|

Father And Daughter |

|

|

Small Business Leaders Have Advice for Trump Renegotiating NAFTA |

Over 100 small business leaders sent a letter to President Donald Trump urging him to ensure that the renegotiation of the North American Free Trade Agreement (NAFTA) and other global trade pacts does not allow foreign multinational corporations to attack US laws that protect US communities and the environment.

As things stand now, foreign-owned companies are allowed to challenge such laws before tribunals of three private lawyers, according the American Sustainable Business Council and Green America. That, they say, is bad for communities and the environment and also puts US-based small firms at a competitive disadvantage.

In May, Trump notified Congress of his administration’s plans to renegotiate NAFTA, setting in motion a 90-day period before negotiations with Canada and Mexico can begin in August. According to trade legislation, the administration must make public its more detailed plans for the negotiations 30 days before negotiations begin.

Of particular concern to small business is Investor-State Dispute Settlement (ISDS) – a provision in NAFTA and other trade deals that enables multinational corporations to sue the US government over laws at the local, state, and federal levels that they claim violate their broad investor rights. These laws, which US small businesses must abide by, are intended to protect the health, environmental, and financial well-being of our nation. As the business leaders’ letter to the president notes, in addition to threatening US laws, the special treatment for foreign investors that the ISDS system allows also incentivizes the offshoring of jobs by removing many of the costs and risks associated with re-locating to low-wage countries.

Corporations do not need these special privileges, according to Jerry Greenfield, co-founder of Ben and Jerry’s Ice Cream. “We started with one store in Vermont, and now Ben & Jerry’s ice cream is sold around the world,” he said. “This success required a good product and hard work from lots of folks, but not special rights to attack other countries’ laws.”

“Trade that enriches and privileges foreign multinational corporations at the expense of US businesses, communities, labor, and the environment is a bad deal,” said Fran Teplitz, director of Green America’s Green Business Network. “The Investor-State Dispute Settlement that allows multinationals to attack US protections for people and the planet should not be part of any trade agreement our nation joins.”

“While there’s no doubt that trade agreements between nations are important to economic development,” added Richard Eidlin, vice president of the American Sustainable Business Council, “the key question is whether the rules are fair to small and mid-sized businesses and to local communities. We’re concerned that the Investor State Dispute Settlement mechanism embedded in current NAFTA and other trade negotiations, tilts the playing field against smaller companies and communities.”

As a presidential candidate, Trump repeatedly denounced NAFTA, calling it “the worst trade deal maybe ever signed anywhere.” There is indeed much that economic, labor, environmental, and other civil society organizations seek to change about NAFTA, say the small business organizations. “Trump is now back-peddling on his earlier pronouncements about eliminating NAFTA,” they said, in a statement, “and we are entering a period where the voice of sectors not at the negotiating table must be heeded if a reformed-NAFTA is to be an improvement.”

|

|

The Sweet Side of Fair Trade |

Sustainability has always been an important value at Food For Thought, the gourmet organic food company Timothy Young started over ten years ago. All of his products—from strawberry preserves to corn muffin mix—include certified organic fruits and vegetables. Social justice has also been a strong part of his mission, so when he saw the opportunity to sweeten his preserves with Fair Trade Certified™ sugar, he leapt at it.

“Choosing Fair Trade, organic sugar was an easy decision for us,” says Young. “The fruit we use comes from local farmers with whom we have direct relationships, so we know that both people and the planet are being treated fairly. Now we can also guarantee that the sugar we use is providing a fair wage to small-scale farmers around the world.”

Young uses Fair Trade Certified sugar to make his unique preserves, and you can use it in our own kitchen. Fair Trade sugar, which made its US debut in 2005, is now widely available to consumers in grocery stores and online—giving people the opportunity to buy white, brown, and powdered sugar that benefits both people and the planet.

Conventional Sugar: Not So Sweet

About 85 percent of the sugar sold in the US is grown domestically, but much of that farming is controlled by large corporations under conditions that harm the environment.

About half of the sugarcane in the US comes from southern Florida, where the sugarcane industry has been encroaching on the Florida Everglades for nearly a century. More than a billion gallons of water are diverted away from the Everglades to the sugarcane fields every day, according to the Everglades Trust Foundation. In addition, phosphorus run-offs from the sugar industry have devastated the Everglades’ ecosystem, and the sugar lobby (called “Big Sugar” by critics) has worked aggressively to avoid responsibility for repairing the damage.

The sugar lobby has consistently worked to postpone the deadlines for cleaning up contaminated water and has shifted the burden of paying for clean-up to tax payers, says Joe Browder, board member of the nonprofit Friends of the Everglades.

“Sugar controls the way water flows through South Florida, both environmentally and economically,” says Browder. “It is depriving the protected Everglades of water in the dry season, and dumping excess water into all the Everglades and south Florida coastal communities in the wet season. When sugar growers need to keep their land dry, they treat the rest of south Florida like a toilet. And those issues are no closer to being resolved in favor of the Everglades.”

US trade policies protect the jobs of domestic sugar farmers, but they result in sugar prices in the US that are usually about three times the price of sugar on the world market, damaging farmers around the world who cannot compete in an unfair US sugar market. High sugar costs also affect manufacturers of food products and beverages in the US, and their customers; a 2003 report by the Organization for Economic Cooperation and Development (OECD) estimates that the US sugar program costs consumers roughly $1.5 billion dollars a year.

And these protectionist policies don’t necessarily help small farmers. The OECD estimates that over 40 percent of US policy benefits go to just 1 percent of all sugar producers.

Sugarcane farming abroad does not have a better record. The World Wildlife Fund estimates that, because of habitat destruction, intensive water use, heavy use of chemicals, and polluted wastewater, sugar may be responsible for more biodiversity loss than any other crop worldwide.

And the harvesting of sugar has often been plagued with labor problems. According to a 2018 report by the US Department of Labor, child labor and forced labor are used in many sugar producing countries, including reports of child labor on sugar plantations in Bolivia, Brazil, India, Kenya, Mexico, and the Philippines.

Better Options: Fair Trade Sugar

If you want a sweetener that is easy on the environment and supports your local economy, you can look for locally grown organic maple syrup or honey. But if it’s sugar you need, Fair Trade Certified™ sugar is now increasingly available in stores throughout the US and online.

Through Fair Trade, farmers are paid a guaranteed price for their products—a price that covers their living costs while also helping to improve their communities. The Fair Trade price also includes a “social premium,” which is used for social projects decided upon democratically by the farmers, and an additional premium is paid for sugarcane that is certified organic.

“Fair Trade certification ensures that sugarcane farmers receive a fair price for their harvest, helping farmers around the world put food on their tables,” says Anthony Marek, public relations director at TransFair USA, which certifies Fair Trade sugar for sale in the US. “It also creates direct trade links between farmers and buyers, and provides access to affordable credit. And Fair Trade premiums allow farmers to invest in and improve their communities.”

Sugarcane farmers in the Chikwawa district of Malawi have put the Fair Trade premiums to life-saving use. Before the Kasinthula Cane Growers sugar cooperative was certified by the Fairtrade Labelling Organisations International in 2002, people in the farmers’ villages were beset by waterborne illnesses like bilharzias, cholera, and dysentery. The cooperative’s first project using the Fair Trade premiums was the drilling of two wells, which now provide clean drinking water to two villages and help prevent these diseases.

The cooperative has also used its Fair Trade premiums to bring electricity to the village of Chinangwa, and members are currently at work building a school.

In addition to guaranteeing farmers a fair price, Fair Trade certification also helps farmers use environmentally sustainable farming practices. On Fair Trade farms, producers must adhere to strict standards regarding the use and handling of pesticides; the protection of natural waters, virgin forest, and other ecosystems of high ecological value; and the management of erosion and waste, according to TransFair USA.

And the premiums that come with Fair Trade certification often enable farmers to switch to organic farming—90 percent of the Fair Trade Certified™ sugar in the US is also certified organic.

What You Can Do

Go Fair Trade for your sweet needs by purchasing Fair Trade Certified™ sugar. If your local grocer doesn’t have it, ask that they carry it and order it online until it’s available locally.

Learn more about Fair Trade and take action to promote it by joining Green America’s Fair Trade Alliance and by requesting a copy of our new Guide to Fair Trade.

|

|

Peaceful Pets Aquamation, Inc. |

|

We saw the need for an aftercare company that transparently gave respectful and personal care to our pets. When we came down to it, we wanted to be a company run by pet lovers for pet lovers. We also felt that, in today's world, being environmentally responsible is an important part of honoring our pets and protecting our planet. So, we designed Peaceful Pets from the ground up, to take care of your pets in the exact same way we want our own pets to be treated. And, we decided to use the technology called aquamation. Aquamation is water-based and 100% green, providing huge benefits over fire-based cremation. It replicates and accelerates the natural process of decomposition, making it the most natural aftercare available. Peaceful Pets Aquamation has become a world leader in setting a new standard for the care of your pets.

|

|

|

Shrink Your Impact, Offset the Rest |

When Ethan Merlin, a school teacher and Green America member in Rockville, MD, had an opportunity to take a group of students to visit Moscow, he had just one regret: by flying roundtrip across the Atlantic, he and his students would have no choice but to each cause the emission of more than three tons of carbon dioxide, a greenhouse gas.

“The trip was an amazing learning experience for me and for my students,” says Merlin. “But I also care about the climate crisis, and the world that we are leaving for future generations.”

So rather than forego the trip altogether, Merlin helped mitigate the climate impact of the students' trip by purchasing carbon offsets equivalent to the greenhouse gas emissions associated with their airplane flights.

"I was so glad [to discover this option,]" he says.

Carbon offsetting provides a powerful way to address climate change. By purchasing offsets, you help fund a project that prevents one ton of greenhouse gases (GHGs) from being emitted for each ton that you have caused. Carbon offset providers sell the GHG reductions associated with projects like wind farms or methane-capture facilities to customers who want to offset the emissions they caused by flying, driving, or using electricity.

For example, Big Tree Climate Fund sells offsets to consumers from a methane-reduction project in Brazil. The Irani Project, located at a paper and pulp factory in the city of Vargem Bonita, treats wastewater from the plant in a special way, so it degrades aerobically (like compost) instead of anaerobically (like landfill waste). Anaerobic wastewater treatment produces massive amounts of climate-warming methane; according to Big Tree, businesses around the world emit 33 to 44 million tons of methane through anaerobic wastewater treatment each year. Methane is 23 times more potent as a greenhouse gas than carbon dioxide, according to the EPA. Because of the innovative methane-reducing technology it uses, the Irani Project has reduced its methane emissions by nearly 56,000 tons each year. It also reduces the paper mill's water use.

Over the past few years, the carbon offset market has grown rapidly, directing $705 million in 2008 to carbon-reducing projects worldwide. As the market has expanded, it has also matured—and finding a trustworthy offset provider is easier than ever.

Before you turn to offsets, it’s important to reduce your climate impact first (see box, below). A good mantra when it comes to reducing your carbon footprint is: reduce what you can, offset the rest, and then repeat. Once you’ve taken steps to shrink your emissions, follow these steps to offset what’s left. ...

Do the Math

The first step to offsetting your climate impact is to calculate how many tons of GHGs your activities emit. Most offset retailers provide online calculators (see “Resources,” below). Their estimates will come in about the same, with one exception: there is an ongoing controversy about the climate impact of air travel. In addition to the carbon dioxide that planes emit directly, they leave behind other emissions that ultimately contribute to global warming, in a phenomenon known as “radiative forcing.”

Some carbon calculators multiply a flight’s emissions by a radiative forcing index (RFI), but unfortunately, they multiply by a factor of anywhere between about one-and-a-half and three, resulting in different totals.

So what’s an eco-conscious traveler to do? Until a uniform RFI is in place, it’s best to err on the side of too much offsetting, rather than too little—after reducing your air travel as much as possible. Use a carbon calculator that incorporates a radiative forcing index, like those from offsetters in the resources box. If a carbon calculator offers a check-box to “include radiative forcing” in its calculations, choose this option.

Look for Certified Offsets

Because you can’t see or touch a reduction of greenhouse gases, it’s important to know exactly what reduction you are purchasing, and that the reduction wouldn’t have happened without your purchase. The leading offset providers have developed shared standards for carbon offsets, and their offsets are verified by independent third parties, providing assurance that you’re getting what you paid for.

Look for offset providers that have met the standards of the International Carbon Reduction and Offset Alliance (ICROA) or the Green-e Climate program. Both the Alliance and Green-e Climate require their member retailers to ensure that any reduction in GHGs sold as a carbon offset is “real, verified, permanent, additional, and unique.” (Visit www.icroa.org or www.green-e.org for a fuller definition of each criterion.) The Alliance’s members source their offsets from projects that would not have been implemented without offset funding and that have been certified to meet the above criteria by one of five standards: the Clean Development Mechanism, Joint Implementation, the Gold Standard, the Voluntary Carbon Standard, or the Climate Action Reserve.

Choose a Carbon-Busting Project

Once you know how many tons of GHGs you’ve added to the atmosphere, select a certified offset that will reduce GHGs by the same amount. Your offset purchases can support a variety of carbon-reducing projects.

Renewable energy generation: More than half of offset purchases worldwide support renewable energy projects, which help to displace coal-fired electricity. Look for offsets certified to have caused new GHG reductions that wouldn’t have happened otherwise. For example, 3Degrees offers Green-e Climate certified offsets from wind facilities in northeastern China and Karnataka, India. Buying these offsets contributes to the viability of these projects, and you are buying new energy generation that is never resold, displacing coal power and reducing emissions in rapidly developing countries. Or, NativeEnergy’s WindBuilders program sells offsets to finance new wind projects. Many promising projects lack the capital they need to get built. So by purchasing a carbon offset that finances new construction, you help build wind farms and solar installations.

Methane projects: Another category of offset products helps prevent the release of methane, a particularly potent greenhouse gas which has over 20 times the impact of CO2. For example, TerraPass offsets support methane capture at landfills from Maine to South Dakota.

Energy efficiency and other projects: Offset dollars can also support other creative projects that reduce GHG emissions. For example, the CarbonNeutral Company offers offsets from a project to install compact fluorescent light bulbs and other energy-saving devices in hotels throughout Jamaica.

Forestry: In the past, Real Green has urged readers to steer clear of carbon offsets based on tree-planting projects (though trees have lots of other environmental benefits). Trees certainly do “breathe in” carbon dioxide, but it doesn’t make sense to offset emissions from a recent flight by planting trees that only remove that much CO2 from the air over many decades. The good news is that several of the leading offset project standards have developed clear criteria for forestry-based offsets whose GHG reductions will occur on a more immediate timeframe. Some reputable offsets based on forestry projects are available from the ICROA-member offset retailers (listed in the “Resources,” below).

Look for a Reputable Carbon Offset

If you’re a conscientious consumer who tries to live a low-emission lifestyle, consider offsetting the remaining emissions for which you are responsible. Buying offsets will help you direct much-needed capital to worthy projects that will keep greenhouse gases out of the atmosphere.

Then, return to the beginning of the reduce-offset-repeat cycle, and continue looking for ways to reduce the climate impact of your household, workplace, neighborhood, and community.

Reduce Your Impact First

Purchasing carbon offsets only makes sense for those who have already reduced their emissions by flying less, driving less, eating less meat, and curbing electricity use. For guidance from Real Green on reducing your climate impact, check out our archives.

For a comprehensive guide to cutting your home electricity use in half over the next five years, download the Efficiency First! issue of our magazine.

Offsets vs. RECs

Warning: Don't purchase renewable energy credits (RECs) as offsets.

Why? When you buy an offset, you should know for sure that your purchase caused a new reduction in greenhouse gas emissions that wouldn’t have happened otherwise, and not all renewable energy qualifies. RECs are typically sold from existing projects to give electricity customers a green power option. But renewable energy that customers purchase to offset their GHG emissions is held to a different standard. Buying a REC does not ensure that your purchase caused a measurable reduction in greenhouse gas emissions that wouldn’t have happened otherwise.

To buy carbon offsets sourced from renewable energy projects, look for an offset from an ICROA member or search Green-e Climate’s “Find Certified Carbon Offsets” page for certified renewable energy offsets. These offsets can result from new renewable energy projects, but only those that are beyond business as usual.

|

|

How is Our Electricity Generated in the US? |

The chart below explains where our energy comes from and what each type’s impacts are on people and the environment. Energy sources in red or yellow have significant environmental and social problems, while sources in green are key to a green energy future. Almost all types of energy generation end up doing the same thing: they turn the arm of a generator that moves strong magnets around copper coils. Copper atoms have particularly “loose” electrons, and inside generators, the steady rotation of strong magnets pumps out a flow of electrons: electricity.

|

Type of Power Source

|

How It Works

|

Eco-impact

|

| Coal-fired Power Plants |

Coal is burned to heat water, which makes steam. The steam turns a turbine, which powers a generator. |

Burning coal emits massive quantities of greenhouse gases and leaves toxic mercury in the air and water. The mining of coal is unhealthy and dangerous work, and mountain-top removal mining is destroying ecosystems and communities in Appalachia. |

| Nuclear Power |

Radioactive uranium heats huge tanks of water. (Precisely “fired” neutron particles cause atoms of uranium-235 to split apart, and this “fission” releases enormous heat and radiation. Every fission reaction in a reactor releases a neutron that causes another fission reaction.) The hot water generates steam, and the steam turns a turbine which powers a generator.

|

Nuclear power does not produce greenhouse gas emissions or other pollution. It does use massive quantities of water, and releasing the warmed water damages ecosystems and wildlife. Nuclear power creates radioactive waste that is dangerous to people and living things for millions of years. It also creates dangerous targets for terrorists and contributes to the proliferation of nuclear materials for terrible weapons. |

| Petroleum or Natural Gas |

These fuels are burned to heat water, whose steam turns a turbine that powers a generator. When energy is in high demand, some power plants don’t just burn natural gas to heat water to make steam – they burn natural gas directly to generate vapors that turn turbines that generate electricity. This kind of natural gas power can be quickly dialed up and down to respond to fluctuating demand. |

Burning petroleum generates nitrogen oxides and carbon dioxide, and burning natural gas releases these same chemicals in lower quantities. The burning and transporting of natural gas can emit methane, a potent greenhouse gas. The extraction of oil and natural gas can disrupt habitats and communities. |

| Biomass |

Some power plants burn wood chips or waste products to heat water whose steam turns a turbine that drives a generator. |

For biomass, the eco-impact varies widely depending on what is being burned. When municipal solid waste is used to create energy through burning in huge incinerators, MSW plants produce nitrogen oxides, sulfur dioxide, mercury compounds and dioxins. Even when stronger air pollution filters prevent these chemicals from being released into the air, they collect in tons of toxic ash that has to be buried in landfills. |

| Hydropower |

Generates electricity when the force of water flowing through a dam turns the blades of a turbine which drive a generator. |

Building new dams can be disruptive to ecosystems and habitats, and can intervene in the migration patterns of some fish. New dams have decimated some communities, such as the Three Gorges Dam in China, and dams in Canada and New England have hurt Native American communities. Once built, hydropower is a fairly clean energy source that does not emit greenhouse gases or other pollution. |

| Wind farms |

Collections of turbines sense and turn to face the wind. Wind turns the blades of the turbines, and a gear magnifies the rotor’s speed. This shaft’s turning powers a generator. |

When sited correctly, wind farms are safe for birds and bats. They can generate completely clean power, emitting no greenhouse gas or other pollution. They have a small on-the-ground “footprint,” leaving the land they are placed on free for agriculture or forest. |

| Solar Power |

Photovoltaic panels are made of a semiconductor material such as silicon. When sunlight shines on the silicon, the material absorbs some of the energy, knocking some electrons loose. An electric field concentrates the flow of electrons in a single direction, generating electricity. “Solar farms” —large areas covered with solar panels—function as a power plant, placing power onto the grid for transmission to homes and businesses. |

Once installed, solar panels generate zero-emissions electricity. Though their manufacture can generate some pollutants, including silicon tetrachloride, which should be recycled rather than dumped, a recent study by the Brookhaven National Laboratory found that even when the manufacture of solar cells is taken into account, displacing grid power with solar power results in at least an 89 percent reduction in greenhouse gases and pollutants. |

| Geothermal Power |

In some Western states, heat from the center of the earth is used to heat water, which creates steam, which turns a turbine that powers a generator. |

Some geothermal power plants release hydrogen sulfide and trace amounts of other pollutants, but overall this is a significant source of cleanly-generated electricity. |

Electricity Production in the United States, August 2007 [DOE]

|

|

A Power Primer: Electricity 101 |

Our demand for electricity is at the heart of the nation’s single greatest source of the pollution that causes climate change. Fully half of our electricity in this country is generated by coal-fired power plants and coal power by itself is responsible for 40 percent of US greenhouse gas emissions. Electricity can be difficult to think about because it is invisible. We see what it does, but not what it is or where it came from. What is actually happening when we plug something into an outlet at home and watch it turn on or light up?

What is electricity?

Everything — you, the clothes you’re wearing and the computer you're looking at — is made up of atoms. Electricity is created when electrons — tiny particles that orbit around the nucleus of each atom—are stripped off and pulled along in the direction of a positive charge.

We use electricity in our homes to refrigerate and cook food, play music, keep the lights on, drive computers and televisions, and power hundreds of appliances large and small. “Plugging something into an outlet and flipping the switch is like opening the water valve,” writes Paul Scheckel in The Home Energy Diet. “Electrons flow from the outlet into the device … the electrons can be manipulated by the circuitry in an appliance in hundreds of ways to turn motors, light bulbs, calculate formulas, play music, record movies, or project an image. The list of uses for electricity is endless and nearly miraculous.”

How do power plants generate electricity?

The force of strong magnets can push electrons off of their atoms and generate electricity. Almost all types of energy generation end up doing the same thing: they turn the arm of a generator that moves strong magnets around copper coils. Copper atoms have particularly “loose” electrons, and inside generators, the steady rotation of strong magnets pumps out a flow of electrons: electricity.

There are many different methods, though, for driving the generators that create electricity. Some have dire impacts on people and the planet; others are clean and sustainable. (See our chart.)

How is "green" electricity different from other electricity?

How electricity is generated has a big impact on people and the planet. But wind turbines, solar panels, nuclear power plants, and coal-fired power plants are all making the exact same thing—the electricity flowing through the grid is a pulsing line of electrons, indistinguishable regardless of how that energy was generated. You can’t choose what sort of energy will come to your house’s outlets from the “grid”—that energy is a generic flow of electrons, created from the “energy mix” of sources in your region.

What is "the grid"?

Electricity is a generic row of electrons pulsing at a given rhythm that enters a common system from many different sources. Electricity can travel up to 300 miles from where it is generated to where it is used. The interconnected system of wires that connects all power generators to power users is known as the “grid.” The grid is interconnected and overlapping across the country, although power generated in one place cannot be used more than several hundred miles away. That said, electricity routinely crosses state or even country lines; and households with solar panels can even create power that they place onto the grid from their homes, which joins the common energy supply for use in their area.

How do I impact this system when I reduce my energy use?

The generation of electricity is driven by demand. Fully a third of the energy generated in this country is for residential use—when you make changes in your household to reduce your energy use, your decision has an impact on the utilities that are generating energy.

Over the short term, fast-acting power plants fueled by natural gas can be dialed up and down to respond to daily changes in demand. Other power generators using coal and nuclear are used for steady demand and can only be adjusted over the long term. Because utilities generally make use of all renewably generated wind or solar power placed on the grid, changes in energy use will eventually reduce coal and nuclear power generation. All of the 108 new coal-fired power plants currently being proposed around the country are being justified as necessary because of projected power demand; and demand for more coal is driving the “mountaintop removal mining” currently taking place in Appalachia. So in both the short and long-term, reducing your own energy use helps to reduce the dirty generation of power.

How does electricity get from power plants to my house?

Generators don’t just pump out a line of electrons flowing towards a positive charge—they flip the charge from positive to negative 120 times and back again every second, so that rows of electrons vibrate in every electric wire. This pulsing line of electrons, called alternating current (AC), can transmit electricity over great distances.

The cycles of alternating current mean that the electricity moves in steady waves of rising and dropping voltage as the electrons cycle back and forth. Most generators generate power in three overlapping phases. Transformer stations “pump up” the force with which the electrons are flowing through the wires to a high voltage, hundreds of thousands of volts, for transmission over long distances.

The huge towers running through rural areas have three wires, one carrying each phase of power at very high voltage, and a top “ground” wire designed to balance the other three. (Some power towers also serve to carry telephone or cable lines.) Somewhere near your house, the power enters a substation that steps down the power’s voltage to much lower levels; typically two wires carrying just one phase of power at 240 volts splits off from the main power line to serve each household.

What happens when I buy green power by purchasing renewable energy credits?

Once electricity generated by a wind farm is placed on the grid, it is indistinguishable from electricity generated by a coal-fired plant. So energy customers who wish to support wind and solar power can do so by purchasing renewable energy certificates, also known as “RECs,” or “green tags.” The day is coming soon when government incentives and shifting market forces will bring the cost of generating zero-carbon power below the cost of burning coal for power. But until then, buying a green tag allows customers to help renewable energy projects by making up the difference between the “grid price” of 1 kilowatt of power and the slightly higher price of renewably generating that kilowatt of power. Purchasing green tags doesn’t directly change anything about what is coming into your outlets, but it is a powerful way of displacing dirty power production by helping to place renewably generated energy on the grid.

|

|

The Mystery of Deodorant: What's Really In There? |

Lots of people take pride in how they smell, going to great lengths to ensure there's no funk and thinking if they're not always fresh from the shower, nobody will want to be around them. And so many turn to deodorant, making it a $70 billion per year industry. A study from the University of Bristol found that of 117 women who didn’t produce odor, three-quarters of them still used deodorant.

Conventional deodorant isn’t very good for your body, as many types contain toxic chemicals that may harm human health and the environment. Deodorant soaks directly into skin, so it’s important to know its ingredients and their risks.

Here are some of deodorants’ most common and toxic ingredients:

-

Aluminum: Aluminum is the main ingredient in most antiperspirants. It may alter the balance of odor-causing bacteria in your armpits, which can actually make you smell worse. Aluminum is linked to health issues that affect the liver and kidneys.

-

Parabens: These are commonly found in makeup and deodorant and are used to prevent bacterial growth. However, they can interrupt hormonal balance in the body, and they're estrogen mimickers that can lead to breast cancer.

-

Propylene Glycol: Often listed as PG, this ingredient is a suspected skin and kidney toxicant. It's also skin sensitizer, meaning it could result in allergic reactions on the skin.

-

Triclosan: Triclosan is a chemical that’s used to help keep the odor-causing bacteria out of your pits, but it can also kill the good bacteria in your body. Killing the good can mean that when bacteria repopulates, the good might be replaced by even more bad, which could make you stinkier or even sick. Consequently, triclosan has been linked to rising numbers of antibiotic-resistant bacteria. The FDA has issued warnings against this ingredient because of its ability to disrupt the functioning of thyroid hormones.

-

Silica: Silica is added to deodorant to help absorb moisture from sweat, but it is also known as a skin irritant. The silica in deodorant may also be contaminated with a compound called crystalline quartz, which has been linked to the development of cancer cells and respiratory diseases.

Solution: Natural Deodorants

Opting for a natural deodorant is safer than using a deodorant with one or more of the five ingredients from above. Most natural deodorants use ingredients like baking soda and coconut oil, which have antibacterial properties. Natural products tend to be deodorants, not antiperspirants, meaning they stop the smell but not the sweat itself. Most have essential oils for scent and are gentle on the skin.

-

Creating Harmony LLC sells the Sage & Rose Deodorant Mist. This mist is made with mineral salts, which helps prevent odor.

-

Schmidts Naturals sells Schmidt’s Natural Deodorant Stick, which is enriched with mineral-derived odor-fighting ingredients such a magnesium and baking soda, and has plant-based powders that help absorb wetness without aluminum.

-

North Coast Organics offers 100 percent vegan and cruelty-free deodorant in five different scents. Natural ingredients include coconut oil and baking soda.

|

|

Mars Takes Puppy Steps - Removes GMOs from Pet Food Brand |

Recently, Mars Inc. relaunched its natural pet food line Nutro, announcing that its dry food would now be made without GMOs (genetically modified organisms). The new product line aims to have “recipes that are simple, purposeful and trustworthy, made with real, recognizable, non-GMO ingredients as close to their native form as possible.” For the last year GMO Inside and thousands of consumers have been pushing Mars to remove GMOs from all of its pet and human food. Producing higher quality pet food free of GMOs is a great first step.

Learn more on the GMO Inside Blog

|

|

Martha Stewart |

|

|

Getting Scrappy: A New Life for Food Waste |

At this Boston company they just love to talk trash -- composting that is!

By Alexandra Lim-Chua Wee

At CERO Cooperative, trash is never really trash. The Massachusetts-based business -- which was recently awarded the Green America’s People & Planet Award -- collects food scraps from local food businesses and turns them into compost. The compost is then delivered to local farms where it can be used to grow fresh produce to be sold and cooked again.

In Boston, local businesses pay some of the highest rates just to get their trash picked up every day and carried off to landfills. Moreover, for the area’s food businesses, about 65 percent of daily trash collection is compostable. “At the landfills, decomposing food produces the harmful gas, methane, which is then permanently in our air,” says CERO team member, Maya Gaul. “And when you look at food waste as an issue, it is the third largest emitter of greenhouse gases in the world.”

When they work with CERO, local businesses receive easy-to-use, industrial-grade compost carts that can be placed in kitchens or storerooms for easy food scrap disposal. At the end of each day, these carts are picked up and replaced with clean carts. Not only does this save businesses the higher cost of normal trash pick-ups -- or hefty fines under the state’s 2014 food waste ban -- but it makes for a greener environment. It’s a win-win-win!

Another win-win is that CERO is a cooperative. The workers equally own and govern the business, and directly profit from their labor. “It’s important to approach sustainability from all perspectives, from the people to the business, to the planet,” Gaul says. “Not only are we helping to reduce methane emissions, but we’re able to provide local green jobs to the community.”

|

|

Sustainable Computing |

I have been coaching Mac users for over 15 years, boosting productivity, erasing frustration, and increasing happiness. I deeply value sustainability, showing up by bicycle and helping you compute more efficiently and with less waste. My clients appreciate my patient, inquisitive approach, ability to meet them where they are, and that I provide the tools so they can learn to help themselves.

|

|

Bond & Devick Wealth Partners |

An established firm using goals-based planning for 35 years. For decades, we’ve advised clients interested in SRI investing and are local leaders for those interested in aligning their values with their investments.

|

|

Five Cool (and Free) Tools for Financial Wellness |

Find Out Your Financial Health

Have a bit of time on your hands? Why not check your financial wellness with CNN Money’s financial health calculator? Enter your current debt, emergency savings, retirement savings, and other information for a big-picture look at how well you’re doing with your money.

Pay Down Your Debt

Have debt? SavvyMoney can help you pay it off ASAP. This app gives you free, ongoing access to your credit score, and provides personalized advice on low-interest ways to pay down your debt and raise your score.

(PC, Android)

Is Your Retirement on Track?

Will you have enough to retire? Enter a few important pieces of info, like your age and how much you have saved already, into AARP’s calculator, and it’ll tell you how much you will have saved by retirement age and how much you need to step up.

Add SRI to Workplace Retirement Accounts

Do you wish you could choose SRI investments in your workplace retirement plan? Or are you an employer who’d like to offer them but doesn’t know where to start? Green America’s free Plan for a Better Future guide can help you add SRI options to your workplace retirement plan.

Track Your Spending, Savings,& Investments

If you’ve ever thought being able to track your spending and your investments in one place would be a good idea, wait no longer. The Personal Capital app lets you know where you’re spending money, while helping you analyze the risk level of your portfolio, get advice on your 401(k), calculate what you need to save for retirement, and more.

(PC, iOS, and Android)

|

|

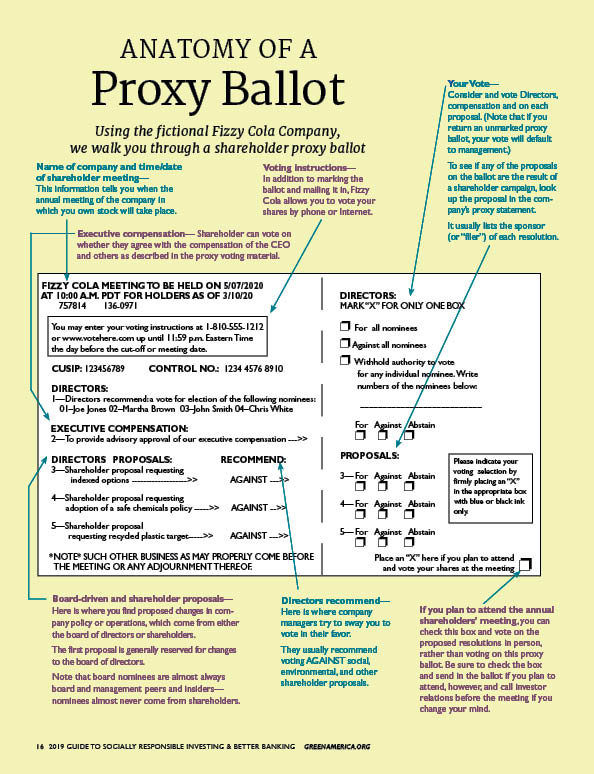

Anatomy of a Proxy Ballot |

Using the fictional Fizzy Cola Company, we walk you through a shareholder proxy ballot. If you'd prefer to view this image as a PDF, click here to open.

|

|

How Karen and Joe Greened Their Investments |

Karen Bearden compares greening her money to a waterfall: one act of socially responsible investing (SRI) was like a drop of water that led to a cascade.

She became a Green America member back in 2005. After reading about SRI in our publications, she and her husband Joe moved some of their investments into a Pax World socially responsible mutual fund that year.

That one act led to another and yet another. They found a socially responsible financial advisor and started screening their investments with his help. In 2010, the Beardens broke up with Bank of America in favor of a local credit union, and cut up their mega-bank credit cards, choosing a card from their credit union and the Green America VISA instead.

Today, the Beardens are still invested in Pax World Funds, along with Green Century Funds and Domini Social Funds. Karen screens their individual stock holdings, with her advisor’s help, to ensure that they don’t include fossil fuels or firearms. She also pays special attention to including renewable energy companies.

The investments, she says, have paid off: “Many of our SRIs perform equal to conventional investments,” she says, noting that those that don’t are close. Plus, she says, “we know we’re investing in and supporting better companies. Those investments will pay off more in the future as we move toward more sustainable ways in the world.”

When the Beardens receive shareholder proxy ballots, for companies in which they own stock, they always vote in favor of social and environmental shareholder proposals. Karen says she’s also brought Green America publications to her financial advisor to explain to him their values of social responsibility.

In addition, Karen has been active in the fossil-fuel divestment movement. In 2009, she started volunteering with 350.org. After seeing the hardships that the Standing Rock Sioux faced in fighting the Dakota Access Pipeline, she helped 350.org organize activists in her area to persuade the cities of Raleigh, Durham, and Chapel Hill to divest from Wells Fargo, a bank that has loans supporting the pipeline.

“It’s important to me to not be investing in corporations that are destroying the Earth and hurting people and hurting our food system,” says Karen. “Everything is connected.”

|

|

Does Social Investing Affect Performance? |

You know by now that socially responsible investing (SRI) does make a difference in the world, but perhaps you’re wondering what kind of difference it will make in your portfolio. Will you sacrifice financial returns if you align your investments with your values?

The evidence, amassed through hundreds of studies, shows that historically, SRI investments have performed as well as or better than their conventional counterparts.

A 2015 study from Harvard and University of Minnesota researchers found that consistently, “firms making investments on material ESG issues outperform their peers in the future in terms of risk-adjusted stock price performance, sales growth, and profitability margin growth.”

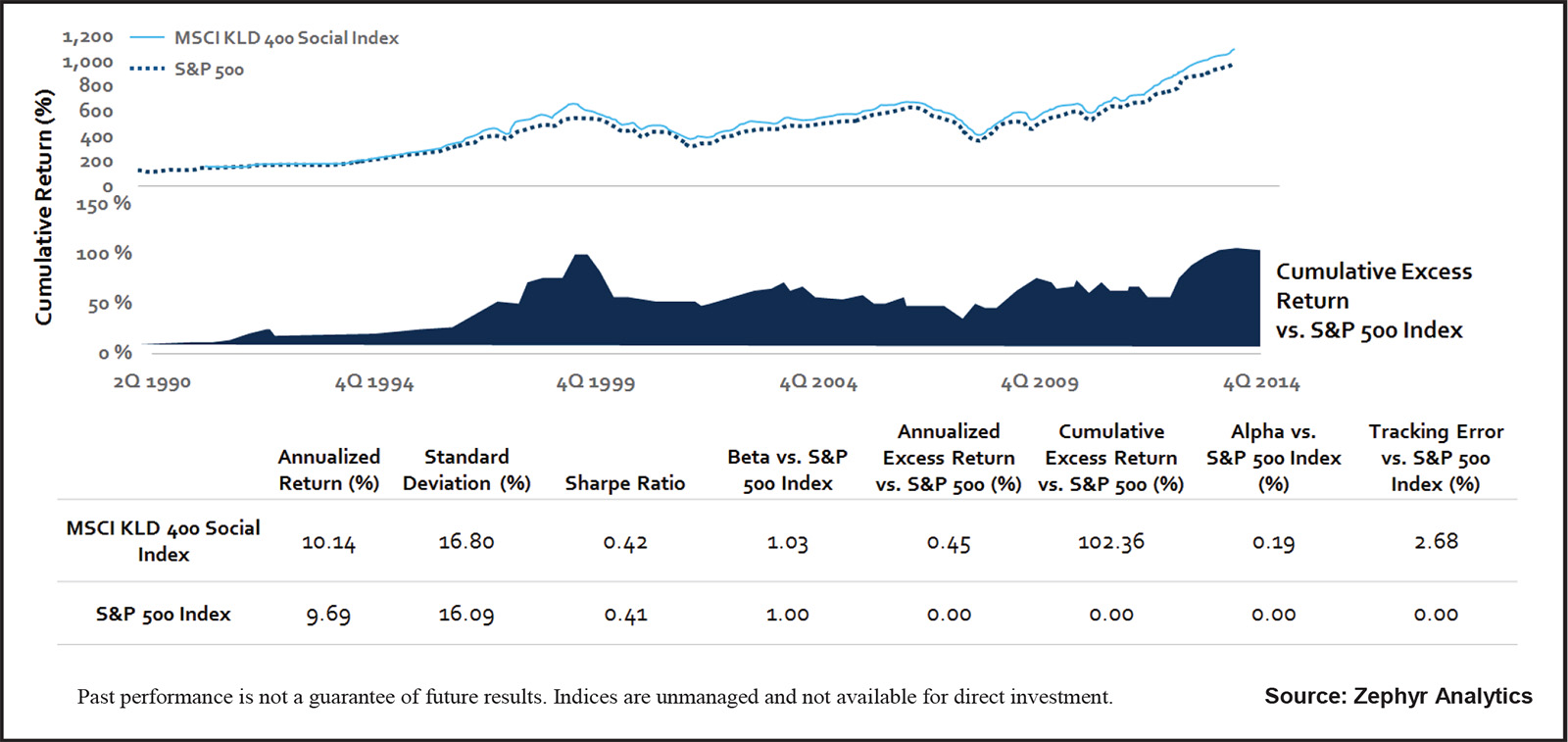

In addition, in a white paper published in 2014, TIAA-CREF selected five widely known US equity SRI indexes with track records of at least ten years—Calvert Social Index, Dow Jones Sustainability US Index (DJSI US), FTSE4Good US Index, MSCI KLD 400 Social Index, and MSCI USA IMI ESG Index—and compared their returns with two conventional US equity-based indexes, the Russell 3000 and the S&P 500. The analysis found that the SRI indexes performed competitively with the conventional indexes.

Likewise, a 2015 survey by the Morgan Stanley Institute for Sustainable Investing found that, “Benchmark performance of the MSCI KLD 400 Social Index, which includes firms meeting high Environmental, Social, and Governance (ESG) standards, has outperformed the S&P 500 on an annualized basis by 45 basis points since its inception” in 1990.

And a 2012 meta-analysis of over 100 academic studies, conducted by DB Climate Change Advisors, found that incorporating SRI results in “superior risk-adjusted returns for investors.”

Conclusion: You can do well by doing good with SRI.

This graph from the Morgan Stanley Institute for Sustainable Investing shows how the MSCI KLD 400, the world’s oldest socially responsible investment index, has outperformed the S&P 500 since its inception. Graphic by Zephyr Analytics

|

|

You Can Invest in Change: Pick an Issue |

Wondering how you can make a real difference in the world? Move your money.

People who bank and invest in a socially responsible manner arguably have never been more important to the health of humanity and the Earth. As Donald Trump’s administration doubles down on anti-environment, anti-science, and anti-immigrant policies, it’s clear that Congress and the Supreme Court aren’t able to provide the checks and balances they once did. Enter investors.

Yes, investors, believe it or not.

For instance, Trump has denied that the climate crisis is caused by humans, signing an executive order in March dismantling Obama’s Clean Power Plan. In early June, he officially started pulling the US out of the Paris Climate Agreement, which 195 countries are supporting. Meanwhile, Apple, Amazon, Walmart, and several other companies pledged to stick by their Obama-era promises to meet Paris Agreement emissions targets—despite Trump. And 12 states and Puerto Rico have formed the US Climate Alliance to negotiate with the United Nations to have their climate-reduction pledges counted as American participation in the Paris climate deal. As of June 14, ten more states and hundreds of US cities had pledged support for the Paris Agreement as well.

“Strong clean energy and climate policies ... can make renewable energy supplies more robust and address the serious threat of climate change while also supporting American competitiveness, innovation, and job growth,” Apple, Google, Microsoft, and Amazon said in a joint statement to Bloomberg.

Why would these companies and leaders stand for the environment in spite of getting carte blanche to pollute from the Trump administration? In part because their customers have demanded they do so. And their shareholders have the loudest voices of all.

While the administration—particularly vice-president Mike Pence—hints it may try to roll back LGBTQ legal rights, some corporations are fine-tuning LGBTQ anti-discrimination policies. Many of these policies have been in place for years, and the credit for them lies largely with concerned shareholders who put pressure on companies to do the right thing.

And when Trump signed an executive order banning travelers from seven Muslim countries, 127 companies filed an amicus brief in support of a federal court challenge to the ban. (Green America’s Green Business Network® members also signed a statement against the ban.) Why? They knew their customers and shareholders—the latter of whom have been pushing for greater board and management diversity and anti-discrimination policies for decades—wouldn’t want them to be silent.

You don’t have to be rich to be a social investor. All you need is the will to use your money to support your values—and the kind of world you want to see for the future. In spite of Washington.

Pick an issue:

Climate Change:

As the Trump administration pulls the US out of the Paris Climate Agreement, investors are pressuring companies to reduce greenhouse gas emissions and increase renewable energy. They’re also reinvesting that money in green energy and energy-efficiency technologies.

The Environment:

While Trump puts people with ties to the fossil-fuel industry in charge of the EPA and rolls back environmental protections, shareholders and people with bank accounts are pressing companies to do better for the planet —and moving their money into companies that go the extra mile to care for the Earth.

LGBTQ Rights:

Many Fortune 500 companies have LGBTQ policies in place, thanks to investor pressure. Investors are still working on laggards to improve—and they’re taking on entire states with discriminatory laws.

Indigenous Rights:

The Dakota Access Pipeline (DAPL) and its encroachment on the lands and rights of the Standing Rock Sioux galvanized a new crop of shareholder activists, fossil-fuel divestors, and people willing to break up with their mega-banks—and move their money into community investing banks and credit unions.

Diversity:

Too many white men in the White House? Definitely. And while we can’t do much about it until the next election, we can push Corporate America to put more women and people of color on boards and in upper management—and invest in companies with a commitment to fostering diversity.

The Border Wall, Prisons, And More:

The fossil-fuel divestment movement is sending a message to the market that oil and gas aren’t sustainable—financially or environmentally. Divestment is also being used to pull assets out of companies tied to Trump’s border wall between the US and Mexico, and out of private prison companies, letting both groups know that our money won’t fund these harmful efforts.

|

|

background |

|

|

social k ad |

|

|

Green Business Network Fellow |

|

|

Vote with Your Investments for a Better World |

In the 1990s, socially responsible investors played a key role in bringing down South Africa’s brutal and racist apartheid regime. Since then, they’ve made a difference on a wide range of issues, pressing companies around the world to move in a more socially and environmentally responsible direction.

Thanks to engaged shareholders:

- In January of 2017, ExxonMobil appointed an atmospheric scientist and climate-change expert, Susan Avery, to its board of directors.

- In recent years, McDonald’s and Dunkin’ Donuts agreed to phase out styrofoam cups. And Dell and Ikea have begun phasing out foam packaging.

- In 2016, nine tech companies, including Apple, Intel, Expedia, Amazon, Adobe, Microsoft, and eBay, agreed to publicly disclose and close their gender pay gaps.

To press for this kind of change, anyone with a bank account and retirement savings can engage in a practice called socially responsible investing (SRI). Though SRI is known by many names—impact investing; natural investing; sustainable and responsible investment; and environmental, social, and governance (ESG) investing—it all means banking and investing in ways that make large corporations more accountable to people and the environment, as well as supporting companies with forward-thinking practices and products.

“The single greatest impact you can have is how you invest your savings, yet this is one area where most investors do not realize they have any power. ” says Andrew Behar, CEO of As You Sow, a nonprofit that promotes corporate responsibility through shareholder advocacy. “It is not only a right that you have but a responsibility to manifest your values in the real world. That is why the shareholder movement is growing stronger by the day, and corporations are realizing that it is in their best interest to listen closely.”

Socially responsible investors use a four-pronged approach to put their money to work for change: screening, shareholder activism, community investing, and divestment. It’s a powerful way to “vote with your dollars.”

Investors have put $8.72 trillion into SRI, according to the Forum for Sustainable and Responsible Investment’s (US SIF) 2016 trends report. That’s a lot of financial might working for a better world, and it’s growing exponentially. SRI has grown 14-fold since 1995, states US SIF. Today, one out of every five dollars under professional management in the US is involved in SRI.

If Washington won’t work for a better world, you and your money can.

If you want to:

- Get problematic industries like tobacco, fossil fuels, weapons, and others out of your portfolio

- Invest in forward-thinking companies on the cutting edge of green technologies, like renewable energy, water purification, and responsible waste management

Try: Screening

What is it?

- Screening is making the choice to include or exclude investments in your portfolio based on social and environmental criteria.

- Avoidance screens keep investments that violate your social and environmental criteria out of your portfolio.

- Affirmative screens seek out investments that support business practices in which you believe.

Scale

Investors have put $8.05 trillion into vehicles where environmental, social, and governance concerns were integrated into investment decision-making, according to US SIF.

Impact

“The very act of buying a portfolio that’s more consistent with goals of universal human dignity and ecological sustainability changes the conversation. It expands the mission of companies. You now have over 6,000 companies filing corporate responsibility reports. You now have around 17 countries that will not allow a company to trade stock unless it files a corporate social responsibility report. Those things never would have happened had only straight Wall Street been their shareholders.”

—Amy Domini, Domini Social Investments

Get Started

Do research and screen your own investments, or hire a socially responsible financial advisor to help you. Find one at GreenPages.org.

If you want to:

Use your investor power to pressure irresponsible corporations to clean up their acts

Try: Shareholder Activism

What is it:

- Shareholder activism/advocacy describes the actions many investors take to press corporations to improve their social and environmental practices—using their status as part-owners of companies as leverage.

- Shareholders, generally in coalition, may start out by dialoguing behind the scenes with corporate management to ask for change.

- If dialogues don’t work, they may introduce a shareholder resolution, which is a formal request to corporate management to change company policies or procedures. All shareholders vote on shareholder resolutions via a proxy ballot mailed to them each spring, or in person at a company’s annual meeting.

Scale

Investors have $2.56 trillion invested in support of shareholder resolutions, according to the US SIF 2016 trends report. For the 2017 shareholder season, activists have introduced over 430 environmental, social, and governance resolutions, according to As You Sow.

Impact

“Publicly traded companies can benefit from the unique insights offered by their shareholders. Shareholders’ specific view on the marketplace, society, resource constraints, and policy provide us with a clear, powerful, and persuasive voice that can be compelling for corporate directors and management. Through dialogue, shareholder proposals, and other channels of communication, investors serve as an important catalyst for improved ESG policies, practices, and performance.”

—Jonas Kron, Trillium Asset Management

Get Started

If you own stock, look for a shareholder ballot to arrive in the mail in the spring, and vote in favor of social and environmental proposals. See p. 20, and visit Green America’s annual shareholder roundup on our key issues.

If you want to:

- Put your money to work helping low- and middle-income people lift themselves up economically

- Move your money away from predatory mega-banks tied to the foreclosure crisis, and toward institutions that are doing good

Try: Community Investing

What is it?

- Community-investing vehicles maximize the social impact of your investments, providing capital to low-and middle-income people in the US and abroad who are underserved by conventional banks.

- The simplest method is to open accounts in a community investing bank/credit union.

- Other options include CDs and money-market accounts in a community-investing bank or credit union, community-investing loan funds and venture capital, and mutual funds with community investments in their portfolios.

Scale

Thanks in part to Green America and US SIF’s publicity campaigns, the community investing field has grown from $5 billion in 1999 to $122 billion currently, according to the US SIF 2016 trends report.

Impact

“[Community development financial institutions like] HOPE [offer] a tremendous return on investment. A credit union is a powerful resource that empowers

individuals and communities to help themselves. For more than two decades, HOPE has generated more than $2.5 billion in financing that has improved conditions for more than 1 million people in Arkansas, Louisiana, Mississippi, and Tennessee. In collaboration with a strong network of partners, ... we equip members to drive positive change. When these kinds of communities have access to the right tools, they thrive. That benefits not only the region, but ultimately the nation.”

—Bill Bynum, Hope Credit Union

Get Started

Find a community investing bank/credit union at GreenPages.org.

|

|

Operations Coordinator, Center for Sustainability Solutions |

|

|

Climate Fellow - Corporate Responsibility |

|

|

Socially Responsible Investing at Every Age |

If you ask multiple financial advisors for generalized advice on money matters, they’ll likely tell you that every person’s finances are different and ever-changing based on goals and plans. If they’re advisors who specialize in socially responsible investing (SRI), they’ll also agree that no matter how much money you have, you can use your money to support sustainable business practices and local economies.

That said, Green America pinned a few of them down on general financial and SRI advice for every decade of our lives, based on where the average person is at each stage. Use it as a rough guide to maximizing the power of your investments as you go through life.

In Your 20s

People in their 20s tend to have:

- Some debt, including student loans.

- An entry-level salary in their field.

- Few expenses (may have no kids, rent instead of own a home, etc.).

- They are also often just starting out with investments.

Start saving early: People in their 20s may feel that the need to save for retirement is less urgent, since it’s 40-plus years away. However, Kathleen McQuiggan, senior vice president of Global Women’s Strategies at Pax World, stresses that the money you put away today will compound over time, so the earlier you start saving, the more you’ll have when you need it most.

Steve Dixon, principal and investment manager at Birchwood Financial Partners, says it’s critical for young people to start saving: “My parents, the Baby Boom generation, didn’t need to figure this stuff out like younger generations will need to. Pensions were more prevalent and Social Security was more secure. Nowadays, [no one can count on these]. It’s much more critical that young people save for retirement. The nice part is that there are lots of ways to do it.”

Save as much as you can: Elizabeth Warren, Massachusetts Senator and bankruptcy expert, coined the “50/30/20” rule of budgeting, which suggests you should keep your necessary costs to 50 percent of your after-tax income, spend up to 30 percent on “wants,” and sock 20 percent into savings. When you’re just starting out in the working world, 50/30/20 might be more of a goal than a reality, but make a point to save as much as you can until you can reach 20 percent.

Make saving routine: Steve Dixon says your financial plan in your 20s should emphasize making saving for retirement part of your routine.

“It’s like working out or exercising or eating right; if you build it into a routine, it’s so much easier than if you put it off,” he says. “Don’t wait until you have money to put away, because invariably, we never feel like we have enough money to put away.”

Get involved in your workplace retirement account: The easiest place to start saving is at work: If your employer offers a retirement savings account and will match a portion of your savings, take advantage of that—it’s free money! Make sure to save at least the amount that earns you the maximum employer match amount.

Save more if you’re a woman: McQuiggan warns young women to consider their savings and investments even more strategically than men: “Women live five to six years longer than men. Also, the wage gap exists—[white] women make 80 cents [for every dollar a man makes, and women of color make even less]. So when women retire, they have to have more money than men.”

SRI in your 20s

Break up with your mega-bank: The easiest way to use your money for good is to switch banks. Break up with your mega-bank, if you belong to one, and choose a community investing bank or credit union. (The federal government provides certification for some, which will be called “community development financial institutions.” Not all are certified.)

Community investing banks and credit unions are known for treating customers better and generally charging lower fees than mega-banks. Most allow the same convenience of online banking that a mega-bank would have.

Where does the socially responsible part come in? Community investing banks and credit unions have a mission to use their money to lift up low- and middle-income communities. For example, Wells Fargo lends its money to fossil-fuel projects, while many community investing banks make a point of avoiding fossil fuels, instead lending money to foster local businesses, support people trying to buy homes, and more. Community investing banks and credit unions are federally insured, which means they’re just as safe as a mega-bank or your local bank.

Get SRI into your workplace retirement account: Ask your employer if socially responsible funds are included in your workplace retirement account. If they aren’t, ask your employer to consider adding them.

In Your 30s

People in their 30s tend to have:

- Less debt.

- A higher salary than in their 20s.

- Growing expenses, from buying a home, growing a family, etc.

- Some retirement savings.

Set aside an emergency fund: The investment advice site Betterment recommends making sure you have an emergency fund by your early 30s. Most experts recommend setting aside at least six months’ worth of your salary in a savings account, in case of illness or job loss, for example.

Don’t cash out retirement accounts: People with even a small amount of retirement savings shouldn’t cash it out early, an article from Money Magazine warns. When you cash out a 401(k), the government takes out extra taxes, so a $5,000 balance could turn into $3,500 cash. If you leave your retirement accounts alone, you keep the money growing.

Reconsider your savings: As you age, make a point to divert as much as you can into retirement and other savings. Increase your contribution to your workplace retirement account, which you can have your employer automatically pull from your paycheck. And have your bank or credit union automatically divert money from your checking account into savings every paycheck, as well.

Consider mutual funds: If you didn’t already start in your 20s, investing some of your savings in mutual funds may also be a good option in your 30s, because at a younger age, you can be more tolerant to risk since you have time to absorb any losses. As a general rule of thumb, the higher the risk, the more potential for greater returns.

SRI in your 30s

Consider SRI mutual funds: Generally, socially responsible mutual funds do as well or outperform the general market (see the "Long Way to Go" section of Taking Stock of Divestment Movements), making them a great option for green-minded people in their 30s who want to get started investing outside of a retirement account.

Look for socially responsible mutual funds, such as those listed in the “Mutual Funds” category at Green America’s GreenPages.org. Mutual funds offer automatic diversification, which can help minimize risk, and most types are actively managed.

Consider a socially responsible financial advisor: Your life is likely to go through some big changes in your 30s. You may get married and/or start a family, and you may buy your first home. Consequently, your finances will go through some big changes as well. A financial advisor can help you navigate these changes. Look for a socially responsible financial advisor, who can offer general financial advice and help you invest your money in line with your values.

Try out community investing: Your 30s may be a good time to maximize the social aspect of your portfolio and move some of your money into community investments that go beyond banking. These investments help finance community-building projects in the US or elsewhere in the world. They may help people build houses, install renewable energy, start small businesses, or otherwise help lift up local communities. The Calvert Foundation, for example, offers Community Investment Notes, which put your money into a pool of community development projects across the US and around the world—from loans for women-owned small businesses in Tanzania powered by solar to loans for affordable housing in Baltimore.

“Community investing is an important part of every portfolio and can play a key role in diversification,” says Fran Teplitz, Green America’s executive co-director.

In Your 40s

People in their 40s tend to have:

- The highest wages of their careers.

- Long-term loans from paying off big purchases.

- Established retirement savings.

- A need to continue saving for big purchases/children’s needs, like college.

Max out your retirement savings: Advisors at Bankrate recommend making the maximum annual contribution possible to your retirement savings in your 40s, if you aren’t already. For example, for the 2020 tax year, the maximum annual contribution to a 401(k) is $19,500.

Consider individual stock investments: If you haven’t already decided to invest in individual stock, your 40s could be a good time to do so. Buying individual stock has more risk than investing in mutual funds, but the rewards can be greater if the company does well.

SRI in your 40s

Screen your stock investments: Research companies before buying stock in them to ensure they’re socially and environmentally responsible. And purge any companies from your portfolio that you find are being poor corporate citizens. A socially responsible financial advisor can screen your holdings for you.

Become an active shareholder: If you hold stock, you’ll receive a shareholder proxy ballot every spring. Vote your proxy ballot in favor of social and environmental shareholder resolutions. (Mutual fund managers receive and vote the proxy ballots for their stock holdings, and they must disclose those votes on the fund website. If you disagree with how one of your mutual funds voted on a particular ballot, call the investor relations department and let them know.)

In Your 50s

People in their 50s tend to have:

- Peak savings and investments.

- A short “time horizon” until retirement.

- A continued need to help children with college, plus assist aging parents with health and other issues.

Consider lessening your investment risk: As you start to think about retirement in the next decade or so, it may be time to shift your investments to be more conservative. Holliday uses the term “time horizon” to talk about how much time people can keep their money in an investment before they need it back.

“We don’t want to be forced to sell out of a volatile market when markets are down. If you have a short time horizon or don’t tolerate much risk, you want to have a good amount in fixed, stable investments,” he says. Consider your personal time horizon until retirement, and check with a financial advisor to see if lessening investment risk is right for your portfolio.

SRI Close to Retirement

Find lower-risk socially responsible investments: Just because your investments may be getting less risky doesn’t mean you have to compromise on your values. No matter what your risk tolerance and time horizon, you or a financial planner will still be able to find socially responsible alternatives that fit with your needs.

Government bonds and certificates of deposit (CDs), for example, offer fixed returns and less risk for investors. Money market funds, or pools of CDs, bonds, and certain other investments offer automatic diversification and reduced risk.

SRI At Retirement (65+)

At 65, you might be setting the date for your retirement, or be retired, and you’re starting to withdraw from your savings and investment accounts. (Be sure to read up on the requirements for starting such withdrawals, to avoid fines or penalties.)

Steve Dixon suggests reconsidering community investing, which generally has a low level of risk, when you retire.

“If I know I’m going to need that money in 18 months, if I’m being prudent, I shouldn’t be willing to take a lot of risk,” he says. “I want it in something secure.”

Community investments can deliver social impact while simultaneously being available for the near term. Many community investments allow you to choose an investment term of anywhere from one to 15 years.

|

|

Special Issue: Guide to Social Investing and Better Banking |

You don’t have to be rich to be a social investor. All you need is the will to use your money to support your values—and the kind of world you want to see for the future. People who bank and invest in a socially responsible manner arguably have never been more important to the health of humanity and the Earth.

|

|

Divestment: A Powerful Tool for Change |

Since 2012, investor activists and college students have been advocating for divestment from fossil fuels, to send a market signal to the industry that investors and the public want it to stop warming the climate and start putting its resources into clean energy and other sustainable sectors.

The success of the fossil-fuel divestment movement (nearly $5.5. billion divested and counting) has spurred others to launch additional divestment campaigns. Investors turn to divestment when companies fail to respond adequately to screening, dialogues, and shareholder resolutions, in the hopes of piling pressure on problematic industries so they’ll improve:

- In the past year, the fossil-fuel divestors have specifically targeted banks helping to finance the Dakota Access Pipeline.

- They’re moving money out of the private prison industry.

- And they’re poised to divest from any company signing contracts to help build Trump’s border wall between the US and Mexico.

“Divestment is a powerful tool, as it generates ongoing bad publicity, communicates to companies that customers and shareholders want urgent change, and may even affect the financial bottom lines of laggards,”says Fran Teplitz, Green America’s executive co-director.

Fossil Fuels

The fossil-fuel industry has five times more carbon in its coal, oil, and gas reserves than experts think would be safe to burn, says bestselling author and 350.org founder Bill McKibben. To prevent their burning and the ensuing exacerbation of climate change, McKibben launched a campaign to get investors around the world—starting with colleges and universities—to divest from the top 200 publicly traded fossil-fuel companies.

Simultaneously, Green America’s Fossil-Free campaign is asking people to reinvest the money they pull out of fossil fuels into sustainable sectors like clean energy and more.

“If we divest and reinvest this way, there is indeed hope that we can create a clean-energy future,” says Teplitz.

As of June 2017, 732 institutions representing over $5.45 trillion in assets, and more than 58,000 individuals with about $5.2 billion in assets have made some sort of divestment commitment.

Notably, in 2015, Bank of America pledged to reduce its credit exposure over time to the coal-mining sector globally, citing pressure from universities and environmental groups as a key driver of its policy shift.

California passed a bill in late 2015 requiring its state public employees’ and state teachers’ retirement systems to divest from companies that get at least half of their revenue from coal.

In March of 2017, Columbia University became the latest higher-education institution to divest from companies that derive 35 percent or more of revenue from coal production.

Even mainstream investment companies are getting in on the act. In April 2017, AXA Investment Managers divested over 99 percent of its €717 billion ($805 billion) assets from fossil fuels.

“We strongly believe that divesting from coal can help to de-risk portfolios over the long term by decreasing exposure to assets that are likely to become stranded in the future as the world moves to be in line with the +2°C scenario,” CEO Andrea Rossi said in a statement, referring to the general agreement that the world cannot afford for global temperatures to rise 2°C above pre-industrial levels.

[Editor’s note: Developing nations say that two degrees is a death sentence for them and have been pushing for carbon reductions that keep world temperatures from rising above 1.5°C. Green America supports this threshold.]

If you’re worried that divesting from fossil fuels might negatively impact your portfolio, consider studies from the past few years that indicate otherwise: “Investors who have dumped holdings in fossil-fuel companies have outperformed those that remain invested in coal, oil, and gas over the past five years,” trumpeted the Guardian in April 2015.

Citing figures from stock market index company MSCI, the Guardian noted that “investors who divested from fossil-fuel companies would have earned an average return of 13% a year since 2010, compared to the 11.8%-a-year return earned by conventional investors.”

More recently, a study conducted by Aperio Group in 2016 estimated that a portfolio excluding all fossil-fuel companies from 1988 through 2013, a 25-year period, would have very little impact on investment risk. The fossil-free portfolio outperformed its benchmark by a fraction of a percent (0.05).

In other words, you don’t have to sacrifice performance to go fossil-free with your investments.

Visit greenamerica.org/fossilfree/ for a list of resources to help you divest from fossil fuels and reinvest in sustainability, including fossil-free mutual funds, CDs, and other vehicles, as well as financial advisors who can help clients construct fossil-free portfolios.

Dakota Access Pipeline

Activists on site at the Standing Rock Sioux camp protesting the Dakota Access Pipeline in 2016. Photo by Alex Hamer.

In July 2016, the Army Corps of Engineers approved construction on the Dakota Access Pipeline (DAPL), a massive oil pipeline that would stretch 1,172 miles from North Dakota, through South Dakota and Iowa, to Illinois. A project of Energy Transfer Partners, Enbridge Energy, Partners and Marathon Petroleum, the DAPL would carry 570,000 barrels of crude oil per day.

Nearly 40 mega-banks are providing financing for the DAPL, including JP Morgan Chase, Bank of America, Wells Fargo, and others. Activists are calling on individuals around the world to break up with their DAPL-supporting mega-banks. To date, investors have committed to pulling more than $4.4 billion out of these banks over the pipeline.

In April, anti-DAPL activists celebrated a major victory when US Bank announced at its annual shareholder meeting that it was pulling out of financing all oil and gas pipelines.

And in June, in response to a lawsuit filed by the Standing Rock Sioux, a federal judge ruled that the federal permits authorizing the pipeline to cross the Missouri River violated the law because they did not “adequately consider the impacts of an oil spill on fishing rights, hunting rights, or environmental justice, or the degree to which the pipeline’s effects are likely to be highly controversial,” according to EarthJustice. The court had requested additional information to consider whether to shut down the pipeline as this guide went to press.

The DAPL is a bad deal on several fronts: It encourages extraction of dirty, climate-warming fossil fuels. A spill could wreak havoc on local ecosystems and pollute the nearby Missouri River, which provides drinking water to 2.5 million people. And there’s a major environmental-justice component here, too: The Standing Rock Sioux reservation lies half a mile from the pipeline route, and the DAPL will run through traditional Sioux territory.

Adding grievous insult to this long-standing injury, the pipeline is also slated be built over areas that are sacred to the Sioux, including burial sites.