|

Amazon – Respect all workers’ rights! |

Amazon has NO public info on its chemical management policy for its own apparel brands nor for any textiles it sells.

|

|

Toxic Textiles Scorecard |

43 million tons of chemicals are used to dye and treat our clothes every year AND there are 8,000 different chemicals used to manufacture clothing as noted in our 2019 Toxic Textiles report.

How do popular apparel brands, leading fast fashion brands, and retailers stack up on chemical management? Our two scorecards reveal which companies are working to end toxic textiles and which are not.

Tell Amazon to ditch the Toxic Textiles!

Even if a company has some policies in place to address sustainability within its current supply chain, it does not negate the sheer volume of resources used and lost annually to manufacture new clothes.

There is still no way for us to shop our way to sustainability, but there are many ways to shop with the planet and workers in mind.

Retailers

When comparing the retailers to brands (such as Nike or Gap), as a whole, retailers are far behind brands in chemical management efforts. This is concerning as some retailers, such as Amazon, are also apparel brands with numerous private label brands.

Target is the clear leader. Target has both an online platform and stores, and sells many apparel items under its own brands, which demonstrates it is feasible for every retailer included in the scorecard to improve its chemical management policies.

The retailers have a unique point of leverage to both strengthen the chemical management of their own-branded products and third-party products sold on their platforms. To start, we are calling on Amazon to both address the impacts of own-branded products and to encourage sellers on its platform to step it up on chemical management. Learn more about what we are asking Amazon to do and take action.

Brands

The success of some companies in this scorecard indicates that those poor preforming companies can and should strengthen efforts to end toxic textiles. Additionally, there are well established multi-stakeholder initiatives to toxic textiles, such as ZDHC. Thus, in addition to being feasible, companies can seek out and find assistance in how to address hazardous chemicals. There is simply no reason a company should not have at a minimum an RSL and an MRSL.

Companies listen to consumers! Looking at the single case of Carter’s, in 2019, it did not have an RSL; since then, over 30,000 people reached out to Carter’s, and it has not only issued an RSL but also increased its sustainability reporting.

For the retailer scorecard, we looked at publicly available information that was relevant to own-branded textiles of leading US retailers, and we conducted the research in August 2021. All retailers included sell products from other companies through their platforms or stores, however, this scorecard only examined policies related to own-branded products.

For the brand scorecard, we examined the public chemical management policies for 10 leading apparel companies in the US, which includes leading children’s clothing brands, leading fast fashion brands, leading sportswear companies, and some of the largest apparel companies.

- If a company had a public restricted substances list (RSL), a manufacturing restricted substances list (MRSL), or a commitment to eliminate or reduce the use of hazardous chemicals, the retailer received a green score for that category;

- If a retailer did not have the information publicly available, the retailer received a red score for that category.

- In order to receive a green for the category ‘Commitment to eliminate or reduce the use of hazardous chemicals’, the company must have a time-bound commitment to eliminate at least one class of chemicals or a time-bound commitment to reduce a % of total chemicals used. This category looked for efforts that either went beyond an MRSL or efforts that are taking place when a company has not issued an MRSL or RSL.

Notes on companies:

- In the case of Macy’s, it has made a timebound commitment to publish an RSL and MRSL, which resulted in a yellow score.

- In comparing Walmart to Macy’s, we did not find an RSL or an MRSL for Walmart that was publicly available. Walmart has goals to reduce the total volume of hazardous chemicals and has identified priority chemicals. Walmart is actively taking steps to reduce the harmful chemicals used in its textiles and has been for multiple years, while Macy’s appears to be starting this process, and we were unable to find information from Macy’s reporting on progress made. Walmart has reported on progress being made. For these reasons, Walmart ranks higher on the scorecard than Macy’s.

- Some of the companies featured in the scorecard, such as Amazon, do have chemical management policies for other products. This scorecard only looked at policies related to apparel.

Check out how apparel companies have changed over time in our previous scorecard.

The scorecards only examined chemical management policies that were publicly available. But there are many factors that contribute to whether a company is sustainable or not. For example, some leading fast fashion brands (H&M and Zara) performed well on the scorecard. However, due to the business model of fast fashion brands (creating short-lived clothing, for example), it is NOT possible for these companies to be sustainable.

The fashion industry takes a huge toll on people and the planet.

- Nearly no brands pay garment workers a living wage; if you would like to learn more about this issue, take a look at FashionChecker.org.

- To learn more about fashion brands’ climate impacts, Stand Earth has ranked companies on climate impact and action.

- Since the Covid-19 pandemic began, garment workers have lost at least three billion dollars in income, a figure which continues to rise. Approximately 10% of the apparel workforce may have already been laid off. Millions more are at risk of being fired and have not received their full wages for months. Along with allies, we are calling on apparel brands to pay their workers – take action here.

|

|

What's Good |

Contact What's Good: Website | Instagram | Twitter | Facebook

Greenwashing. You’ve heard the term. It’s when an organization spreads disinformation to appear sustainable and environmentally responsible without being so.

Jennifer Young began getting frustrated every time she ran into this problem while trying to be an ethical consumer.

“’Hey, here’s an eco-friendly product,’” she describes of various companies’ marketing. “And it’s like, ‘Are you kidding me? That’s not really green.’”

This, combined with being in a moment of transition—“My youngest son was off to college, I was no longer at the job I thought I would be at for the rest of my life,”—led Young to create What’s Good, an eco-friendly online store boasting a variety of products at fair prices.

The way What’s Good works is simple. You’re looking for greener products? What’s Good is your one-stop-shop.

Every product offered at What’s Good is personally vetted by Young—but that’s not all.

“We also take a look at the makers and the small businesses we’re buying from,” she explains. “What is their corporate responsibility? Are they giving back to their community?”

Young also makes sure her company is vetted and giving back. What’s Good has a commitment to 1% for the Planet and donates to a new organization monthly, from the ACLU, to the Equal Justice Initiative and more. When advisors warned Young she may want more of a profit before donating like this, she pushed back.

“It’s my business,” she recounts. “This is where we lay the foundation for what we’re going to do moving forward. Could we put more money in our pocket? Yeah, but we’re giving back and we’re working with makers committed to the environment and social justice in their communities, so it’s a win-win.”

Young says small businesses are “role models.” She describes these environments and their cultures as domino effects. When employees experience an equitable, just, and sustainable work environment, they take that home and model it for others.

“You hear that people say we vote with our dollars,” she says. “Well, small business owners vote with their company culture. Small businesses can create change, not just in the product you're making, but in the way you run your business.”

Ready to get shopping yet? We know, we know, but hold on—there's more good on the way. Each first order comes with a sample packet of monarch milkweed seeds in support of the organization Save Our Monarchs.

“I think it's important—when you're dipping your toe in trying products that are not traditional—to be able to sample them.”

If it sounds like Young runs her business based on her own beliefs and desires, that’s not far off.

She admits part of the inspiration behind What’s Good was a selfish want to find eco-friendly products and not buy from corporations like Amazon or Walmart. Then she thought, why not share these finds and collect them in one place?

You don’t need to be a green expert immediately to buy green products—or ever.

As Young says, not everyone is “ready to go to soap nuts in their washing machines.” Instead, you could try soap strips, eco-friendly powder detergent, and more.

That’s why What’s Good offers a broad variety of products in numerous areas.

“You have a choice,” Young enthuses. “And choice is really important to us. Someday we’ll have huge capital, every product we offer will have three choices.”

Until then, shopping at What’s Good remains an easy and ethical way to find products that are kinder to the planet.

“There are days that I wake up and I'm like, ‘What are we doing?’ Young admits. “Especially with things like plastic-free July, it’s so challenging to try and live in our culture without plastic.

“You get overwhelmed and bombarded with, you know, the planet, the planet, and that creates a lot of anxiety. So I say: ‘Take it easy, just do one green thing.’ I really, really believe that if all of us are doing a little here and there, it's better than none of us doing nothing. And I think it becomes a lifestyle, you start with one thing, and then you move on to the next."

|

|

Emma's Eco Clean |

Contact Emma’s Eco Clean: Website | Facebook

Household products can be a lot more dangerous than you might expect. Did you know that there are over 1,000 chemicals used in the formula to add scent to Clorox? Some of those chemicals have been linked to infertility, asthma, and are even possible carcinogens.

That’s why Emma’s Eco Clean, a woman-owned Bay Area cleaning cooperative, uses non-toxic cleaning supplies to protect the health of their employees and customers. With over 2,600 clients, the business has come a long way from its beginnings at Wages. Wages, now known as Prospera, is a nonprofit founded by two women who were cleaning houses in Palo Alto and were not happy with the poor benefits house cleaners were receiving. So, they decided to teach Latina women how to legally open a cooperative, Emma’s Eco Clean being one of many, with the goal of economically uplifting them.

Maria Rosales, one of the partial owners of Emma’s Eco Clean, was in the original co-op class back in the 90s. “We received weekly training for a year to learn how to run meetings, financials, and legal matters,” she recalls.

Whether they were unsatisfied with pay, looking for better benefits, or had an entrepreneurial mindset, everyone had their reason to join the program. Maria explains, “I always wanted to have my own business— when I was going to school in Mexico, I sold clothes to people. When I heard Wages was helping people start their business, I thought ‘you know what, I’m interested.’”

While many of the women were already housecleaners, people from all backgrounds found their niche within team. Rosales, who worked for an electronic company for 11 years prior to Emma’s Eco Clean, said, “My English was not great, and I cannot do housecleaning because I have a condition that does not allow me to do that. So, Wages offered me a job in the office.”

At the end of the program, more than 20 women dropped out, leaving a group of five to build their business. From the start, they were determined to use simple cleaning agents and vegetable-based soaps from natural brands including Seventh Generations.

“Wages published a study about how people working in cleaning were getting sick with asthma and a cough when using Clorox. We wanted to protect both the housecleaners’ and customers’ health by using safe soaps, which have the same quality clean,” Maria explains.

Starting Emma's Eco Clean

The early days were not easy; their first step was to get funded.

“To get a $10,000 loan from the bank, we had to raise $3,000,” Maria said. “Some of the ladies sold tamales and we hosted garage sales to make it happen.”

With their hard work, they secured the loan and opened in 1999. At times, the team drove an hour just to clean one house and at times and only found a couple hours of work each week.

“Luckily, we grew fast. People were hungry for eco-friendly cleaning,” Rosales recounts.

With 27 co-owners, multiple awards, and residential as well as commercial services, it’s clear that their clean approach is thriving. Their co-op model is also a strong example of the strength of many. Maria says, “We get paid but health insurance, vacation, sick time, profit distributions at the end of the year, which wouldn’t happen if we worked by ourselves.”

To learn more about sustainable labor, check out Green America’s research on everything from chocolate child labor to smartphone sweatshops.

|

|

Is your local Trader Joe’s store a climate polluter? Help us find out! |

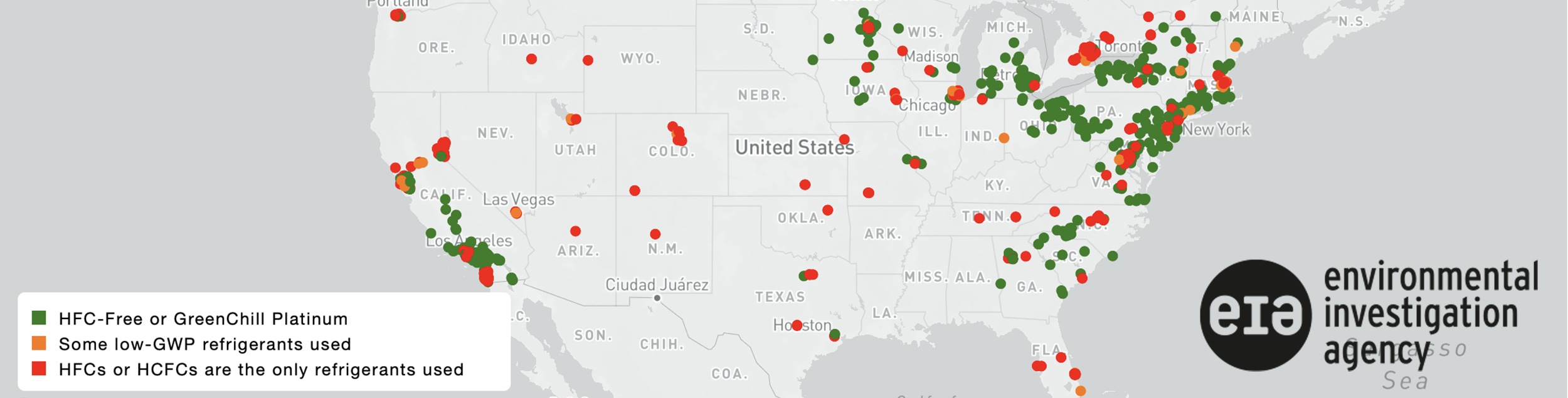

Supermarkets like Trader Joe's are leaking potent greenhouse gases called HFCs and it’s a huge climate problem.

In fact, refrigerant leaks from U.S. supermarkets are the emissions equivalent of adding 9.5 million cars to the road each year! Eliminating HFCs and improving refrigeration can avoid half a degree of global warming and 460 billion of tons of greenhouse gases in the coming decades.

Trader Joe’s has a particularly bad history of emitting refrigerant gases that hurt the climate and the ozone, and the company doesn’t follow best practices in reporting its current refrigerant use. The good news is, it’s pretty easy to find out.

That’s why we’re working with our friends at the Environmental Investigation Agency to crowdsource photos of refrigerant labels at your local Trader Joe’s!

How can you investigate your local store? All you need is a camera phone.

1. Find the label on the refrigerated shelves

On most refrigerator cases in a store there is a label that lists the refrigerant number. Start in the refrigerated foods section for dairy. Take a look up to the top of the refrigerated shelves for the label.

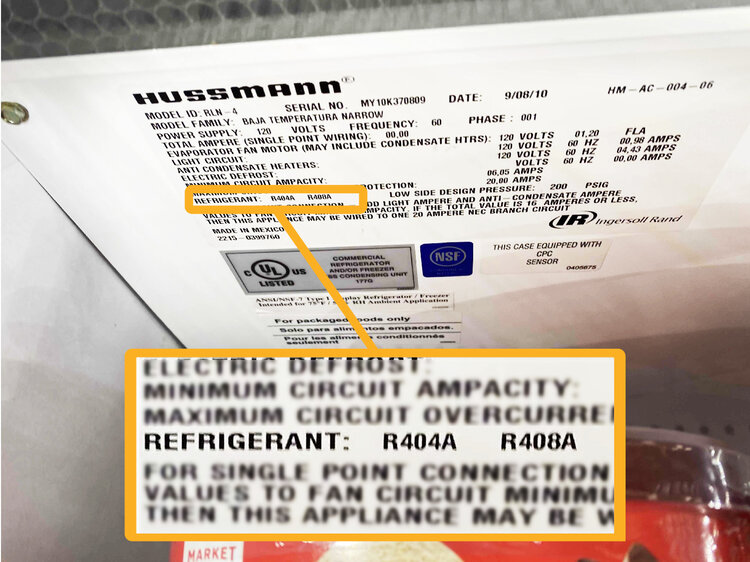

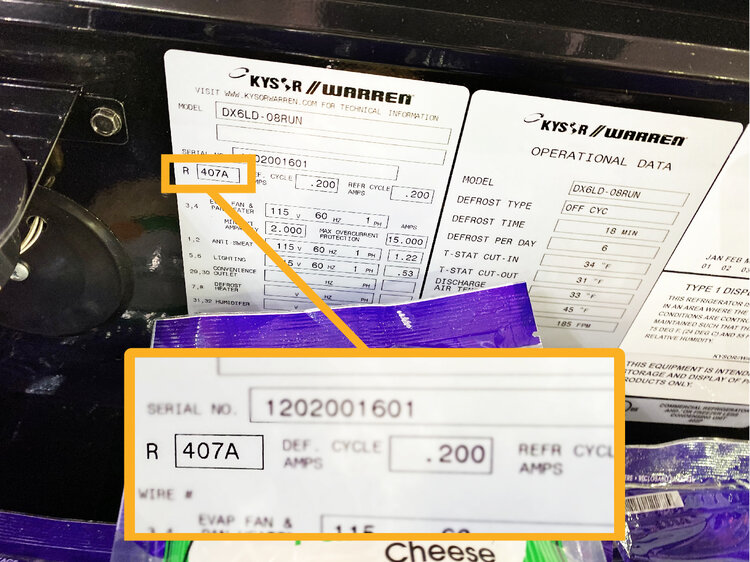

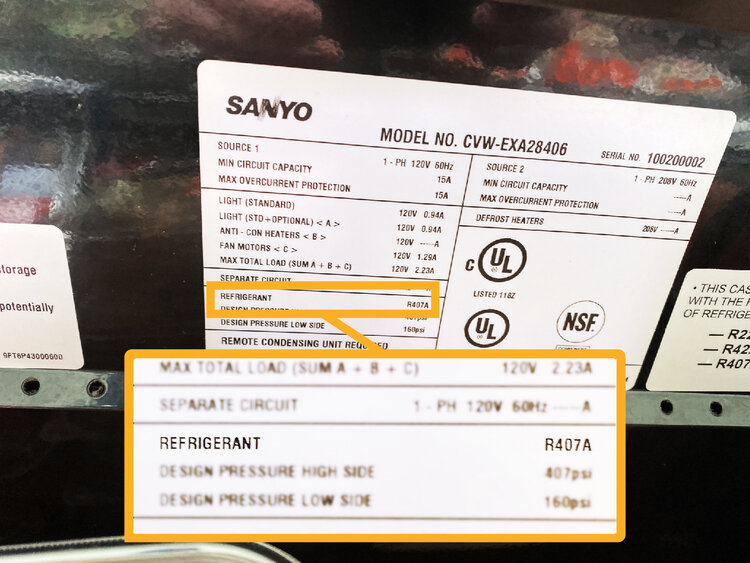

The refrigerant can be clearly marked, or you’ll just see R followed by a few numbers (most commonly, R22, R404A, or R134a - these are all different types of HFCs!), and sometimes you’ll see more than one refrigerant listed. That’s normal too! Look for something like this:

2. Turn on geotagging on your device

This helps us confirm the location of the store for our data collection.

IPHONE

ANDROID

3. Take a photo of the label

Make sure the refrigerant number is in frame!

- The Geotagged Image and ensure geographic information is shared:

- On an iOS device, using the built-in photo app, you must choose to send the image "Actual Size"

- On an android device, you must attach your image from your phone storage and not from the google cloud

- Store name (Trader Joe's)

- Store address and zip code (optional, in case of Goetagging error)

Check back soon to see your store on EIA's Supermarket map that tracks which stores are climate-friendly and which are super polluters!

Have questions? Send us an email!

|

|

Green America's Guide to Socially Responsible Investing & Banking 2021 |

|

|

Mary Swanson |

|

|

Banking On A Better Future: Beneficial State Bank Aims To Transform A Traditional Industry By Empowering Consumers And Communities |

By Christopher Marquis

In establishing Beneficial State Bank as a financial institution with social and environmental impact in mind, co-founders Kat Taylor and Tom Steyer saw an opportunity to serve as an example for others in the U.S. financial industry, which handles trillions of dollars in finances daily. The potential for positive change is great in a system where the biggest U.S. banks have trillions in assets, and even smaller financial institutions oversee millions.

“It’s a very powerful system that has monopolistic tendencies. Banking is really a utility that should be governed in the public interest,” Taylor says. “We had a hunch that this powerful positive public system was going terribly awry, and somebody had to set an example for the banking industry that said, ‘You can be financially sustainable without trashing people or the planet.’”

They launched Beneficial State Bank in 2007, just before the Great Recession, as a foundation-owned, for-profit bank as well as a Community Development Financial Institution and Certified B Corporation. All of that adds up to a mission-focused bank committed to doing good in its communities — so the money goes toward community, environmental, and social benefit. With about $1.5 billion in assets, Beneficial State Bank has offices in California, Oregon, and Washington, and an eye on expansion of its services to provide more people a banking option with positive impact.

By establishing Beneficial State Foundation as the owner of the bank’s economic rights and a public charity, Taylor and Steyer sought to ensure that no entity would use its resources for self-serving interests and instill the community connection from the start. The foundation works with coalitions, campaigns, and other partnerships to advance social and economic justice, and environmental advocacy.

In 2020, Taylor shifted from her role as CEO to a member of the bank’s Board of Directors, and Randell Leach was named to succeed her. As a longtime COO at Beneficial State Bank, Leach is familiar with its unique value set that helps it envision and provide new products, services, and outcomes for its customers and community partners.

Continue reading.

|

|

Taking Stock In Divestment Movements |

If money talks, then divestment walks. At least it does in the fossil fuel divestment movement that has prompted large and scalable campaigns against organizations that ally with oil and gas. Since 2012, investment activists and college students have been pressuring universities, religious institutions, and philanthropic foundations to divest from fossil fuels. Nine years later, the movement has totaled over $14 trillion in institutional divestments, according to advocacy group Fossil Free.

These activists have prompted the largest anti-corporate campaign of its kind, sending a market signal to industries and investors that the public wants companies to stop fueling the climate crisis and start putting their resources into clean energy and other sustainable investments. The success of the fossil fuel divestment movement has encouraged others to launch additional campaigns against companies and projects that are harmful to people and the planet.

Fossil Fuels

2020 is currently tied with 2016 for hottest years ever. US carbon emissions decreased in 2020, but analysts credit lockdown, not significant action by the government or companies to fight the climate crisis. However, the fossil fuel divestment campaign has made significant strides in squeezing the industry: in 2020, Dominion Energy sold its gas transmissions holdings and BP announced the $5 billion sale of its petrochemicals business (chemicals made through the use of oil, like plastics and solvents).

To prevent the burning of fossil fuels and further exacerbate climate change, 350.org founder Bill McKibben launched a campaign to get investors around the world to divest from the top 200 publicly traded fossil-fuel companies. The movement has evolved significantly since its launch in 2012—what began with universities, religious institutions, and philanthropic foundations now includes major capital cities, mainstream banks, insurance companies, and massive pension funds. Divestment pledges now span across 48 countries with over 70% of commitments outside the US, as of Fossil Free’s latest report.

Recent victories have added to the multi-trillion dollar divestment records. New York City promised to completely decarbonize its portfolio by 2040—at a value of over $500 billion. Also in 2020, 42 faith institutions in 14 countries announced their divestment in the largest-ever joint announcement by faith groups.

Despite these new records, there is much work to be done. Harvard University sits on the largest academic endowment in the world, $41 billion. Yet the university refuses to divest despite growing pressure, including a complaint to the Attorney General of Massachusetts claiming the university is violating its duty as a nonprofit by investing in fossil fuels. Other higher institutions have stepped up, including Columbia University, which has divested from companies that derive 35% or more revenue from coal production.

The biggest opportunity for divestment lies with the largest financial institutions in the country. Megabank JPMorgan Chase has not only continued to fund but has increased funding for fossil fuels and their expansion. Its financing of $253 billion in the last four years alone is by far the greatest investment in the climate disaster that any bank in the world has made.

JPMorgan Chase is not the only one—between 2016 and 2020, 56 global private sector banks funneled $3.8 trillion dollars into fossil fuel projects and companies. Some banks have taken small steps such as increasing their lending for renewable energy, but these actions don’t target the root of the problem that is fossil fuel funding. FossilBanks.org has the full list of banks that are the largest financers of the fossil fuel industry, including, but not limited to: Chase, Citi, Wells Fargo, Bank of America, Barclays, TD, and Morgan Stanley.

Studies show that the return on investment for fossil fuels is no longer lucrative. Citing figures from stock market company MSCI, the Guardian noted in 2015 that “investors who divested from fossil fuel companies would have earned an average return of 13% a year since 2010, compared to the 11.8% a year return earned by conventional investors.” Sustainable funds held up better than conventional counterparts in the first quarter market downturn in 2020, according to investment research company Morningstar.

Visit greenamerica.org/divest-reinvest for a list of resources to help you divest from fossil fuels and reinvest in sustainability, including fossil-free mutual funds, CDs, as well as financial advisors who can help clients construct fossil-free portfolios.

Private Prisons and Detention Centers

Incarcerated people in both government and private prisons face poor living conditions such as insufficient food and shelter, coupled with inadequate services like poor healthcare, education, and working environments. Inmates are exempt from the Fair Labor Standards Act and can be required to work for free while incarcerated under the 13th Amendment. Most inmates work in maintenance or food service in their own prison facilities to reduce the overall operating costs.

Operating costs are also cut by skimming on safety, education, and health standards; a 2016 report from the Justice Department found that private prisons have more safety and security incidents per capita than federal institutions.

Private prisons, unlike public ones, have an added profit incentive. Rather than reducing recidivism and rehabilitating prisoners, private prisons can increase their profit margin by lobbying for laws that increase incarceration and extend sentences.

Of the biggest private prison companies, GEO Group derives $1.3 billion in profits from its contracts with the government and CoreCivic makes about $1 billion per year from government contracts. They benefit from the aggressive immigration policy that fills detention beds and backlogs immigration courts—all while having unlimited access to a growing pool of workers. In 2021, President Biden signed an executive order that the Department of Justice would not renew contracts with private prison operators, but this does not affect ICE detention centers, which are run through the Department of Homeland Security.

A federal lawsuit filed in 2018 by a coalition of civil rights groups and lawyers alleges that detainees in the Stewart Detention Center in South Georgia were coerced into working for a few cents each day or go without necessities like food and soap. Stewart Detention Center, which is run by CoreCivic, is still open and oversaw some of Georgia’s highest COVID-19 rates due to a spike at the facility. The lawsuit is ongoing as of June 2021.

Like people convicted to sentences in private prisons, immigrants in for-profit detention centers face—and work in—inhumane conditions; however, asylum seekers are fleeing persecution, torture, or death in their home countries and come to the US for protection. Zero-tolerance policies led to the separation of over 5,500 children from their families at the US-Mexico border. Some of those families have been reunited. Others have not been deemed eligible, or parents had already been deported, cutting contact without well-kept records.

Activists are standing up for prison workers and unfairly detained immigrants through divestment. Freedom to Thrive (formerly Enlace) is urging investors to remove investments from GEO Group and CoreCivic. They’re also targeting the The Million Shares Club, a group of 39 major financial investors that each own over one million shares of these two private prison companies combined. The Million Shares Club includes groups like BlackRock Inc., Vanguard Group INC, and Prudential Financial Inc, to name a few.

In a wave of 2019 victories, JPMorgan Chase, Bank of America, Wells Fargo, BNP Paribas, SunTrust, and US Bancorp all announced decisions to exit the private prison and immigrant detention industries. Private prisons continue with funding from smaller banks, contracts with ICE/DHS, and with states.

You can take action by breaking up with mega-banks that support fossil fuels or private prisons and detention centers and put your funds in a community development, green bank or credit union. These institutions work to build the green economy through community development projects and loans—not private prisons and detention centers.

Get A Better Bank |

|

How Green is Robo-Investing? |

Since 2018, professionally managed assets in the U.S. using socially responsible investing (SRI) strategies have grown by 42% and now total $17 trillion, according to the United States Forum for Sustainable and Responsible Investment.

With SRI—which also refers to sustainable, responsible, and impact Investing—on the rise, robo-advisors, automated investment management services with minimal or no human involvement, are increasingly offering sustainable investment portfolios.

Whether called SRI; environmental, social, governance (ESG) investing; impact investing; or sustainable investing—a few of the terms currently in use—this approach to investing recognizes that the social, environmental, and corporate governance impacts of investments are part of the returns generated by every portfolio. Those impacts should help guide investment decision-making. In other words, with SRI (the term we’ll use), you can invest for profit, people, and the planet.

Robo-advisors, such as Ellevest, Wealthfront, or SoFi, use computer software and an algorithm to both put together and maintain investment portfolios. Many robo-advisors champion certain causes or target specific audiences. For example, Ellevest is a robo-advisor which markets itself specifically to women in order to address a gender gap in the financial services industry. According to Data USA, 68.5% of personal financial advisors are men.

“Some robo-advisors have different focuses than others,” says Helen Beichel [see footnote], founder of FatTail Financial Advisory Group {GBN}. “But one thing I think they probably have in common is basic investment management services with a focus on low cost, passive investment management.”

Art Tabuenca is the founder of EarthFolio, an automated investing service managed by Blue Marble Investments which focuses solely on sustainable investing. Tabuenca says robo-advisors have made investing in a fully diversified portfolio more accessible because of lower management fees and what is typically a lower minimum investment amount. Consulting a financial advisor, he says, is significantly more expensive.

“What robos did is just kind of disrupted [the personal] model and said, ‘Look, we can deliver this advice to someone at a high level, at a much lower amount,’” he says.

Boris Khentov, senior vice president of operations and legal counsel at Betterment, a financial advisory company which offers robo-advising services, says it can be more expensive to have a portfolio composed entirely of SRI investments because the investments required to put together that kind of investment portfolio are more expensive to manage. Betterment’s portfolios generally consist of a broader mix of exchange-traded funds (ETFs), which are less expensive to manage.

Betterment, which first launched its SRI options in 2017, offers three SRI portfolios—Broad Impact, Climate Impact, and Social Impact. These options are greener than conventional robo-investing offerings and less green than a non-robo option that actively screens and engages with companies. SRI does not have a fixed definition but can instead be understood as a range of practices. Khentov says Betterment’s SRI portfolios aim to balance financial performance with accessibility and impact.

EarthFolio offers entirely ESG portfolios, some of which are also fossil-free. Tabuenca says an entirely ESG portfolio can be more expensive because it must incorporate different types of investments, such as mutual funds, which can lead to slightly higher operating expenses. This is because there is not currently enough variety in ETFs to build a fully ESG portfolio.

The Importance of Accountability

One factor to consider is whether an investment firm is independent. Beichel says conflicts of interest can arise when companies, including those offering robo-advisors, provide multiple in-house financial services, which decreases the checks and balances that come from doing business with other companies. These practices can create incentives to only offer clients in-house services or portfolios, rather than considering other potentially more beneficial options.

“One thing to consider is what the potential conflicts of interest might be,” Beichel says. “Is the firm you’re dealing with independent? Are your financial planning, custodial, broker, dealer, and investment advisory firms separate, and if they’re not separate, why not?”

Beichel also recommends being aware of what criteria and data providers portfolio managers are using when integrating SRI concerns, especially when it comes to robo-advisors that lack active, human management and have fewer investment options.

“[Robo-advisors] could be a good option for novice investors, in particular for people who are just beginning to grow their portfolios,” Beichel says. “[People] just need to be educated consumers and understand that robo-advisor money managers are not involved in changing corporate manager behavior beyond using the data from ESG data providers.”

Human vs. Robot

Investors should also consider the pros and cons of robo-advisors when searching for the best tools and products to increase their socially and environmentally responsible investments.

Robo-advisors differ from traditional financial advisors in that they offer investment management services and advice at a lower investment minimum and money management fee. Tabuenca says an online platform may also make investing more accessible to younger generations who frequent that medium and tend to support social justice issues.

However, robo-advisors do not know the ins-and-outs of a person’s financial situation, or interests, which can be important in SRI.

“Robo-advisors provide services online and through call centers,” Beichel says. “They don’t actually meet people face-to-face like I do. You don’t get a person who knows your financial situation intimately, and financial advising can be an intimate process.”

The value to working with live financial advisors is that they have more strategies and products to offer, including community investment options and support for shareholder engagement.

Beichel also says robo-advisors tend to provide only basic, standardized financial education and investment management based on your investment goals, values, and risk with limited support for more complex financial needs.

As the SRI marketplace continues to grow and evolve, both Tabuenca and Khentov predict that more investment options will become available, expanding what robo-advisors can offer.

“We see social and environmental issues that we’re grappling with, and we’re saying, ‘Well, what can I do about it?’” Tabuenca says. “Money becomes an extension of what you want to see in the world.”

What can you do to green your investments?

No matter what kind of advisor you may use, there are ways you can make your money work for the causes you care about.

Find a Financial Advisor Focused on SRI

Having an expert guide you through the transition to SRI, or strengthen your current SRI portfolio, can help you navigate the growing number of investment options. Find an advisor that is the best fit for you at greenpages.org.

Divest and Reinvest

The burning of fossil fuels is a major cause of climate change. You can contribute to a clean-energy economy by divesting from fossil fuels, shifting your investments to clean energy and supporting policies which work toward a fossil-free future. Learn more about how you can divest at greenamerica.org/divest-reinvest.

Use Your Power as a Shareholder

If you own stock directly, rather than in a mutual fund, you have influence over how companies operate. As a shareholder, you can advocate for the issues that you care about and have an impact on corporate behavior. Learn more about shareholder activism at greenamerica.org/shareholder-activism.

FOOTNOTE: Registered Representative, Cambridge Investment Research Inc., a Registered Broker/Dealer, Member FINRA/SIPC, Investment Advisor Representative, Cambridge Investment Research Advisors Inc., Cambridge and Fattail Financial Advisory Group are not affiliated.

|

|

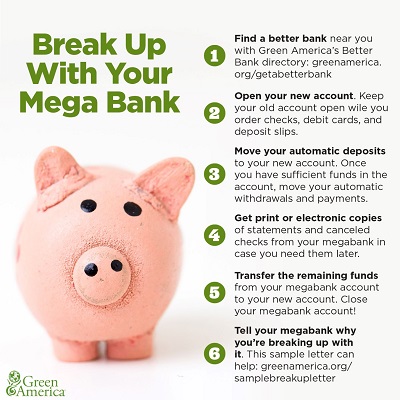

Break Up With Your MegaBank in 10 Easy Steps |

Breaking up with a megabank is easy. And it can make your life easier, too.

In New Orleans, Louisiana, Michael Butler sold his car to pay his medical bills, and racked up 1,400 miles on his Nikes walking to and from work for nine months. His mother saw an ad for HOPE Credit Union {GBN} and encouraged him to apply for a car loan, even though he thought his bad credit would disqualify him. An auto loan from HOPE helped him get a 2015 Dodge 3500. “I was overjoyed to get a car loan from HOPE,” Butler says, “I haven’t met too many people that nice. Of course I want to pay it forward. Now I’m happy to be able to help other people who also need a hand.”

Get Started Today:

1.

Choose your new bank or credit union. While picking a local bank is a good option, and a local credit union an even better option, moving your accounts to a community development bank or credit union is your best bet to matching your banking with your values. Find hundreds of options at greenamerica.org/getabetterbank.

2.

Open your new account. Keep your old account open as you order checks, debit cards, and deposit slips.

3.

Make a list of your automatic payments and withdrawals.

4.

Move your automatic deposits to your new account. Ask your employer to transfer your direct deposit paychecks to your new account. Do the same for Social Security and other deposits you receive. Ask for the date on which deposits to your new account will take place.

5.

Move your automatic withdrawals to your new account, once you know you’ll have sufficient funds in the account. Ask for the date on which payments from your new account will begin. It’s wise to leave a small amount in your old account for a month after you’ve shifted your deposits and withdrawals to your new bank or credit union, just in case.

6.

Get print or electronic copies of statements and canceled checks that you may later need if you have only online banking through your mega-bank.

7.

Transfer the remaining funds in your mega-bank account to your new account after you have all your automatic payments and deposits transferred and any final checks have cleared your old account.

8.

Close your mega-bank account! Obtain written confirmation that your account is closed.

9.

Inform your mega-bank why you’re breaking up with it. See a sample letter in our “Break Up with Your Mega-Bank Kit,” free at Green America’s BreakUpWithYourMegaBank.org.

10.

Encourage your house of worship, alma mater, workplace, and community organizations to use a community development bank or credit union.

For congregations, turn to US SIF’s {GBN} free “Community Investing Toolkit for Faith Communities” at ussif.org/pubs.

Colleges and universities can get assistance from the Responsible Endowment Coalition {GBN} at endowmentethics.org.

|

|

Shareholders Take on Climate Policy from Inside Companies |

The Black Lives Matter protests after the murders of George Floyd and Breonna Taylor, inequities exposed by the covid-19 pandemic, and a rising sense of urgency on climate and environmental issues have made people reevaluate their priorities and question the systems they are a part of. One of those systems is the financial system, which attracted a historic level of support from investors in the spring 2021 proxy season for resolutions on issues such as corporate political activity, corporate policies on diversity, and corporate impacts on the climate.

For example, as of June 24, 2021 there have been 34 majority votes on shareholder resolutions pertaining to environmental, social, and governance issues (ESG), with more possibly by the end of the year, according to Proxy Preview, an annual report which tracks shareholder action. This is extraordinary because corporate management typically urges all investors to vote against resolutions on ESG issues and most investors follow that advice—even when it’s contrary to the long-term benefit of the company and society. During the 2021 season, 17 votes broke 70% support; in comparison, only two resolutions received that much support in 2020. Moreover, four ESG resolutions that received over 90% support also had the support of management. For so many ESG-focused resolutions to receive majority support is historic and a dynamic to watch closely.

Importantly, however, shareholder resolutions can succeed by earning far less than 50% support since success includes the ability to remain in front of management and investors in subsequent years by remaining on the proxy ballot. A first-time resolution now needs to garner 5% support, a second-year resolution needs 10%, and thereafter a resolution needs 25% support to continue to appear on the ballot and thereby generate investor pressure for corporate transparency and change in corporate conduct.

Some are crediting the overwhelming turnout to the volatility of the last year.

“We’ve been locked in our homes and had a little time to think about what’s important in life,” says Andrew Behar, the CEO of As You Sow [GBN]. “[As shareholders,] we are owners of these companies, we profit from these companies … [and] we are complicit in the system that we live in.”

The increased attention to ESG issues among shareholders is also a possible sign that investors are seeing issues of climate, racial equity, and political transparency as important to long-term financial sustainability. Even larger asset managers, like BlackRock and Vanguard, have begun voting in favor of ESG proposals, which is vital to ensuring change, says Josh Zinner, CEO of the Interfaith Center on Corporate Responsibility.

“We’re seeing that the big fund managers like BlackRock, who have been talking for some years now about ESG, are finally beginning to look their proxies in accordance with what their stated values and concerns are,” Zinner says. “Once you have those big fund managers who are significant universal owners starting to support these proposals, you’re seeing a major rise in the votes.”

Changes to the Shareholder Resolution Process

Despite investor support of ESG issues this proxy season, the next year in shareholder action is hard to predict. In late 2020, the Securities and Exchange Commission, under the Trump administration, made changes to the 14a-8 rule that decides exactly who and how a stockholder can file resolutions.

Previously, any stockholder owning at least $2,000 worth of stock for a year could file a resolution; investors must now own a whopping $25,000 worth of stock if they have owned the stock for one year. Shareholders need $15,000 worth of stock if held for two years if they wish to file a resolution, and smaller shareholders, with at least $2,000, must now wait three years before they can file resolutions. This is an attack on shareholder democracy and the rights of smaller investors. As SEC Commissioner Caroline A. Crenshaw said in opposing the new rule, “the implication of today’s rulemaking is that the wealthy are more likely to possess ideas worthy of corporate consideration. That is one way to reduce the burden on corporations, but I believe that that is a bad result.”

Green America mobilized thousands of concerned investors and consumers to oppose the SEC rule, calling for strong corporate oversight through the shareholder resolution, rather than less oversight by restricting the participation of smaller shareholders and by increasing the percentage of support needed for resolutions to be refiled.

As You Sow, the Interfaith Center on Corporate Responsibility, and individual investor James McRitchie have filed a lawsuit to challenge the SEC’s proposed changes to the 14a-8 rule. The lawsuit, which was formally presented on June 15, argues that the new regulations are a Trump-era attempt to curb the voices of activist shareholders and smaller investors.

“It’s really ironic that at a time where investor support for ESG resolutions is skyrocketing that this SEC rule would significantly curb the filing of those resolutions,” says Zinner.

Vote your proxy ballots, for Pete’s sake! This is one of a series of graphics made for Green America to accompany our annual Shareholder Focus List (shareholderaction.org). The series takes aim at companies like Walmart that faced resolutions in 2021 focused on climate and other crucial issues. Image by FI Creative.

Vote your proxy ballots, for Pete’s sake! This is one of a series of graphics made for Green America to accompany our annual Shareholder Focus List (shareholderaction.org). The series takes aim at companies like Walmart that faced resolutions in 2021 focused on climate and other crucial issues. Image by FI Creative.

Climate

Perhaps the most notable shakeup in 2021 in the realm of shareholder action happened at ExxonMobil, where shareholders voted to elect three activist investors to the oil company’s board of directors this June. The three new directors were put forward as candidates by Engine No. 1, a relatively new, small investment firm, with the intention of installing leaders who would push Exxon to reduce its carbon footprint and explore sustainable energy options.

What’s more, BlackRock, Vanguard, and State Street voted on behalf of their clients against the formal recommendation of ExxonMobil’s management to oppose the new board candidates—instead supporting Engine No. 1’s dissident directors.

Heidi Welsh, the Executive Director of the Sustainable Investment Institute, says that the change in the board was a result of a perceived lack of climate action on Exxon Mobil’s part.

“The results that occurred are enough to make companies really think hard about how much disclosure they need to do and what their goals are with regard to climate change,” Welsh says. “It’s basically an affirmation that climate change is a big problem for business.”

In addition to the events with Exxon, eight climate change proposals earned more than 50% support this year, resulting in two of the highest votes of the season. Management-backed resolutions at Bunge and General Electric calling for reporting on different environment-related goals resulted in 98.8% support and 98% support, respectively.

More shocking, however, were the majority votes for climate and environmental resolutions that were opposed by management. A resolution at DuPont for more disclose on plastics pollution received 81.2% support from investors, and one at Chevron asking for reductions of greenhouse gas emissions received 60.7% support.

Investors at Walmart also voted this past season on the first-ever resolution regarding the climate impacts of refrigerants, specifically the leakage of hydrofluorocarbons (HFCs). The resolution was filed by the State of Rhode Island with Walmart and built on refrigerant-related campaigns at Green America and the Environmental Investigation Agency. HFCs are an incredibly potent greenhouse gas and make up 48% of the company’s climate emissions. The resolution received 5.5% approval—despite the Walton family owning half of Walmart’s shares—and has reached enough support to be refiled next season.

Political Spending and Lobbying

Proposals about political spending, money donated by corporations through PACs, trade associations, and other organizations to influence elections and policymaking at all levels, received 14 majority votes overall, the most out of any other issue. The Center for Political Accountability found that, since 2010, IRS-designated 527 PACs have raised over $1.5 billion. Much of this spending is undisclosed or only partially disclosed, to the peril of our democracy. Resolutions at Netflix and Chemed asking for more disclosure about election spending received 80.6% support and 80.1% support, respectively.

ICCR members introduced resolutions this year regarding climate lobbying—that is, asking corporations to not only disclose corporate lobbying activities, but to lobby in favor of environmentally-responsible policies.

“The resolutions on climate lobbying are noteworthy because they're not policy engagement with their stated values,” Zinner says.

ICCR members filed climate lobbying resolutions with seven companies, reaching agreements with five of them. Most noteworthy is the resolution at Norfolk Southern, a transportation corporation, which went to vote and received 76.4% support.

Diversity and Race

Increased national attention to racial justice issues throughout 2020 resulted in shareholders asking for reports on racism. Resolutions covered a broad area of issues—asking for reports on lobbying related to equity and racial justice; gender and minority pay gaps; racial justice impact reports; and more.

Of the 46 proposals in the 2021 proxy season that asked companies to address a human rights issue, 18 asked companies to produce reports on how racism affects company proceedings or plans to address systemic racism. Proposals at Amazon and JPMorgan Chase received 44.2% and 40.5% support, respectively—which is an unusually high level of support for a first-year resolution.

Behar says that the success of resolutions asking for racial justice audits was especially noteworthy, considering that organizations like As You Sow have only developed metrics for measuring racial justice in the past year or so.

“We only started … collecting data on racial justice after the George Floyd murder, and to see that data become actionable, and companies really using it to rate and rank themselves—that was, I think, really profound,” Behar says.

Additionally, more attention was given to the diversity of companies, their executives, and their boards of directors during this proxy season. A resolution at IBM asking for a report on the effectiveness of Diversity, Equity, and Inclusion (DEI) programs received 94.3% with management support, while a call for more diversity at First Solar received 91.2% without management support. Overall, there were nine majority votes on diversity-related proposals.

To monitor and strengthen follow-up on corporate pledges made to fortify their diversity and equity commitments, William Michael Cunningham of Creative Investment Research [GBN] filed a petition with the SEC in May 2021 calling on the Commission to develop a “comprehensive framework requiring any public companies or issuers that have promised financial support for Black Lives Matter ("BLM Pledge") to accurately disclose, on a timely basis, all activity related to that pledge” as well as to address the costs of anti-Black racism and how BLM corporate pledges could reduce that cost. These points and others raised in the petition, if enacted, would demonstrate the reliability of corporate BLM pledges and as Cunningham states, “Requiring additional BLM Pledge disclosure will enhance the competitiveness of U.S. markets and help correct economic injustices perpetrated against African Americans.”

Creative Investment Research has also developed a Black Lives Matter Donation Tracker to hold corporations accountable for their BLM pledges and to help ensure that needed changes in corporate conduct actually take root.

Looking to Future Seasons

The 2022 proxy season is expected to be a transition period as the changes to the 14a-8 rule go into effect unless they are reversed; as such, it’s hard to predict exactly what will happen in the next year. That being said, Welsh says that she expects issues of diversity, political spending, and climate change to be leading issues, but the individual focus of those proposals might change.

Regardless of changes to the resolution process, there are still ways for investors and shareholders to encourage change. Tim Smith, the director of ESG shareowner engagement for Boston Trust Walden, noted that pressure on companies to make change is happening not just through shareholder action — fund managers like BlackRock are also putting pressure on companies through pledges of divestment.

“In 2020, several large institutional investors pledged to divest from fossil fuel companies,” Smith says. “In addition, we witnessed record levels of votes supporting climate-related shareholder resolutions in the 2020-21 proxy season. This combined pressure from global investors should prompt company management and boards of directors to take a closer look at how they are addressing the climate crisis.”

Green America resources on shareholder action include our infographic on how to read a shareholder proxy ballot (p 19) and our list of sample resolutions to vote at greenamerica.org/shareholder-resolutions-vote.

Special thanks to the authors of the 2021 Proxy Preview report

|

|

These Banks Invest In Community |

When Gambian immigrant Mariama Jallow aspired to launch an African hair shop in Maine more than five years ago, she lacked a cosmetology license and other means to start a business in an unfamiliar country. Today, however, thanks to assistance from a community development financial institution (CDFI) called Coastal Enterprises, she runs Mariama’s Beauty Supply, a unique hair-braiding salon employing immigrants in Portland.

Across the US, people from diverse economic backgrounds are increasingly recognizing and moving toward community investing, which uplifts marginalized localities by boosting livelihoods and economic resources. This trend has expanded substantially over the past couple decades, delivering job creation, affordable housing, sustainable agriculture, robust infrastructure, and climate change mitigation. According to the US Forum for Sustainable and Responsible Investment, community investing assets rose to $266 billion last year, climbing 44% since 2018.

What’s more, anyone can explore and contribute to them via CDFIs and similarly mission-centered institutions.

“It’s never been easier” to invest for racial, gender and economic justice, according to Justin Conway, vice president of investment partnerships at Calvert Impact Capital, a community investment firm based in Washington, DC.

Fostering Wealth to Counter Injustice

The goal of community development financial institutions is to shift resources to under-served and under-estimated communities and those of color, where longstanding unjust policies and underinvestment have trapped a lot of residents in poverty and hindered their success.

Calvert Impact Capital{GBN} collaborates with organizations worldwide to fix the harms of structural racism, sexism, economic injustice, and environmental injustice. It uses investor dollars to fulfill local needs like housing, healthcare, schooling, and childcare and spread prosperity by supplying inexpensive credit. The nonprofit aims to spur capital markets to make a difference “loan by loan, family by family [and] community by community,” Conway says.

To maximize investor payoffs and promote racial equity, Community Capital Management’s {GBN} Minority CARES investment program combines investment themes, receiving the most financing for community development ventures and people of color, including enterprise development, affordable housing and healthcare, and education and childcare.

“Economic inequality, racial injustice and the need for sustainable investing are very connected,” according to David Sand, the Florida-based company’s chief impact strategist.

In Maine, Coastal Enterprises concentrates its lending, investing, and advising on underprivileged entrepreneurs and businesses in poorer localities or with low-wage workers. It maintains a special focus on America’s rural regions, which often experience limited access to economic resources. To aid in establishing jobs, the CDFI leverages flexible private funding via the federal New Markets Tax Credit (NMTC) program, and even venture capital funds.

Another CDFI, Chicago Community Loan Fund{GBN}, turns investor contributions into advances for projects in low-income minority neighborhoods throughout the city to “ignite the local economy,” according to its president, Calvin Holmes. It takes chances on for-profit and nonprofit organizations that would otherwise struggle to obtain financing, he says. This enables “their growth, their employee growth, their balance sheet growth [and] their ability to spend money in the neighborhoods, which all leads to higher levels of community wealth.”

And Optus Bank, a CDFI in Columbia, South Carolina, uses deposits to offer loans and banking services to elevate disadvantaged locals like minorities and women through businesses, homes, and savings they can hand down to later generations. To address the racial wealth gap that African Americans face, CEO and president Dominik Mjartan says the bank aims to uplift entrepreneurs and empower would-be homeowners in the community.

“When communities are thriving with small businesses, they can employ other members of the community to help them grow, create wealth and ultimately give back to that same community, which hopefully creates long-term effects of growth and self-sufficiency,” Danielle Burns says.

Many Needs, Many Possibilities

Community investing presents a broad scope of causes to finance, with the prospect of steady gains over several years.

Affordable housing and small-business advancement are areas of high impact , according to Danielle Burns, vice president of CNote, a company that harnesses technology to facilitate investment in CDFIs. She also serves on the board of directors at Green America.

In addition to providing a debt-refinance deal to save Ingrid Murray’s New York business, Prospect Cleaning Service, CNote partner CDFI Pursuit prepared her for sustained growth. Credit: Pursuit.

In addition to providing a debt-refinance deal to save Ingrid Murray’s New York business, Prospect Cleaning Service, CNote partner CDFI Pursuit prepared her for sustained growth. Credit: Pursuit.

“When communities are thriving with small businesses, they can employ other members of the community to help them grow, create wealth and ultimately give back to that same community, which hopefully creates long-term effects of growth and self-sufficiency,” Burns says.

Due to the massive number of jobs resulting from construction of housing, affordable housing is a smart investment. Recent investing trends involve scaling up livelihoods in poorer locales through avenues such as green technology production, affordable housing construction, and mixed-use development, Holmes says. The numerous layoffs suffered due to the coronavirus stress the need to ensure all Americans have, at minimum, living-wage jobs producing savings to buffer against future disasters.

Calvert Impact Capital’s Justin Conway noted that small-business investments have not seen serious risk since 2020 because community-based financing institutions are designed to serve their people. They “work with their customers and provide accommodations…to make sure people can stay in their homes or keep their jobs and doors open through challenges.”

He added that given climate change’s disproportionate burden on disadvantaged communities, investors are now most interested in improving racial and climate justice.

Renewable energy, sustainable food, and education are also major investment sectors, according to Coastal Enterprises’ spokesperson Elizabeth Rogers. She highlighted the opportunity the food system offers, from farming and fishing to processing, manufacturing, and distribution. She added that work from home policies due to the pandemic requirements underscored the importance of funding childcare and broadband as well.

The coronavirus fallout and George Floyd’s killing have raised awareness of entrenched racial wealth disparities and related vulnerabilities, including inadequate livelihoods, housing and healthcare, according to Optus Bank’s Mjartan. He added that those two events have emphasized community investing’s significance and encouraged participation in mission-oriented local initiatives. He pointed out that billions of dollars went into CDFIs last year—more than the total across their prior 25-year history.

“That’s an unprecedented opportunity to build a stronger economy for everyone in America, not just the top 1%,” Mjartan says. He underlined the need to transform this moment into a movement to secure community resilience and equitable opportunities for everyone, no matter their zip code or inherited privilege.

Tips for Investing

From community banks and credit unions to investment advisers and brokerage accounts, the opportunities are growing when it comes to community investing. Supporting a nearby CDFI such as by holding a checking or savings account there, is a good start.

According to Community Capital Management’s Sand, CDFIs are “first financial responders…helping communities survive and rebuild,” so the Federal Reserve deems them “economic shock absorbers.”

Using CDFIs to hold your checking or savings account is a low-risk way to manage your money, with the potential to make a big impact. By definition, federally certified CDFI banks and credit unions must be insured by the Federal Reserve for at least $250,000 per account. You can ask your bank or credit union if it is federally insured.

“Have a real honest conversation with yourself and your family about what areas of impact are important to you,” says CNote’s Burns. She recommends incorporating issue and geographic priorities into your portfolio.

Optus Bank’s Mjartan says if you’re able, putting your money into an account or financial product for five to fifteen years gives it the greatest potential to solve longer-term systemic problems. Community investments can play an important role in every portfolio, no matter what size.

Over 60% of Calvert Impact Capital partner ECLOF’s worldwide clients reside in rural areas, and 30% of its loan portfolio is dedicated to agricultural loans, like for this beet farmer in Colombia. Credit: Calvert Impact Capital.

Over 60% of Calvert Impact Capital partner ECLOF’s worldwide clients reside in rural areas, and 30% of its loan portfolio is dedicated to agricultural loans, like for this beet farmer in Colombia. Credit: Calvert Impact Capital.

Individual Action Matters

While institutional investors bring large sums to community investing, individuals can also have big impact. Although individuals frequently think their actions are too tiny to achieve change, people are nimbler than institutions and are able to have collective power, putting their dollars to work.

Community investing leaders who have witnessed amazing growth in community development investments appreciate how individuals continue to strengthen this effort with their assets and voices.

“Every person in America can be a community investor,” Mjartan says. “Regardless how much money you have and where you’re located now, you can align your money with your values.”

“Ultimately,” says Fran Teplitz, Green America’s executive co-director for business, investing and policy, “community development investments are about dignity, hope, and opportunity for individuals and neighborhoods left out of the economic mainstream.”

Find a bank or credit union

Find a credit card

|

|

Social Investing at Every Age |

If you ask multiple financial advisors for generalized advice on money matters, they’ll likely tell you that every person’s finances are different and ever-changing based on goals and plans. If they’re advisors who specialize in socially responsible investing (SRI), they’ll also agree that no matter how much money you have, you can use your money to support sustainable business practices and local economies.

That said, Green America pinned a few of them down on general financial and SRI advice for every decade of our lives, based on where the average person is at each stage. Use it as a rough guide to maximizing the power of your investments as you go through life.

In Your 20s

People in their 20s tend to have:

- Some debt, including student loans.

- An entry-level salary in their field.

- Few expenses (may have no kids, rent instead of own a home, etc.).

- A beginner's knowledge and comfort level with investments.

Start saving early: People in their 20s may feel that the need to save for retirement is less urgent, since it’s 40-plus years away. However, Kathleen McQuiggan, senior vice president of Global Women’s Strategies at Pax World {GBN} stresses that the money you put away today will compound over time, so the earlier you start saving, the more you’ll have when you need it most.

Steve Dixon, principal and investment manager at Birchwood Financial Partners {GBN} says it’s critical for young people to start saving. “My parents, the Baby Boom generation, didn’t need to figure this stuff out like younger generations will need to. Pensions were more prevalent and Social Security was more secure. Nowadays, [no one can count on these]. It’s much more critical that young people save for retirement. The nice part is that there are lots of ways to do it.”

Save as much as you can: Elizabeth Warren, Massachusetts Senator and bankruptcy expert, coined the “50/30/20” rule of budgeting, which suggests you should keep your necessary costs to 50% of your after-tax income, spend up to 30% on “wants,” and sock 20% into savings. When you’re just starting out in the working world, 50/30/20 might be more of a goal than a reality, but make a point to save as much as you can until you can reach 20%.

Make saving routine: Steve Dixon says your financial plan in your 20s should emphasize making saving for retirement part of your routine.

“It’s like working out or exercising or eating right; if you build it into a routine, it’s so much easier than if you put it off,” he says. “Don’t wait until you have money to put away, because invariably, we never feel like we have enough money to put away.”

Get involved in your workplace retirement account: The easiest place to start saving is at work: If your employer offers a retirement savings account and will match a portion of your savings, take advantage of that—it’s free money! Make sure to save at least the amount that earns you the maximum employer match amount.

Save more if you’re a woman: McQuiggan warns young women to consider their savings and investments even more strategically than men: “Women live five to six years longer than men. Also, the wage gap exists—[white] women make 80 cents [for every dollar a man makes, and women of color make even less]. So when women retire, they have to have more money than men.”

Considering SRI:

Break up with your mega-bank: The easiest thing to do to use your money for good is to switch banks. Break up with your mega-bank, if you belong to one, and choose a community investing bank or credit union. (The federal government provides certification for some, which will be called “community development financial institutions.” Not all are certified.)

Community investing banks and credit unions are known for treating customers better and generally charging lower fees than mega-banks. Most allow the same convenience of online banking that a mega-bank would have.

Where does the socially responsible part come in? Community investing banks and credit unions have a mission to use their money to lift up low- and middle-income communities. For example, Wells Fargo lends its money to fossil-fuel projects, while many community investing banks make a point of avoiding fossil fuels, instead lending money to foster local businesses, support people trying to buy homes, and more. Community investing banks and credit unions are federally insured, which means they’re just as safe as a mega-bank or your local bank.

Get SRI into your workplace retirement account: Ask your employer if socially responsible funds are included in your workplace retirement account. If they aren’t, ask your employer to consider adding them.

In Your 30s

People in their 30s tend to have:

- Less debt.

- A higher salary than in their 20s.

- Growing expenses, from buying a home, growing a family, etc.

- Some retirement savings.

Set aside an emergency fund: The investment advice site Betterment.com recommends making sure you have an emergency fund by your early 30s. Most experts recommend setting aside at least six months’ worth of your salary in a savings account, in case of illness or job loss, for example.

Don’t cash out retirement accounts: People with even a small amount of retirement savings shouldn’t cash it out early, an article from Money Magazine warns. When you cash out a 401(k), the government takes out extra taxes, so a $5,000 balance could turn into $3,500 cash. If you leave your retirement accounts alone, you keep the money growing.

Reconsider your savings: As you age, make a point to divert as much as you can into retirement and other savings. Increase your contribution to your workplace retirement account, which you can have your employer automatically pull from your paycheck. And have your bank or credit union automatically divert money from your checking account into savings every paycheck, as well.

Consider mutual funds: If you didn’t already start in your 20s, investing some of your savings in mutual funds may also be a good option in your 30s, because at a younger age, you can be more tolerant to risk since you have time to absorb any losses. As a general rule of thumb, the higher the risk, the more potential for greater returns.

Considering SRI

SRI mutual funds: Generally, socially responsible mutual funds do as well or outperform the general market (see p. 15), making them a great option for green-minded people in their 30s who want to get started investing outside of a retirement account.

Look for socially responsible mutual funds, such as those listed in the “Mutual Funds” category at Green America’s GreenPages.org. Mutual funds offer automatic diversification, which can help minimize risk, and most types are actively managed.

A socially responsible financial advisor: Your life is likely to go through some big changes in your 30s. You may get married and/or start a family, and you may buy your first home. Consequently, your finances will go through some big changes as well. A financial advisor can help you navigate these changes. Look for a socially responsible financial advisor, who can offer general financial advice and help you invest your money in line with your values.

Community investing: Your 30s may be a good time to maximize the social aspect of your portfolio and move some of your money into community investments that go beyond banking. These investments help finance community-building projects in the US or elsewhere in the world. They may help people build houses, install renewable energy, start small businesses, or otherwise help lift up local communities.

The Calvert Foundation {GBN}, for example, offers Community Investment Notes, which put your money into a pool of community development projects across the US and around the world—from loans for women-owned small businesses in Tanzania powered by solar to loans for affordable housing in Baltimore.

“Community investing is an important part of every portfolio and can play a key role in diversification,” says Fran Teplitz, Green America’s executive co-director.

In Your 40s

People in their 40s tend to have:

- The highest wages of their careers.

- Long-term loans from big purchases.

- Established retirement savings.

- A need to continue saving for big purchases/children’s needs, like college.

Max out your retirement savings: Advisors at Bankrate.com recommend making the maximum annual contribution possible to your retirement savings in your 40s, if you aren’t already. For example, for the 2019 tax year, the maximum annual contribution to a 401(k) was $19,000.

Consider individual stock investments: If you haven’t already decided to invest in individual stock, your 40s could be a good time to do so. Buying individual stock has more risk than investing in mutual funds, but the rewards can be greater if the company does well.

Considering SRI

Screen your stock investments: Research companies before buying stock in them to ensure they’re socially and environmentally responsible. And purge any companies from your portfolio that you find are being poor corporate citizens. A socially responsible financial advisor can screen your holdings for you.

Become an active shareholder: If you hold stock, you’ll receive a shareholder proxy ballot every spring. Vote your proxy ballot in favor of social and environmental shareholder resolutions (see p. 16). (Mutual fund managers receive and vote the proxy ballots for their stock holdings, and they must disclose those votes on the fund website. If you disagree with how one of your mutual funds voted on particular ballot, call the investor relations department and let them know.)

In Your 50s

People in their 50s tend to have:

- Peak savings and investments.

- A short “time horizon” until retirement.

- A continued need to help children with college, plus assist aging parents with health and other issues.

Consider lessening your investment risk: As you start to think about retirement in the next decade or so, it may be time to shift your investments to be more conservative. Bill Holliday of AIO Financial uses the term “time horizon” to talk about how much time people can keep their money in an investment before they need it back.

"We don’t want to be forced to sell out of a volatile market when markets are down. If you have a short time horizon or don’t tolerate much risk, you want to have a good amount in fixed, stable investments,” Holliday says.

Consider your personal time horizon until retirement, and check with a financial advisor to see if lessening investment risk is right for your portfolio.

Considering SRI

Find lower-risk socially responsible investments: Just because your investments may be getting less risky doesn’t mean you have to compromise on your values. No matter what your risk tolerance and time horizon, you or a financial planner will still be able to find socially responsible alternatives that fit with your needs.

Government bonds and certificates of deposit (CDs), for example, offer fixed returns and less risk for investors. Money market funds, or pools of CDs, bonds, and certain other investments offer automatic diversification and reduced risk.

SRI At Retirement (65+)

At 65, you might be setting the date for your retirement, or be retired, and you’re starting to withdraw from your savings and investment accounts. (Be sure to read up on the requirements for starting such withdrawals, to avoid fines or penalties.)

Steve Dixon suggests reconsidering community investing, which generally has a low level of risk, when you retire.

“If I know I’m going to need that money in 18 months, if I’m being prudent, I shouldn’t be willing to take a lot of risk,” he says. “I want it in something secure.”

Community investments can deliver social impact while simultaneously being available for the near term. Many community investments allow you to choose an investment term of anywhere from one to 15 years.

|

|

Does Social Investing Affect Portfolio Performance? |

You know by now that socially responsible investing (SRI) does make a difference in the world, but perhaps you’re wondering what kind of difference it will make in your portfolio. Will you sacrifice financial returns if you align your investments with your values?

The evidence, amassed through hundreds of studies, shows that historically, SRI investments have performed as well as or better than their conventional counterparts.

For well over a decade, financial studies have been confirming what green investors already know: that investing to support people and the environment makes financial sense.

In 2021, a study from Morgan Stanley Institute for Sustainable Investing found that in a year marked by volatility and recession, funds that focused “on environmental, social and governance (ESG) factors, across both stocks and bonds, weathered the year better than non-ESG portfolios.” The research looked at more than 3,000 mutual funds and exchange-traded funds (ETFs) and found that sustainable funds performed better than non-ESG funds in 2020 and 2019.

Investment research firm Morningstar published a report in 2021 finding that the returns of 69% of sustainable funds ranked in the top half of funds, and 37% in the top quartile for returns. Data from the last five years found similar results.

And even in 2007, a report by the United Nations Environment Programme Finance Initiative analyzed academic work and key broker studies and found that SRI investment strategies had a competitive performance with non-SRI strategies.

Conclusion: You can do well by doing good with SRI.

The Green America Visa

Cut up those mega-bank credit cards and get a card issued by a community investing bank or credit union that puts its money to work helping people and the Earth.

To make it even easier for you to find such a card, Green America offers a credit card in partnership with TCM Bank, N.A. which is owned by ICBA Bancard, a subsidiary of the Independent Community Bankers of America. Every purchase on the card supports Green America’s high-impact action campaigns. The card even allows you to earn reward points!

Visit TakeChargeofYourCard.org to learn about Green America’s card and other cards that benefit environmentally and socially conscious organizations.

|

|

How To Use Your Finances For A Better World |

1. If you want to:

- Get problematic industries like tobacco, fossil fuels, weapons, and others out of your portfolio

- Invest in forward-thinking companies on the cutting edge of green technologies, like renewable energy, water purification, and responsible waste management

Try: Screening

What is it?

- Screening is making the choice to include or exclude investments in your portfolio based on social and environmental criteria.

- Avoidance screens mean that investments that violate your social and environmental criteria are kept out of your portfolio.

- Affirmative screens seek out investments that support business practices in which you believe.

Scale

- As of November 2020, investors have put $17.1 trillion into vehicles managed with sustainable investing strategies, up 42% from that figure in 2018, according to the Forum for Sustainable and Responsible Investing (Also called US SIF).

Impact

“The very act of buying a portfolio that’s more consistent with goals of universal human dignity and ecological sustainability changes the conversation. It expands the mission of companies. 90-plus global stock exchanges have joined the Sustainable Stock Exchanges Initiative, which means that over 50,000 companies now attempt to track their impact on people and the planet. Those things never would have happened had just Wall Street been their shareholders.” —Amy Domini, Domini Social Investments {GBN}

Get Started

- Do research and screen your own investments, or hire a socially responsible financial advisor to help you. Find one in the “Financial—Advisors & Planners” category at Green America’s GreenPages.org.

2. If you want to:

- Use your investor power to pressure irresponsible corporations to clean up their acts