Not all banks are created equal. Whichever bank you use, your money will be there when you want it. But while it’s in your account, the bank can use your money how it wants, which could be aligned with your values, or not.

You can put your money to good use simply by doing your banking with a community development bank or credit union to meet all your regular banking needs, including accounts for checking, savings, certificates of deposit, loans and more.

Why are megabanks bad news?

- They may invest your money in industries you don’t support, like fossil fuel projects, military development, or abusive sweatshops.

- They lent billions in predatory sub-prime mortgages that their borrowers couldn’t repay, which led to the housing market crash in 2008.

- Their main objective is to make their Wall Street CEO and shareholders wealthier, too often ignoring harm to people and the planet.

- They don’t treat people right. Megabanks have been ordered to repay billions of dollars wrongfully taken from consumers.

- They are bankrolling the climate crisis, as shown in Banking on Climate Chaos Report.

- When choosing to have a checking or savings account at a community development bank or credit union, you are investing in a financial institution that supports communities, the environment, and your values.

Benefits can include:

- Creating good-paying local jobs.

- Supporting clean energy, fair labor, and food security in food deserts.

- Providing financial services to low-income people and investments in small business, affordable housing, and education.

- Investing in your local economy.

- More accountability to individual customer-members.

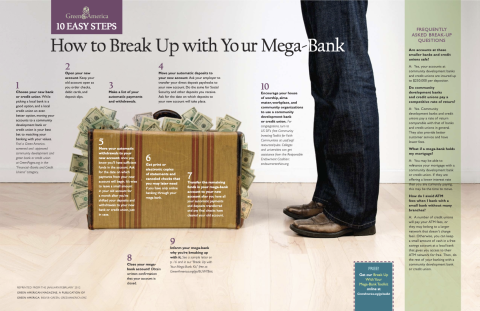

10 steps to move your money from a megabank

1.

Find a new community development bank or credit union through Green America’s Get a Better Bank. As you research your new financial institution, be sure to ask about fees, services, and the details about the banking products you need. Make sure to ask that the institution you select is FDIC- (for banks) or NCUA- (for credit unions) insured—which means the government will guarantee your deposits up to a certain amount, in the case of a bank failure.

2.

Open your new account with a small deposit while keeping your megabank account open. Order the products you need such as checks, debit cards, and deposit slips.

3.

Make a list of your direct deposits, like your paycheck, and automatic withdrawals, like your phone bill, that you want to transfer from your megabank to your new bank.

4.

Move your automatic deposits to your new account. If you have direct deposit for your paycheck, ask your employer to transfer your paychecks to your new account, for which you will need your account number and routing number—which are on the bottom of personal checks or online when you log into your account, or you can call to ask. Social Security payments or other forms of income you receive automatically into your account will need the same information. Ask for the date on which the first payment to your new account will take place.

5.

Move your automatic withdrawals to your new account (you will again need to provide the routing and account numbers). When you know that sufficient funds will be in your new account, transfer your automatic payments so they are now deducted from your new account. Ask for the date on which the payments from your new account will begin. It’s wise to leave a small amount of cash in your megabank checking account for at least a month after you think you have shifted your deposits and withdrawals to your new bank or credit union to guard against any unforeseen circumstances like checks that hadn’t yet been cashed or payments you forgot about.

6.

If you only have online banking through your megabank, download bank statements and save them in a safe place or print them. Save them for your records and keep canceled checks you may later need.

7.

Transfer the final funds from your megabank account to your new account—once you have all your automatic deposits and payments transferred and any last checks have cleared your old account. Electronic transfer of these final funds to your new account is usually the fastest and safest method to use.

8.

Close your megabank account. Once the last remaining funds in your old account have transferred to your new account, follow the bank’s procedures for closing accounts. Obtain written confirmation that your account is closed.

9.

Inform your bank why you broke up. Let them know you chose a bank that does not invest in fossil fuel projects or engage in predatory lending practices.

10.

Encourage your workplace, congregation, or alma mater to use a community development bank or credit union if they do not already do so. Also, if you are on the board of any nonprofits or live in a condo or housing co-op, encourage these organizations to switch too.

For colleges and universities, and other endowed institutions, turn to the Intentional Endowments Network for information on using their investments and accounts to help communities and not hurt the planet.

Download these 10 steps

Bonus Steps!

Tell all your friends and family about your great new banking relationship and why you made the choice to switch.

Take action to put the rest of your money to work creating a greener planet by reading the rest of this Guide to Socially Responsible Investing and Better Banking.