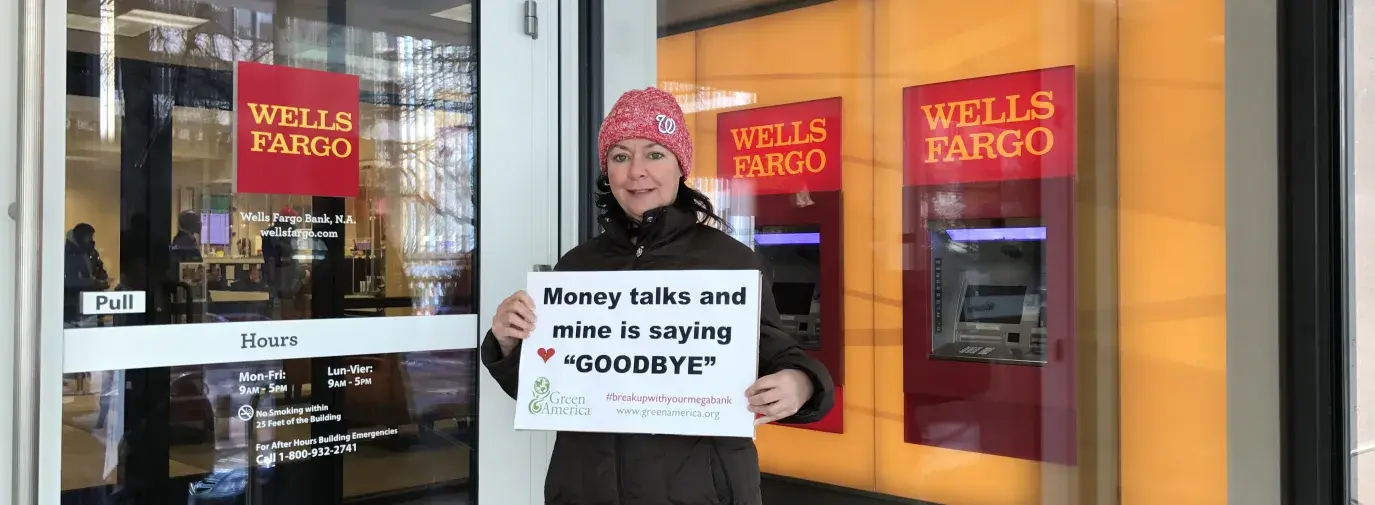

Photo by Green America

Back to the Vote With Your Dollar Toolkit

- Choose your new bank or credit union. While picking a local bank is a good option, and a local credit union an even better option, moving your accounts to a community development bank or credit union is your best bet to matching your banking with your values. Find hundreds of options at Green America’s Get a Better Bank.

- Open your new account. Keep your old account open as you order checks, debit cards, and deposit slips.

- Make a list of your automatic payments and withdrawals.

- Move your automatic deposits to your new account. Ask your employer to transfer your direct deposit paychecks to your new account. Do the same for Social Security and other deposits you receive. Ask for the date on which deposits to your new account will take place.

- Move your automatic withdrawals to your new account, once you know you’ll have sufficient funds in the account. Ask for the date on which payments from your new account will begin. It’s wise to leave a small amount in your old account for a month after you’ve shifted your deposits and withdrawals to your new bank or credit union, just in case.

- Get print or electronic copies of statements and canceled checks that you may later need if you have only online banking through your mega-bank.

- Transfer the remaining funds in your mega-bank account to your new account after you have all your automatic payments and deposits transferred and any final checks have cleared your old account.

- Close your mega-bank account! Obtain written confirmation that your account is closed.

- Inform your mega-bank why you’re breaking up with it. See a sample letter that you can use to make the big break.

- Encourage your house of worship, alma mater, workplace, and community organizations to use a community development bank or credit union.

For congregations, turn to US SIF’s free “Community Investing Toolkit for Faith Communities.” Endowed institutions can get assistance from the Intentional Endowments Network.

From Green American Magazine Issue