What You Need to Know About Shareholder Activism

Dialogues...proxy voting...resolutions. What does it all mean? How can you use your investments to join shareholder advocacy for corporate responsibility? Below, we give you the basics about how shareholder activism works, and how you can get involved.

What is shareholder action?

Shareholder action, also known as shareholder advocacy or shareholder activism, describes the efforts of a growing number of investors to use their status as part-owners of companies to influence corporate behavior. As one of the three main strategies of socially responsible investing (SRI), shareholder action is a powerful tool for encouraging corporations to improve their social and environmental records.

Shareholder activists employ the following strategies:

Dialogues

Often, the first step a coalition of investors will take to change corporate behavior is to request a dialogue with management on issues of concern. Individual investors often participate in the dialogue process by writing letters to corporate management in support of shareholder campaigns.

Shareholder resolutions

If dialogues yield no progress, or if a company refuses to discuss issues with shareholders in the first place, concerned investors will often introduce shareholder resolutions, or written requests to company management. As owners of a corporation, shareholders have the right to participate in annual meetings—and to file resolutions to be voted on at these meetings. These resolutions can request reports from management or propose that the company consider changes in practices or policies.

Here's where the power of the individual comes in: All shareholders who have held at least one share of company stock for two months or more may vote on resolutions either in person at the company's annual meeting or via a proxy ballot that is mailed or e-mailed to all investors before the annual meeting. Proxy ballots arrive together with the proxy statement, which is a booklet that presents the details of the proposals that must come to shareholders for a vote. Proxy voting is the primary forum where management seeks affirmation of what it is doing, and where shareowners weigh in on important issues.

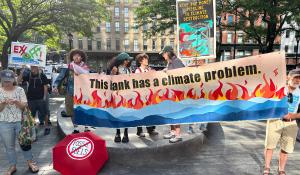

Divestment campaigns

If dialogues and resolutions fail to get results, shareholders may divest, or sell off, their stock in the company in protest. Divestment campaigns were key in persuading corporations with a stake in South Africa to pull out of the country as a means of pressuring the government to abolish apartheid. Even the hint of a divestment campaign being launched against it can make a corporation sit up and take notice, as divestment represents a potential drop in share price and loss of revenue. However, divestment is used as a last resort of shareholders, since it signals an end to attempts to negotiate.

I get proxy ballots in the mail (or e-mail). What do I do with them?

Your proxy ballot will arrive before a company's annual meeting, which generally takes place in the spring of each year, so look carefully at any correspondence from the companies in which you hold stock, or from your financial adviser.

Remember, if you invest in mutual funds, you automatically delegate your proxy voting rights to the fund managers, so it is important to invest in funds that share your values.

You vote your proxy simply by filling out the form you receive and mailing it back before the due date; phoning your results in, if there is a call-in option listed on your ballot; or voting on the Internet using special voting Web sites like proxyvote.com. Be sure to mark your votes on your ballot, even if the instructions don't specifically tell you to do so; ballots returned unmarked count as votes for management's position. How to read a proxy ballot

Some organizations such as As You Sow are now using a proxy voting app. Votes are recommended for board elections and shareholder resolutions in hundreds of companies; you can follow all the recommended votes, or review them individually to decide how to vote. Learn more

I heard that some shareholder resolutions get less than 10 percent of the vote. How can these low numbers trigger corporate change?

Historically, very few social resolutions achieve majority votes at corporate annual meetings. In fact, many votes come in at the 5 percent to 25 percent range. However, even those seemingly low numbers represent a significant number of unhappy shareholders. And, since shareholder action campaigns are often accompanied by coordinated consumer and media campaigns, resolutions represent damage to a company's reputation and branding, and a potential loss of revenue through negative publicity, consumer boycotts, and loss of investor confidence.

In fact, the mere act of filing a proposal has prompted some companies to amend their policies. When a resolution succeeds even before it comes to a vote, investors will usually withdraw it from the ballot.

If a resolution comes to a vote and the company doesn't respond, shareholder activists will often keep the pressure on by re-filing the proposal the following year. According to rules of the Securities and Exchange Commission (SEC), approved in 2020, a resolution must receive 5 percent of the vote the first year it is filed, 15 percent the second year, and 25 percent every year thereafter to continue to be included on the proxy ballot.

I own stock, but I never see my proxy ballots. Why?

Your money manager or financial adviser may be receiving your proxy ballots and voting on your behalf. When you first hired your money manager or financial adviser, you may have signed paperwork saying you didn't want to receive these materials. Ask your money manager or financial adviser if you can get the proxy ballots so you can vote—or if you can give instructions on how you want the votes cast and let him or her do the paperwork. Warning: Many money managers or advisory groups have policies dictating that they automatically vote with corporate management. If this is the case, you'll have to get guarantees from your financial adviser that s/he will follow your instructions, or take voting into your own hands, since corporate managers almost always recommend voting against social and environmental concerns.

If you invest in mutual funds, you automatically delegate your voting rights to fund managers. To find out how your mutual fund is voting on proxy resolutions, call the fund's investor relations department, request this information, and express your views on the position you want the fund to take. Thanks to a recent SEC ruling, mutual funds have been required to disclose how they vote their proxies since August 31, 2004.

Why does my socially responsible mutual fund invest in companies with questionable practices? Is it engaging in shareholder action?

Most likely, yes. As noted above, socially responsible mutual funds promote corporate responsibility by targeting exceptional companies for investment, by avoiding the most irresponsible companies, and by putting their considerable investment clout behind shareholder campaigns targeting borderline companies.

Thanks to a recent SEC ruling mandating transparency in mutual fund proxy voting, all mutual funds are now required to provide investors with information about how they are voting all their proxy ballots. If you have a particular concern about a company included in your mutual fund, call the fund's investor relations department and ask for its proxy voting information.

Can I introduce a shareholder resolution?

Any shareholder who has owned $2,000 worth of a company's stock for a continuous three years or more can introduce a proposal. However, it's often best for individual investors to team up with investor coalitions or organizations. More on filing shareholder resolutions

Often, the first thing a company will do upon receiving a resolution is to take it before the SEC and ask that it be thrown out; groups with experience introducing shareholder resolutions have the resources and legal backing to ensure that their proposals make it onto the ballot and are written correctly. An easier way to get involved in filing a proposal is to join an existing group of filers and be a co-filer, lending your shares to the coalition, being updated on its progress, and providing input on negotiations within the company.

Green America is not an investment adviser, nor do we provide financial planning, legal, or tax advice. Nothing in our communications or materials shall constitute or be construed as an offering of financial instruments or as investment advice or investment recommendations.

Additional Resources

- Are Corporations Accountable for Their Political Spending?

- The State of Shareholder Activism

- Shareholder Resolution Highlights

- New App Makes Rocking Your Proxy Votes Easy

- Vote with Your Dollars for a Better World

- Shareholder Activism Advances Labor Rights

- FAQs About Shareholder Activism

- Anatomy of a Proxy Ballot