In 2023, the United States experienced a record number of weather- and climate-related disasters that each caused $1 billion or more in damages: 28 severe storms, floods, wildfires, winter storms, hurricanes, and droughts, according to the National Oceanic and Atmospheric Administration (NOAA).

Since 1980 the United States has experienced 376 of these billion-dollar+ events, with damages totaling $2.6 trillion, and tragically, 16,340 associated deaths.

The insurance industry stands on the front lines of this climate crisis. Every time a climate-related fire, flood, or storm damages or destroys an insured person’s home or business, they expect their insurance policy to help foot the bill for repairs and rebuilding. Unfortunately, as climate events become more common, major insurance companies have begun to cancel or restrict coverage in climate-vulnerable states.

In May, State Farm—the largest insurer in California—stopped accepting new applications for homeowners insurance in the wildfire-prone state due to “rapidly growing catastrophe exposure.” In June, Allstate followed suit. In July, Farmers Insurance stopped offering home and auto policies in hurricane-prone Florida, forcing 100,000 ratepayers to find new insurance.

As major insurers limit coverage, prices continue to rise for everyone else. In California, State Farm has raised prices for the homeowners policies it still holds by 20%. In Florida, the average homeowners insurance premium is now $6000—up 200% from 2019.

In fact, according to the 2023 Policygenius Home Insurance Pricing report, the cost of homeowners insurance has risen for 94% of people surveyed. Premium costs are now 35% higher nationally compared to two years ago for all homeowners, whether or not they live in an area with heightened climate-related risk.

Underwriting and Investments

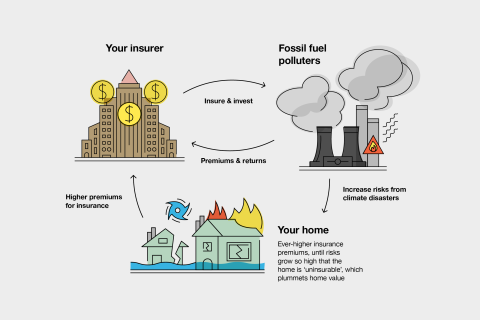

Unfortunately, despite the insurance industry paying policyholders for an increasing number of climate disasters and then passing these costs onto policyholders, many of them continue to support one of the chief causes of the climate crisis: the burning of fossil fuels.

Major insurance companies continue to support the fossil fuel industry in two ways, according to Insure Our Future, a campaign comprising environmental, consumer protection, and grassroots organizations that hold the US insurance industry accountable for its role in the climate crisis:

- By underwriting—that is, insuring—new fossil fuel projects

- By investing billions of dollars in fossil fuels

In fact, US insurance companies invested $582 billion in fossil fuels in 2019, the most recent year for which composite figures are available. However, the International Energy Agency has since stated that investors must not finance any new coal, oil or gas projects if we are to hold the rise in global temperatures under 1.5ºC. The Paris Climate Agreement set 1.5ºC as the goal for limiting global warming to prevent catastrophic and irreversible climate damage.

While most of the large US insurance companies tracked by Insure Our Future have set restrictions on underwriting coal, few have restricted underwriting conventional oil and gas projects. Three of the top eight US insurance companies—Berkshire Hathaway, W.R. Berkley, and Starr—maintain no policies whatsoever to limit underwriting and investment in fossil fuel projects, whether coal or oil and gas.

Berkshire Hathaway is especially notable: It fully owns 11 coal plants, partially owns 13 more, and ships millions of tons of coal by rail. Its CEO, Warren Buffett, has said climate change should not be a factor in the company’s decision-making.

Underwriting Notorious Fossil Fuel Projects

Without insurance, fossil fuel companies cannot get loans or investments for their notoriously risky projects. At the same time, the riskier the project, the higher the premium—and resulting profits—for the insurance company involved.

The market intelligence firm Insuramore estimated gross direct premiums from insuring the fossil fuel industry at $21.25 billion in 2022. Top US fossil fuel insurers include Chubb, which took an estimated $700 million in fossil fuel premiums, Zurich (parent of Farmers), which took $600 million, and AIG, which took $550 million.

While it is difficult to find out which companies underwrite which projects, climate activists have uncovered the insurers of two of the most notorious fossil fuel projects:

- Freeport LNG—This Texas facility will be capable of exporting 15 million tons of liquified natural gas per year when it is fully online. The plant has been cleared for full operation in 2024, following a settlement with the EPA in Dec. 2023 related to an explosion at the plant. AIG, Chubb, and Liberty Mutual, among others, insure Freeport LNG.

- The Trans Mountain Pipeline—When fully operational, this pipeline will ship 590,000 barrels per day of tar sands oil to British Columbia. Chubb, AIG, and Liberty Mutual insure this pipeline.

Investing in Climate Chaos

Insurance companies do not simply insure fossil fuel projects; they also invest billions in fossil fuel companies, according to the Investing in Climate Chaos database by Urgewald, a German environmental and human-rights NGO.

Berkshire Hathaway, the parent company of Geico, invests the most in fossil fuels, compared to all US insurance companies. The company has invested more than $9.4 billion in coal and $45.7 billion in oil and gas. Berkshire Hathaway is the top investor in Chevron.

State Farm is second in fossil fuel investments among US insurance companies, with $18.2 billion, including $7.9 billion in coal and $10.3 billion in oil and gas. It is the 12th-largest investor in Exxon.

“It seems nonsensical at best—and complicit at worst—for State Farm to carefully factor climate risk from wildfires into its homeowner’s insurance policies, refusing in some cases to provide such policies at all, while apparently ignoring the heightened climate risk that its investment portfolio is helping to create,” Sens. Sheldon Whitehouse (D, RI), Ron Wyden (D, OR), and Bernie Sanders (I, VT) wrote to State Farm in June.

Popular home and auto insurance company Amica has invested $86 million in fossil fuels, not enough to appear among the top investors, but still significant.

What Can Policyholders Do?

The good news is that it is possible to find alternatives to the largest insurance companies that continue underwriting and investing in fossil fuels, and to take action to push the worst companies to improve.

Take Action! Tell over 70 executives at Berkshire Hathaway/Geico/Guard, State Farm, AIG, Nationwide, Allstate, Liberty, Mutual, Travelers, and The Hartford to insure our communities, not fossil fuels!

Seek out regional mutual insurance companies: The best option for ratepayers seeking a more responsible company for home or car insurance is to shop in your local area. Call three independent insurance agents and ask them to quote costs and coverage for policies at regional mutual insurance companies, or speak with companies directly.

Different agents work with different companies, so talking to more than one will give you a fuller picture of what is available in your area. Regional insurance companies are no more risky than large insurance and could save you money on your premium for the same coverage.

Examples of responsible regional mutuals include American Family Insurance based in Wisconsin, Grange Insurance based in Ohio, and Utica Mutual Insurance based in New York. Be sure to ask about a company’s holdings and policies before purchasing an insurance plan.

Push the biggest companies to do better: If you hold an insurance policy with a company that may be underwriting or investing in fossil fuels, call them up, send a letter, or otherwise make your disapproval of fossil-fuel investing known. Explain how your concerns are in the insurance companies’ best interest, given their exposure to the effects of climate disasters.

Insure Our Future demands for insurance companies:

- Immediately cease insuring new and expanded coal, oil, and gas projects.

- Immediately stop insuring new customers from the fossil fuel sector not aligned with a credible 1.5ºC pathway, and stop insuring the expansion of coal, oil, and gas for existing customers.

- Immediately divest all assets from coal, oil, and gas companies not aligned with a credible 1.5ºC pathway.

- Define and adopt binding targets for reducing insured emissions that are transparent, comprehensive, and aligned with a credible 1.5ºC pathway.

- Immediately establish and adopt robust due diligence and verification mechanisms to ensure clients fully respect and observe all human rights, including a requirement for Free, Prior, and Informed Consent (FPIC) of impacted Indigenous Peoples.

- Immediately bring stewardship activities, membership of trade associations, and public positions in line with a credible 1.5ºC pathway.

Stay tuned! While several resources list alternatives to megabanks that fund fossil fuels, no such directory exists for insurance—yet. Green America and Rivers and Mountains GreenFaith have begun working to close that gap. We are conducting research and compiling a responsible insurance list that we will release as a directory later this year.

The insurance market is just the latest financial sector to hear from Green Americans, climate advocates, and others about the need for change. The same strategies that have shifted other industries—speaking up for improvements, boycotting irresponsible companies, and organizing with others for change—can shift the insurance industry as well.