When coronavirus arrived in 2020, it hit the food sector hard—including Urban Growers Collective, a Black- and women-led nonprofit in Chicago working to build a more just and equitable food system.

With eight operating farms on 11 urban acres and almost 30 employees, the Urban Growers Collective needed a Paycheck Protection Program loan to survive, like many nonprofits during the pandemic.

It found that loan at Self-Help Federal Credit Union {GBN}.

“We were essential frontline workers, and the loan allowed us to deepen our community relationships and our ability to address food insecurity and bring nutritionally dense food to our communities that need it the most,” says Erika Allen, founder and CEO.

Allen’s experience with Self-Help was “night and day” different from working with the larger bank where her nonprofit did its daily business. “We were immediately contacted, our application was submitted, and we received relief really quickly. They really catered to our nonprofit,” she says. “It helped us not lose money during the pandemic, and it helped us stabilize our staff.”

Chicago. Photo credit: Erika Allen.

Allen enjoyed working with Self-Help so much that a few years later she went back as a first-time homebuyer to finance a mortgage. Again, her experience was much better than at her conventional bank.

“I have worked in not-for-profits for my whole career,” Allen says. “Most of us have been underpaid for many, many years, so even the minimum 3% down, that’s like a whole extra salary.”

While the mortgage terms at her previous bank were “really not great,” at Self-Help, Allen was able to qualify for a mortgage under the Equity Boost program.

“It provided support for my down payment and for closing costs, and because of that I was able to purchase a home—and I was able to use the money I thought I would be putting down to furnish my home,” Allen says.

“It was really a godsend, one of the best programs I’ve ever encountered,” she adds.

Self-Help’s Equity Boost is one of many examples of impact banking and investing that truly helps build community—and programs like that exist all over the country.

Other examples include:

- The Wisdom Fund by C-Note {GBN} provides lending for women-owned small business—which receive less than 5% of total lending for small-business.

- The Community Investment Note by Calvert Impact {GBN} finances organizations creating positive social and environmental change, with investments starting as low as $20.

- The Interest on Lawyer Trust Account (IOLTA) program at Beneficial State Bank {GBN} uses interest earned from bank accounts for court awards to support legal aid services.

- The Clean Energy for All program at Clean Energy Credit Union {GBN} families experiencing lower income, and communities of color, so they can install clean energy and join energy efficiency projects.

- Natural Investments {GBN}, a network of financial advisors, has restructured as a Public Benefit LLC, enabling its entire team—60% women and 30% people of color—to share power and profit equally in perpetuity.

Why bank and invest for good?

The reasons these community financial service organizations bank and invest for good are as varied as the institutions themselves.

“First and foremost, the world needs it,” said Justin Conway, vice president of investment partnerships at Calvert Impact{GBN}. “Whether it’s our climate, environmental crisis, or the widening inequality we see in the world, the world needs investors to care about these issues.”

“Community investing allows mom and pop shops to stay open, expand, and build community,” said Brady Quirk-Garvan of the Money with a Mission Team at Natural Investments {GBN}. “We want to keep unique diverse cities and towns thriving.”

“We were created because we saw there was a gap in people being able to afford clean energy for their homes, whether that be solar, geothermal, or making green home improvements,” said Nicole Burford, senior director of marketing and sustainability at Clean Energy Credit Union {GBN}.

Outsized impact

Even small and medium-sized banks, credit unions, and investment firms can have a large impact on local communities and people’s lives. For example, in 2021, Beneficial State Bank (BSB) made $762 million in loans in areas such as affordable housing, environmental sustainability, and fair auto loans.

“A lot of auto financing either hides fees or has predatory fees or interest rates,” said Monique Johnson, director of client and community partnerships at BSB. “We can actually prove that our auto loan borrowers saved an average of 8.32% in interest after refinancing with us.”

CNote, a women-founded and women-led platform focused on closing the wealth gap, deployed $30 million per month for economic growth in under-resourced groups in 2022. Of that amount, 69% went to borrowers in communities of color, 72% to low-to-moderate income (LMI) communities, and 69% to women-led businesses, creating 1,819 jobs.

Among the borrowers helped by CNote was Terri-Nichelle Bradley, who started Brown Toy Box, an educational play-kit company that makes toys to get Black children excited about a career in science, arts, and engineering. When Bradley got a sudden opportunity to stock Brown Toy Box in every Target store in the country, CNote partnered with Access to Capital for Entrepreneurs, a community development financial institution in Georgia, to provide a loan to create quick inventory.

Overcoming obstacles to housing equity

Home ownership is the biggest investment most families make—yet only 44% of Black Americans own their homes, compared to 50.6% of Hispanic Americans, 62.8% of Asian Americans, and 72.7% of white Americans, according to the National Association of Realtors. “One of the biggest things we are seeing is a lot of borrowers looking to purchase homes, but a lot of different obstacles interfering with their ability,” said Daniel Martinez, director of mortgage origination at Self-Help. “So we took a look at it to see how we as a company can lend responsibly but still get individuals into homes.”

Key barriers Self-Help found to home ownership, especially in Black and brown communities, include a low credit score, lack of lump-sum cash for the downpayment, and student loan debt.

To help boost credit scores, Self-Help offers the Fresh Start loan, a small loan of $500 to $2,000 that borrowers can pay off over six months to two years. The money goes into a savings account that earns interest, and when the loan is paid off, the borrower gets both the principal and interest.

Self-Help’s Equity Boost mortgage approves people with credit scores as low as 580. The program folds up to 5% of closing costs into the mortgage, so borrowers may have no down payment. It does not count student loan payments against borrowers on income-based repayment plans. Borrowers with up to 80% of area median income (AMI), or first-generation home buyers up to 120%, can qualify.

Along with Equity Boost, many Self-Help mortgage borrowers enroll in the Savings Account For Emergencies (SAFE) program. Homeowners commit to depositing at least $25 per month into a savings account, and at the end of three years Self-Help gives them $2,000 more.

“It’s not just about being in the community but looking at community needs and developing programs that are actually going to benefit people in the community,” Martinez said. “The big thing about home ownership is building generational wealth.”

Environmental impacts

Equity issues related to renewable energy access also need to be addressed. Among solar adopters, only 15% have incomes less than $50,000 per year. Most solar adopters make over $100,000 annually, according to Berkeley Labs.

“We looked at that and said, we’ve got to change this,” said Nicole Burford of Clean Energy Credit Union.

To address this, CECU launched the Clean Energy for All program, offering a 0.5% interest rate discount on loans for households experiencing low-income, and households of color, with a credit score of 680 and above, and even steeper discounts for those with credit scores of less than 680. Over time, these lower interest rates save borrowers a lot of money.

CECU is also adding new options for its solar loans. Previously the loan had two parts: a long-term loan for 70% of the cost, and a short-term loan for 30% that borrowers could repay when they received their 30% tax credit through the Inflation Reduction Act.

The problem for borrowers with low income is that they did not make enough to pay taxes, and so did not get the tax credit. “And then they were stuck with a 30% loan that’s due in 18 months,” Burford said. So CECU is designing a 100% long-term solar loan for its low-to-moderate income borrowers.

finance solar panels, electric vehicles and other green upgrades to their homes.

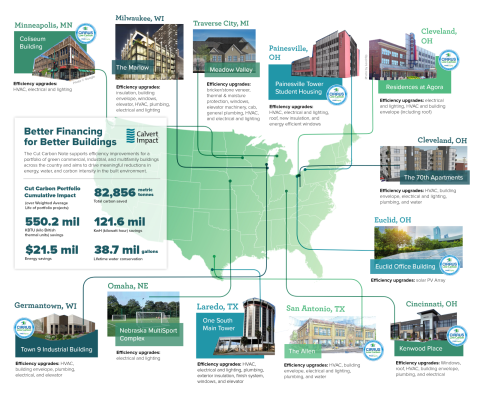

Calvert Impact has also launched a new product to fight climate change: the Cut Carbon Note, which will generate $400 million in financing for sustainability upgrades in office, industrial, and multi-family residential buildings—a top source of greenhouse gas emissions.

“We are pretty far off our climate goals, so we need some big solutions,” said Justin Conway of Calvert Impact. “Through these green bonds, we are trying to change the way we build to a new low carbon standard.”

So far, the program has saved $21.5 million in energy costs and 82,856 metric tons of carbon emissions through efficiency upgrades at the Coliseum Building in Minneapolis, apartment buildings in Cleveland, Cincinnati, Milwaukee, and San Antonio; and a solar array at an office building in Euclid, Ohio, among other projects.

Beneficial State Bank is also investing in the environment through its new location at Altasea, a unique public-private ocean institute that brings together science, business, and education at the Port of Los Angeles. The bank’s commercial loan hub, literally working out of a shipping container, will provide financing for nonprofits and businesses that operate in the burgeoning “blue economy.”

Beneficial also has loan offices at the Los Angeles Cleantech Incubator, Seattle’s Bullitt Center, and Portland’s PAE Living Building.

“All of these locations pick and choose their tenants, we were thrilled to be part of that ecosystem,” said Monique Johnson of Beneficial. “That’s where we need to be—those are our people.”

Future directions

Interest in community banking and investing has skyrocketed in recent years, especially among women and young people.

“Every two years, we do an investor survey, and we’ve always seen high interest in impact investing,” said Justin Conway of Calvert Impact {GBN}. “But this year the number of investors who said they actually made an impact investment jumped from 19% in 2020 to 59% in 2022. That’s almost a three-fold increase in two years.”

For Daniel Martinez of Self-Help, the biggest emerging trend is young home buyers coming into the market. “They don’t have $20,000 to $30,000 fresh out of college,” he says, but Self-Help’s Equity Boost program can help them qualify.

Self-Help is doing outreach at historically Black colleges and universities (HBCUs) to reach young borrowers. “We’re trying to reach particularly Black and Latino young people so they can start building equity in their homes and wealth at a much younger age,” Martinez said.

Danielle Burns, head of business development for CNote, and a Green America board member, also sees a higher interest in impact data measurement and reporting. “Clients are seeking greater transparency around where their dollars sleep at night and want tangible stories on how those dollars are impacting communities,” Burns said.

Impact is also important on the personal level, Self-Help client Erika Allen said. She hopes to pay forward the help she got for her mortgage to her community by partnering with Self-Help to offer financial counseling and technical assistance to other first-time home buyers at a new community education center.

“I wanted to go through the process so I could help support other team members get these resources,” Allen said. “It always helps me when I know I’m helping other people.”