-generation potato farmer.

With more brands and farmers currently working toward verification, look for the Soil & Climate Health Initiative Verified label on additional products at your local grocery store later in 2024!

|

|

How We're Greening America |

From the most recent issue of our magazine, Green American, where we update readers on the progress we've made over the last quarter on climate, finance, food, labor, social justice, and more.

Green America’s New Verification Label: Regenerative Agriculture Hits the Grocery Aisle

A groundbreaking label from Green America’s Soil & Climate Initiative (SCI) will soon arrive in grocery stores, and with it an inspiring vision of a thriving, sustainable future for our food system.

“The Soil and Climate Health Initiative Verified label represents a measurable commitment to farming systems that seek to restore the land that feeds us,” said Adam Kotin, Managing Director of the SCI.

Green America has been working toward this moment over the past three years, and is excited to announce the first products to successfully complete the independent verification process. These products are made using ingredients from farms with confirmed commitments to actions to implement regenerative agriculture—a farming approach that prioritizes healthy, living soil.

Farmers in the Soil Carbon Initiative are taking action to:

- Capture carbon in soils, helping the climate crisis

- Build biodiversity above and below ground

- Reduce the use of synthetic fertilizers, pesticides, and herbicides

- Improve water retention in soils

In order to earn verification, farms track soil health outcomes, use practices that protect and nourish the soil, and commit to continuous improvement.

PACHA, a buckwheat bread company based in Vista, California, uses sprouted buckwheat and sea salt with organic herbs and spices to make their vegan and gluten-free products. PACHA sources its buckwheat from verified regenerative farms for all four of their hearty Sourdough Bread products including Buckwheat Loaf, Garlic Rye, Cheesy Herb, and Buckwheat Buns.

“PACHA is dedicated to nourishing the health of people and our planet through regeneratively grown foods. We are so grateful for the farmers making changes to provide our buckwheat, and for SCI’s work that is making our mission a reality,” said Maddie Hamann, director of marketing and co-founder of PACHA.

Roots Chips, a family-run farm-to-bag potato chip company based in Aberdeen, Idaho uses simple and natural ingredients for its farm-fresh products. Roots Chips sources its potatoes from their very own SCI-Verified regenerative farms for all five of their savory kettle potato chip flavors including: sea salt, barbecue, purple sea salt, jalapeño, and sea salt and vinegar.

“The SCI team has developed an amazing regenerative framework for both farmers and brands that we are thrilled to be a part of. We look forward to this tremendous opportunity to work side by side in this initiative,” said Ladd Wahlen, CEO of Roots Chips and fourth-generation potato farmer.

With more brands and farmers currently working toward verification, look for the Soil & Climate Health Initiative Verified label on additional products at your local grocery store later in 2024!

Clean Electronics Production Network Develops Chemical Safety Trainings

Green America’s Clean Electronics Production Network (CEPN) has begun work on a new project to develop chemical management and safety trainings that protect the health of workers in electronics supply chains. The trainings will be provided to facilities that may not have previously had access to such health-and-safety information, and will provide workers with crucial guidance on how to protect themselves and their coworkers from harmful chemicals.

CEPN will seek commitments from companies to support deployment of the trainings to both workers and management at electronics component manufacturers and final assembly facilities and will make training materials available publicly on the CEPN website.

The project is funded by a grant from the Initiative for Global Solidarity, a program of the Deutsche Gesellschaft für internationale Zusammenarbeit (GIZ) GmbH. CEPN is seeking further funding for the next phase of the project: direct deployment of trainings for as many as 30 facilities in Vietnam and Malaysia.

The Faces of Green America

We’re excited to launch this new Q&A series profiling the talented Green America team enacting our green-economy mission. First up is Cathy Cowan Becker, Green America’s responsible finance campaign director, who brought her valuable expertise and thought-leadership on green and equitable finance to the development of this issue of the Green American.

What excites you most about responsible finance and community investing?

Responsible finance is an opportunity to use your money not just to stop doing harm but to actually do good. Take the financial commitments you probably have anyway: a bank account, credit cards, insurance, and retirement plan. What if you could use these everyday instruments to build a more sustainable and equitable world? The good news is, you can!

What challenges are you facing in this work?

The first challenge is a lack of knowledge. Many people don’t know how to find a community development bank or credit union, responsible credit card issuer, regional mutual insurance company, or social investment fund. Once you learn about these solutions, it’s a process to move your money to align with your values. It’s very personal—this is your money! But once you learn how to pull your own money out of a system designed to prop up climate chaos and racial inequality and move it into building community, you can help others—including any institutions you are part of such as a house of worship or nonprofit board.

What would you say to someone who’s on the fence about moving money to align with their values?

First, understand this is a process. Take our 10 Steps to Break Up With Your Megabank—it will take a few months to go through that process, and the same is true for moving your credit cards, insurance, and investments. Start with research for where you want to move your money to—Green America has resources to help such as our Better Banking map, a series of responsible finance webinars starting in April, and a responsible insurance directory coming soon. You can also consult a socially responsible financial planner or financial-services member of our Green Business Network.

What are the most powerful actions people can take with their money/investments?

No one thinks that moving your personal bank account, credit card, insurance, or investments out of fossil fuels will by itself bring about the end of the fossil fuel era. But what it will do is make continued investment in fossil fuels by big banks, insurance, and investment firms less socially acceptable—it’s one more step in pushing big financial players to do better and removing Big Oil’s social license to operate. Plus, it builds your local community—a win-win for everyone!

What do you enjoy doing when you are not at work?

I’m a founding board member for Save Ohio Parks, which fights fracking in our state parks, wildlife areas, and public lands. I swim five to six miles per week, go to an occasional concert or show, and I like lounging around with my husband and two cats.

|

|

Supporting Black Entrepreneurship |

Green Americans imagine a future where all people have enough, communities are healthy and safe, and the abundance of the Earth is preserved for all the generations to come. Responsible entrepreneurs—including a recent spike in African American business owners—are working towards that future now, growing sustainable and inclusive companies that build social impact for their communities, both locally and abroad.

Black Entrepreneurship on the Rise

Over the last few years, entrepreneurship by Black business leaders has boomed.

Many people lost their jobs during the pandemic and were unsure of when their industry would bounce back. Some decided this was the time to become their own boss—new business applications increased more in 2020 than they had in the past 15 years, according to data from the US Census Bureau. Black entrepreneurs accounted for 26% of all new microbusinesses (businesses with ten employees or fewer), up from 15% pre-pandemic.

In 2020, the city of Pittsburgh’s Urban Redevelopment Authority gave out 350 loans—nearly half of which went to Black-owned businesses. This is a huge spike compared to previous years, when 30 to 50 loans a year overall was the average. It’s a trend that is appearing across the country—between February 2020 and August 2021, African American business owners increased 38%, according to research from the University of California, Santa Cruz.

In fact, Black entrepreneurship has doubled since 2019, according to the Small Business Association. There are currently more than 2 million Black-owned small businesses in the US.

Brewing Bold Change

It wasn’t just the pandemic that triggered change for businesses after 2020. The spotlight that the Black Lives Matter movement shone on racial injustice put pressure on corporations. Many of the country’s largest corporations pledged to do better and work toward racial justice and established Black-owned businesses reported experiencing a surge of support after the murder of George Floyd.

African American entrepreneur Margaret Nyamumbo says she noticed the change in 2020, when she says her company’s coffee became the first from a Black-woman-owned business to appear on the shelves at Trader Joe’s. Her direct-trade company, Kahawa 1893, sells African coffee beans grown and harvested by African women producers.

More recently, with the awareness-raising of 2020 receding into the past, Nyamumbo says she has detected a decline in support. She is hopeful that support for Black businesses will become stronger over time, while pointing out that Black communities shouldn’t have to experience trauma for Black-owned businesses to be seen as valuable.

To further build support, Kahawa 1893 participates in the 15% Pledge, an organization working to promote Black-owned brands beyond 2020. The idea is that, since African Americans make up 15% of the population, 15% of shelf space at retailers should be dedicated to Black-owned brands. Macy’s, West Elm, and Nordstrom, and several other large retailers have committed to the pledge, stocking their shelves with Black-owned brands like Kahawa 1893. Green America has supported this pledge via outreach to retailers like CVS and Target who subsequently engaged in dialogue with the 15% Pledge.

Nyamumbo has high hopes for the growth of her business, especially after securing a deal from the sharks on Shark Tank in 2023.

"Respect the drip:" Margaret Nyamumbo (front) with a Kahawa employee serving coffee (in truck). Coffee beans come from a plant that has its origins in ancient forests in East Africa. Kahawa 1893's name combines "kahawa," the Swahili word for "coffee" with the year East Africans began commercially selling coffee into the global market.

The Scoop on Social Impact

Small businesses, including Black-owned businesses, are uniquely positioned to give back to their communities, and may model their business with this in mind. For example, for Nyamumbo, it’s important for Kahawa 1893 to give back to the continent that birthed coffee and the women producers that cultivate it. Every bag of Kahawa coffee has a QR code, which buyers can scan and send tips directly to women coffee producers.

Similarly, Kai Nortey, co-founder of kubé, built an ice cream brand based on her own values and vision for a healthier society. Nortey and her husband are both lactose intolerant, a fate they share with 65% of the US, according to the National Institute of Health. But when looking for dairy-free ice creams on grocery shelves, the Norteys discovered that many of them contain GMOs. So together, they created a creamy vegan ice cream, made from scratch with organic ingredients, so that vegans and lactose-intolerant folks can enjoy ice cream again.

“Kubé is really a story about food justice and the realization of how ‘necessity is the mother of invention,’” says Nortey.

Via Business Insider

Nortey chooses whole-plant-based foods for kubé's ingredients and refuses to use any chemicals. The coconuts, which are the basis for the full-fat coconut cream in the ice cream, are pressed in-house at a shared commercial kitchen facility. The same can be said for the variety of flavors they offer, from key lime to coffee, which are extracted from organic fruits and plants.

Investing in wholesome ingredients is just as important as investing in people and community for Nortey. In 2023, Nortey hired formerly incarcerated mothers and survivors of domestic violence to make the ice cream, paying $22 an hour.

“Social impact looks like giving people economic opportunities for them to thrive,” says Nortey. Such opportunities are incredibly valuable to the more than 1 million people employed by Black-owned small businesses.

What is more, on average, nearly 53% of dollars spent at a local independent business is recirculated in the local economy, compared to less than 14% at chain stores—that means money you spend at a local independent bookseller is used for employee payroll, which may go to groceries from a local farmers market, and so on, enriching the lives of the everyday American.

For Nortey, not only does that look like hiring locally from underserved populations, but it also means giving to local food producers. Coconut shreds are a byproduct of the production process and are a great addition to soil. Nortey donates coconut shreds to Deep Medicine Circle, a nonprofit with several urban farms, and Planting Justice in east Oakland, which grows food for low-income families.

For now, kubé ice cream can be purchased in California at the Grand Lake Oakland farmers market in the summer months, where you can buy directly from Nortey herself. Kubé ice cream is also stocked on the shelves at Berkeley Bowl West and Mandela Grocery Cooperative in the Bay Area.

Struggles for Black Business Owners

Despite the positive statistics, the United States has a long history of racism that cannot be dismantled in a short time. Kubé has not been spared from this fact.

“A CEO of a popular plant-based food company… asked me if I would work for his company. He offered to pay a high salary to do product development, because I’ve created such a phenomenal product,” recalls Nortey. “And I said, ‘Why don’t you just invest in my company?’ They love what I’m making, and they intentionally choose to try and take what I have … it’s a form of sexism and racism because they think I’m designed to build their empire.”

Systemic racism within financial circles results in inequities for African American customers. Redlined communities remain to this day a result of housing discrimination, where neighborhoods were divided by race when banks denied mortgages to Black homebuyers. When it comes to starting a business, Black borrowers are still rejected at higher rates than white borrowers. Black entrepreneurs therefore often rely on personal savings and funding from family and friends instead of seeking a loan from financial institutions.

For example, in 2018, Nortey and her husband raised over $100,000 to purchase industrial ice cream machines on crowdfundmainstreet.com, a public benefit corporation that shares projects in need of funds from startups. She recommends small businesses raise capital on regulation investment crowdfunding sites like crowdfundmainstreet.com, which attract everyday investors. This option allows Nortey to keep control and leadership of kubé, which wouldn’t happen if the company was bought outright.

One day, Nortey envisions kubé as a storefront, maybe next to another Black-owned restaurant, “where trusted relationships can flourish again, where people can feel dignified and honored because they can finally access vibrant and delicious ice cream that respects their allergies and food restrictions,” she says.

Racial Equity in the Hands of Consumers and Investors

Nortey and Nyamumbo agree that people can best support their companies by purchasing their products. They point to how the original Buy Black movement during the Great Depression worked because it sustained emerging Black businesses when the economy sank. Nortey also states that because building capital is the toughest challenge small businesses face, supporters should consider investing in Black-owned businesses. Take these steps to support and invest in Black entrepreneurship:

Patronize Black-owned businesses: Look for businesses in your community to support! Find more Black-owned businesses from these directories:

- EatOkra.com, for finding Black-owned restaurants.

- BlkGrn.com, for hair- and skin-care products, and wellness and home-cleaning items.

- GetTheBag.biz, for subscription boxes of products from mostly Black-women-owned brands. (GetTheBag recommended Kahawa 1893 and kubé for this article.)

- Coastapp.com/shopblackowned, for Black business directories in Boston, Charlotte, Chicago, Dallas, Los Angeles, New York City, San Francisco, and Seattle.

- Miiriya.com, an app for finding Black-owned fashion, home décor, beauty and hair-care products, and art.

Invest in Black-owned businesses: For as little as $100 or so, crowdfunding sites like crowdfundmainstreet (which helped fund the kubé launch) offer opportunities to invest in startups. That seed money is crucial for Black businesses that are skeptical of lending with banks. Additionally, banking with community development banks and minority depository institutions can help fund Black-owned startups. It’s often part of the mission of these financial institutions to support Black entrepreneurs through low-interest loans and financial resources.

Ask retailers to commit to the 15% pledge: Ask the owners and managers of companies where you shop to increase the representation of Black-owned businesses on their shelves. Call or write to other businesses and take the pledge yourself using 15% Pledge’s consumer commitment guide.

It’s a long road to racial equity in our society and we all have a role to play in lifting up historically marginalized communities. Black business-owners like Nyamumbo and Nortey are doing their part, by helping African farmers reach American markets, and hiring from within marginalized communities. Green Americans can do their part as well, by supporting these and other Black-owned businesses.

|

|

The State of Shareholder Activism |

If you own shares in publicly traded companies, you can use your investor power to shape corporate policy for the better.

As an owner of the company, you have the right to use your voice—and vote—through the shareholder resolution process to direct company management to make change.

When you vote in favor of social and environmental progress at the companies in which you own stock, you are joining powerful shareholder allies who have a track record of shifting the priorities of corporate America.

What are corporate resolutions and how do they work?

Shareholder resolutions are 500-word formal requests for corporate management to take a specific action related to the operations of their company.

Shareholders, as collective owners of the company, have the right to propose and vote on resolutions annually related to a variety of issues—corporate governance, employment policies, supply chain management, environmental and social justice issues, and other concerns. Resolutions alert corporate leadership to growing interest by investors in risks to the company’s future performance and can inspire company action to address these concerns, which is why it is so important that all shareholders cast their votes—every vote counts!

“The filing and refiling of resolutions keeps key issues in front of management year after year and does not require majority support to spur improvements,” says Cathy Cowan Becker, Green America’s responsible finance campaigns director.

If a resolution earns at least 3% support in its first year, it can reappear the next year. A resolution must earn 6% support in its second year, and then 10% every year thereafter to continue to reappear. Each appearance of a resolution draws negative media attention to the company and raises investor and consumer awareness of serious issues with its operations, until the company is persuaded to act.

While companies were once resistant to even examining their social and environmental effects, increasing shareholder and consumer focus over time on such issues has made the issuance of a “corporate social responsibility” report commonplace in 2024. Shareholders have demonstrated succcess in persuading companies to address issues as varied as product safety; waste management; the climate crisis; and diversity, equity, and inclusion priorities.

Every proxy season, Green America tracks resolutions for environmental, social, and governance matters. We compile these so our readers that happen to also be direct shareholders can learn more about what is on their proxy ballot.

So, what happened in the 2023 season?

The State of Climate

Climate resolutions have become more ambitious in scope in recent years, consistent with the scale of the problem, pushing companies to do more than just issue reports, but to actually reduce emissions, strengthen their climate risk management, or begin phasing out their reliance on fossil fuels overall.

Climate-related resolutions were the biggest category of resolution filed in 2023; shareholders voted on 60 resolutions. Notable successes included 47.4% support for a resolution asking PACCAR Inc., the commercial truck manufacturer, to issue a report on how the company’s climate lobbying aligns with the goals of the Paris Agreement on climate change; and 36.6% support for a resolution asking ExxonMobil to measure its methane emissions.

Heidi Welsh, founding executive director of the Sustainable Investments Institute—a nonprofit research firm analyzing organized efforts to influence corporate behavior—says that historically, ambitious resolutions that require a serious change to a company’s business model may take longer to achieve majority support.

Welsh cited a resolution asking JP Morgan Chase to restrict lending to fossil-fuel companies as an example.

“You’re asking companies to completely restructure their lending portfolios to phase out a cornerstone of the current modern economy, which is based on fossil fuels,” says Welsh, who points out that more modest resolutions also took time to build support in the past. To plan for a fossil-free future, it remains important for shareholders to keep pushing for their clear vision of corporate transformation on climate issues, year after year.

The State of Diversity

Bank of America, Ford Motor, and Target all faced resolutions requesting these companies to report on the success of their diversity programs; all resolutions were withdrawn prior to a shareholder vote. Welsh notes that withdrawal is usually a positive outcome.

“A withdrawal in almost every instance comes because the proponent and the company have sat down to talk about the issue,” says Welsh. “The company has agreed to do enough to persuade the proponent that the company is moving forward and doing at least some of what the proponent has asked for.”

The shareholder advocacy organization As You Sow, which tracked the resolutions’ progress, reports that for each proposal withdrawn, filers and the company reached an agreement on next steps.

Welsh notes that investors are interested in making decisions based on hard data, which, in the case of diversity-related resolutions, demonstrates that a commitment to company diversity will pay dividends for investors. For example, a 2020 McKinsey report demonstrated that companies committed to diversity, equity, and inclusion (DEI) in management are more profitable. Similarly, a November 2023 As You Sow report, which analyzed more than 1,600 publicly traded US companies, found greater diversity in corporate management to correlate with many benefits to the company, including income after taxes, and long-term growth.

“Simply put, a diverse workforce led by a diverse management team performs better financially,” said Andrew Behar, CEO of As You Sow.

The State of Racial Justice

Shareholders at Alphabet, Amazon.com, AT&T, Bank of America, Altria, and BlackRock filed resolutions requesting that these companies report on racial justice impacts and plans. None of these resolutions achieved majority support, and some did not appear on the ballot.

However, a resolution doesn’t need to win the majority to provoke a company to respond with improvements.

Cathy Cowan Becker, Green America’s responsible finance director, says that a resolution that garners at least 20 to 30% support could lead to company to take action anyway. While not a majority percentage, such a vote still represents millions or billions of dollars of investor leverage, and companies are likely to listen.

For the racial justice resolutions that did make it to the proxy ballot (AT&T, Amazon.com, and Altria), they garnered between 21% and 30% of the shareholder vote. With votes like that, companies may recognize that concerns about their racial justice outcomes will not go away and will consider ways to enact new policies.

Looking Ahead to the 2024 Season

As You Sow’s 2024 Proxy Preview and Green America’s look at shareholder resolutions will be released in March. Use these resources to find information on upcoming resolutions; if you are a shareholder, you have the opportunity to vote.

Already one 2024 development reflects the recent ESG backlash. In February, ExxonMobil filed suit against investors who proposed a resolution calling on Exxon to reduce its emissions. Exxon’s unusual lawsuit alleges that the resolution is driven by an “extreme agenda” and does not serve investors’ interests. “This amounts to tactics of intimidation and bullying” of investors, said Natasha Lamb, chief investment officer at Arjuna Capital, which filed the resolution.

Most importantly, however, Welsh reminds us that making change in the shareholder arena is a long game, and in that long game, shareholders are powerful, “There are trillions of investor dollars behind efforts to get companies to do the right thing.”

|

|

What Responsible Investing Can Do |

HopeWorks Station in Everett, Washington, has been drawing attention for its multiple areas of socially conscious innovation. The LEED Platinum-certified development integrates 65 affordable apartments for low-income households and those recovering from addiction alongside supportive services, job training, a child-care center, and community meeting space. People who were once homeless and struggling with alcohol- or drug-related issues live on the upper floors and go downstairs to work at Kindred Kitchen, a catering business and community café, or at the business next door, RENEW Home & Décor—all within the same complex.

The innovation behind HopeWorks extends to how it was financed. Affordable housing is usually funded by multiple sources, including large investment companies through Low Income Housing Tax Credits and other federal programs. HopeWorks was financed through a mission-driven nonprofit organization, Enterprise Community Partners, which included financing from its Enterprise Community Loan Fund, a community development financial institution (CDFI).

Individuals interested in investing in innovative projects that reflect their values, like HopeWorks, can do so through financial products offered by CDFIs, like Enterprise. Enterprise's Community Impact Note helped finance the HopeWorks project. Proceeds from the Impact Note support the organization’s general lending work (about 70% goes to affordable housing), with money loaned to nonprofit and mission-aligned for-profit developers.

HopeWorks Station represents a meaningful case study to Anna Smukowski, director of the Enterprise Community Loan Fund, because it shows how CDFI funding works alongside other more conventional sources of capital from Enterprise. “We’re providing funding to communities but also allowing individual people to get more invested in their communities, people who want to live their values through their investments,” Smukowski says.

Investment in the Enterprise Community Impact Note is open to people around the country, for a minimum investment of $5,000. However, many CDFIs and community-focused lenders offer even lower entry points for their financial products—including as little as $20 (see box on p. 21).

The Role of CDFIs and Community-Focused Lenders

Environmental and social impact investing has become part of the investment mainstream recently, and CDFIs have an important role, according to the “CDFIs and the Capital Markets” white paper, cowritten by Smukowski, alongside other writers from Enterprise and the Local Initiatives Support Corporation.

“CDFIs now have the opportunity to position the industry as the ultimate impact investment, capable of addressing key social and environmental issues like the acute affordable housing crisis; persistent racial health, wealth, and opportunity gaps; and environmental sustainability measures in low-income and historically underserved communities,” Smukowski and her co-authors say. CDFIs are required to report on impacts on a regular basis, an opportunity to tell the stories about how communities are affected by these investments.

When you invest in community-focused products like the examples in this article, you can earn a rate of return for yourself, while also supporting important community-building projects. For example, the Connecticut Green Bank, which accepts minimum investments of just $100, works with families, businesses, houses of worship, and other community groups to develop clean-energy solutions from solar photovoltaic installations to energy-efficiency retrofits and green-building projects.

The Benefits of Impact Investing

With socially responsible investing, you can align your investments with impacts you care about whether it’s creating affordable housing, mitigating climate change, or supporting business owners who have been left out of conventional lending. Sometimes multiple issues that investors care about intersect in one responsible project, such as the HopeWorks project combining affordable housing, sustainable design, proximity to transit, job training, and reducing homelessness.

Brandon Atkins (left), himself a survivor of addiction and homelessness, teaches cooking skills at Kindred Kitchen to residents like Carlhie Thompson (right) at HopeWorks Station, a LEED-Platinum-certified affordable housing and rehabilitation community financed by the Enterprise Community Loan Fund.

Brady Quirk-Garvan of Natural Investments, a social investing advisory group, described how he has helped some investors combine their interest in affordable housing with a desire to support business ventures led by women, such as Shortstack Housing in Portland, Oregon: “It’s woman-owned and run and focuses on ‘missing middle’ housing [such as duplexes and townhomes] … that is affordable, near public transit, and that will remain affordable for decades.”

How to Get Started with Impact Investing

An easy first step for getting involved with community investing is to first open a checking or savings account with a CDFI or other responsible bank or invest in a certificate of deposit (CD).

As a next step, consider investment vehicles with lower minimum requirements, like the Community Investment Note, issued by Calvert Impact Capital, a community development organization that supports and partners with CDFIs. This gateway investment for individuals getting started with impact investing offers an entry point of just $20. In Calvert Impact’s 2022 survey of their investors, 54% said it was their first cause-based investment.

Capital from the note has supported a wide range of projects including Artspace, affordable live-work spaces for artists across the US; Central City Concern, which offers housing, health, recovery, and employment support in Portland, Oregon; and Self-Help Enterprises, which provides home-ownership support to farmworkers and other hard-working families in California’s San Joaquin Valley.

The Connecticut Green Bank’s Green Liberty Bonds and Notes—inspired by Green America’s Clean Energy Victory Bonds campaign—offers similarly accessible investments priced at $100 and $1,000, to fund local clean-energy projects. The Enterprise Community Impact Note is another effective way to get started investing with a community development financial institution.

Finally, if you have the means, and wish to directly invest in specific responsible community-building projects, consider consulting an individual investment advisor, like Quirk-Garvan at Natural Investments, who can match options with your values and the amount you plan to invest.

Whichever vehicle you choose, you can feel confident when you seek out a mission-focused financial product that your investment dollars are doing good in the world.

|

|

The Next Frontier in Climate Finance: Property Insurance |

In 2023, the United States experienced a record number of weather- and climate-related disasters that each caused $1 billion or more in damages: 28 severe storms, floods, wildfires, winter storms, hurricanes, and droughts, according to the National Oceanic and Atmospheric Administration (NOAA).

Since 1980 the United States has experienced 376 of these billion-dollar+ events, with damages totaling $2.6 trillion, and tragically, 16,340 associated deaths.

The insurance industry stands on the front lines of this climate crisis. Every time a climate-related fire, flood, or storm damages or destroys an insured person’s home or business, they expect their insurance policy to help foot the bill for repairs and rebuilding. Unfortunately, as climate events become more common, major insurance companies have begun to cancel or restrict coverage in climate-vulnerable states.

In May, State Farm—the largest insurer in California—stopped accepting new applications for homeowners insurance in the wildfire-prone state due to “rapidly growing catastrophe exposure.” In June, Allstate followed suit. In July, Farmers Insurance stopped offering home and auto policies in hurricane-prone Florida, forcing 100,000 ratepayers to find new insurance.

As major insurers limit coverage, prices continue to rise for everyone else. In California, State Farm has raised prices for the homeowners policies it still holds by 20%. In Florida, the average homeowners insurance premium is now $6000—up 200% from 2019.

In fact, according to the 2023 Policygenius Home Insurance Pricing report, the cost of homeowners insurance has risen for 94% of people surveyed. Premium costs are now 35% higher nationally compared to two years ago for all homeowners, whether or not they live in an area with heightened climate-related risk.

Underwriting and Investments

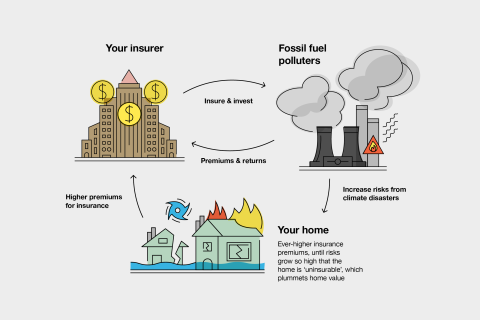

Unfortunately, despite the insurance industry paying policyholders for an increasing number of climate disasters and then passing these costs onto policyholders, many of them continue to support one of the chief causes of the climate crisis: the burning of fossil fuels.

Major insurance companies continue to support the fossil fuel industry in two ways, according to Insure Our Future, a campaign comprising environmental, consumer protection, and grassroots organizations that hold the US insurance industry accountable for its role in the climate crisis:

- By underwriting—that is, insuring—new fossil fuel projects

- By investing billions of dollars in fossil fuels

In fact, US insurance companies invested $582 billion in fossil fuels in 2019, the most recent year for which composite figures are available. However, the International Energy Agency has since stated that investors must not finance any new coal, oil or gas projects if we are to hold the rise in global temperatures under 1.5ºC. The Paris Climate Agreement set 1.5ºC as the goal for limiting global warming to prevent catastrophic and irreversible climate damage.

While most of the large US insurance companies tracked by Insure Our Future have set restrictions on underwriting coal, few have restricted underwriting conventional oil and gas projects. Three of the top eight US insurance companies—Berkshire Hathaway, W.R. Berkley, and Starr—maintain no policies whatsoever to limit underwriting and investment in fossil fuel projects, whether coal or oil and gas.

Berkshire Hathaway is especially notable: It fully owns 11 coal plants, partially owns 13 more, and ships millions of tons of coal by rail. Its CEO, Warren Buffett, has said climate change should not be a factor in the company’s decision-making.

Graphic by Insure Our Future Graphic by Insure Our FutureUnderwriting Notorious Fossil Fuel Projects

Without insurance, fossil fuel companies cannot get loans or investments for their notoriously risky projects. At the same time, the riskier the project, the higher the premium—and resulting profits—for the insurance company involved.

The market intelligence firm Insuramore estimated gross direct premiums from insuring the fossil fuel industry at $21.25 billion in 2022. Top US fossil fuel insurers include Chubb, which took an estimated $700 million in fossil fuel premiums, Zurich (parent of Farmers), which took $600 million, and AIG, which took $550 million.

While it is difficult to find out which companies underwrite which projects, climate activists have uncovered the insurers of two of the most notorious fossil fuel projects:

- Freeport LNG—This Texas facility will be capable of exporting 15 million tons of liquified natural gas per year when it is fully online. The plant has been cleared for full operation in 2024, following a settlement with the EPA in Dec. 2023 related to an explosion at the plant. AIG, Chubb, and Liberty Mutual, among others, insure Freeport LNG.

- The Trans Mountain Pipeline—When fully operational, this pipeline will ship 590,000 barrels per day of tar sands oil to British Columbia. Chubb, AIG, and Liberty Mutual insure this pipeline.

Investing in Climate Chaos

Insurance companies do not simply insure fossil fuel projects; they also invest billions in fossil fuel companies, according to the Investing in Climate Chaos database by Urgewald, a German environmental and human-rights NGO.

Berkshire Hathaway, the parent company of Geico, invests the most in fossil fuels, compared to all US insurance companies. The company has invested more than $9.4 billion in coal and $45.7 billion in oil and gas. Berkshire Hathaway is the top investor in Chevron.

State Farm is second in fossil fuel investments among US insurance companies, with $18.2 billion, including $7.9 billion in coal and $10.3 billion in oil and gas. It is the 12th-largest investor in Exxon.

“It seems nonsensical at best—and complicit at worst—for State Farm to carefully factor climate risk from wildfires into its homeowner’s insurance policies, refusing in some cases to provide such policies at all, while apparently ignoring the heightened climate risk that its investment portfolio is helping to create,” Sens. Sheldon Whitehouse (D, RI), Ron Wyden (D, OR), and Bernie Sanders (I, VT) wrote to State Farm in June.

Investing in Climate Chaos database by Urgewald. Data collected January 2023. Figures for "coal" and "oil and gas" do not always add up to the total fossil fuel figure as some companies are active in both industries and counted in both columns. Investing in Climate Chaos database by Urgewald. Data collected January 2023. Figures for "coal" and "oil and gas" do not always add up to the total fossil fuel figure as some companies are active in both industries and counted in both columns.Popular home and auto insurance company Amica has invested $86 million in fossil fuels, not enough to appear among the top investors, but still significant.

What Can Policyholders Do?

The good news is that it is possible to find alternatives to the largest insurance companies that continue underwriting and investing in fossil fuels, and to take action to push the worst companies to improve.

Take Action! Tell over 70 executives at Berkshire Hathaway/Geico/Guard, State Farm, AIG, Nationwide, Allstate, Liberty, Mutual, Travelers, and The Hartford to insure our communities, not fossil fuels!

Seek out regional mutual insurance companies: The best option for ratepayers seeking a more responsible company for home or car insurance is to shop in your local area. Call three independent insurance agents and ask them to quote costs and coverage for policies at regional mutual insurance companies, or speak with companies directly.

Different agents work with different companies, so talking to more than one will give you a fuller picture of what is available in your area. Regional insurance companies are no more risky than large insurance and could save you money on your premium for the same coverage.

Examples of responsible regional mutuals include American Family Insurance based in Wisconsin, Grange Insurance based in Ohio, and Utica Mutual Insurance based in New York. Be sure to ask about a company’s holdings and policies before purchasing an insurance plan.

Push the biggest companies to do better: If you hold an insurance policy with a company that may be underwriting or investing in fossil fuels, call them up, send a letter, or otherwise make your disapproval of fossil-fuel investing known. Explain how your concerns are in the insurance companies’ best interest, given their exposure to the effects of climate disasters.

Insure Our Future demands for insurance companies:

- Immediately cease insuring new and expanded coal, oil, and gas projects.

- Immediately stop insuring new customers from the fossil fuel sector not aligned with a credible 1.5ºC pathway, and stop insuring the expansion of coal, oil, and gas for existing customers.

- Immediately divest all assets from coal, oil, and gas companies not aligned with a credible 1.5ºC pathway.

- Define and adopt binding targets for reducing insured emissions that are transparent, comprehensive, and aligned with a credible 1.5ºC pathway.

- Immediately establish and adopt robust due diligence and verification mechanisms to ensure clients fully respect and observe all human rights, including a requirement for Free, Prior, and Informed Consent (FPIC) of impacted Indigenous Peoples.

- Immediately bring stewardship activities, membership of trade associations, and public positions in line with a credible 1.5ºC pathway.

Stay tuned! While several resources list alternatives to megabanks that fund fossil fuels, no such directory exists for insurance—yet. Green America and Rivers and Mountains GreenFaith have begun working to close that gap. We are conducting research and compiling a responsible insurance list that we will release as a directory later this year.

The insurance market is just the latest financial sector to hear from Green Americans, climate advocates, and others about the need for change. The same strategies that have shifted other industries—speaking up for improvements, boycotting irresponsible companies, and organizing with others for change—can shift the insurance industry as well.

|

|

Align Your Banking and Credit Card with Your Values |

What is the largest part of your carbon footprint: Is it a) your car, b) your furnace, c) your stove, or d) your bank account?

If you bank with or use credit cards issued by one of the four biggest US banks—JPMorgan Chase, Citi, Wells Fargo, or Bank of America—or other conventional banks, the answer is likely your bank account.

That’s because these four banks have plowed $1.37 trillion—that’s trillion with a T—into coal, oil, gas, fracking, pipelines, and other dirty fossil fuel projects since the Paris Agreement in 2015, as documented by the “Banking on Climate Chaos” report. This report—researched by seven climate-finance organizations—has been endorsed by more than 600 groups including Green America.

If you hold a balance of $1,000 at one of these banks, the resulting annual carbon emissions are equivalent to those generated by flying from New York to Seattle. If you hold $62,500 in one of the Big Four banks, your money is producing as much carbon as all the driving, heating, cooling, cooking, and flying the average American does in six months.

Want to stop your bank from using your deposits to fund climate-destroying projects that go against your values? Get a better bank and better credit card.

Finding a Better Bank

Green America’s “Get a Better Bank” map can help you find a bank that will not only minimize the carbon emissions associated with your account, but also actively use your money for good. The map’s more than 6,000 bank and credit union locations nationwide follow a social-justice mission to invest in low- to moderate-income people, serve communities of color, or finance sustainability projects, among other positive goals, rather than prioritizing lending to the fossil fuel industry or other polluting mega-corporations.

To appear on the Green America map, banks and credit unions must be confirmed to be at least one of the following:

- Federally certified Community Development Financial Institution (CDFI)

- Member of Inclusiv, a group of community development credit unions

- Member of the Global Alliance for Banking on Values (GABV)

- FDIC-identified Minority Depository Institution

- Certified by the Green America Green Business Network

Other organizations offer similar better-banking directories. For example, Bank for Good and Bank.Green list 30 to 50 banks and credit unions that have signed a fossil-free pledge, and Mighty Deposits uses federal reporting data to pinpoint the percentage of investments a bank or credit union is making in its local community.

By using a mix of these resources, while keeping in mind the services you need, you can find a bank or credit union that’s right for you, your community, and the planet.

Finding a Better Credit Card

Your credit card purchases also make a difference, and can do harm or good, depending on the activities of the underlying bank. To understand how, it is helpful to know how credit cards work.

Credit card issuers make money—which they may invest in projects you don’t support—in three ways:

- The annual fee. Credit card annual fees can run $100 or more and may include perks like travel assistance. Not all credit cards have an annual fee.

- Interest payments. If you carry a balance on your card, you know how exorbitant interest rates are. Credit card debt in the United States is a serious problem, totaling over $1 trillion at the end of 2023, according to the Federal Reserve Bank of New York.

- Transaction fees. Even if you have a card with no annual fee, and you pay your bill in full every month, your purchases will still earn the credit-card issuer the majority of each transaction fee. This fee—usually around 3%—is deducted from the payment to the merchant for each credit card charge.

Next, it’s important to understand the difference between the branding of a credit card and its issuer. The branding is the name on the front of the card. The issuer is usually on the back in small print. The issuer is the financial institution that receives your monthly payments.

Sometimes the branding and issuer of the card are the same—such as when a bank or credit union issues its own card. If your responsible bank or credit union issues its own card, then you can use that card knowing the fees you pay will help the institution invest for good.

If your responsible bank or credit union does not issue its own credit card, then you’ll need to look elsewhere—and the key is to find out which bank is issuing the card (it may be one of the Big Four). You may need to read the fine print in the application, research the card online, or call the phone numbers provided on the application to ask questions. For example, some banks and credit unions have issued credit cards through Elan Financial, which is owned by US Bank, an investor in the fossil fuel industry.

If you hold an American Express card, according to a Forbes article published in January 2024, American Express “does not appear to reflect the investment-heavy models of many banks.” American Express claims to have been carbon-neutral since 2018, and made a public commitment to net-zero operations globally by 2035. However, American Express cards often require a higher annual fee than cards issued by responsible, mission-focused banks.

Some more responsible credit-card issuers include:

- Beneficial State Bank, a Green Business Network member, a B-Corp, CDFI, and fossil-free bank on the West Coast. Their Climate Card offers points that can be redeemed for merchandise, cash back, or charitable donations.

- First National Bank of Omaha, a Green Business Network member and a family-owned independent bank dedicated to investing locally. Their Evergreen card offers 2% cash back.

- Hope Federal Credit Union, a Green Business Network member and a community development bank that invests in under-resourced communities in the Deep South, offers a Platinum Rewards Visa card to members.

In addition, consumers often carry credit cards from other branded categories such as:

- Store or airline cards, which are branded for a merchant where you may do a lot of shopping, or an airline you fly regularly. Many are issued through Synchrony Bank or Community Bank, which specialize in providing store cards and do not invest in fossil fuels. However, some popular store cards are issued through fossil banks. For example, Costco’s card is issued by Citibank, a major funder of fossil fuels. Green America has joined with allies to urge Costo to either pressure Citibank to stop financing fossil fuels or drop Citi as its issuer.

- Affinity cards, which let you support your favorite nonprofit through purchases on your credit card—usually half a percent is donated. It’s critical to know the issuer of these cards. For example, the Green America card (see box at right), is issued through TCM Bank, which is the credit-card-issuing arm of Independent Community Bankers of America (ICBA). Sadly, some other nonprofit cards are issued through big fossil banks, undermining the very good the nonprofit is trying to do in the world.

Using the information in this article, you can choose a credit card that puts your money to work for your community and the planet. The card does not have to be issued by the bank or credit union where your bank account is—any card issued by a responsible bank or credit union is a good choice.