Now is the time to break up with your megabank. Find a community development bank or credit union on our Get a Better Bank map.

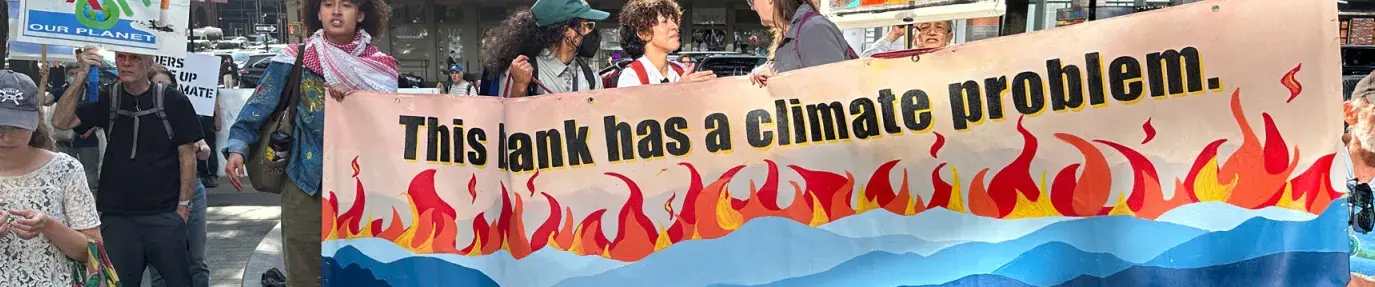

What if you found out the money in your bank account was being used to fuel fires and floods, leading to contaminated water from fracking or coal mining, or air pollution where you live? If you bank with one of the large Wall Street megabanks, that’s likely the case, according to the annual Banking on Climate Chaos report.

This year’s report – the 15th annual version – shows why it’s imperative to get a better bank or credit union if your account is at one of the megabanks highlighted in the report as a major lender or underwriter of fossil fuels. This includes switching from a credit card issued by one of these banks to a new card.

Here’s how it works: When you put your money into a bank account, it doesn’t just sit there. The bank uses the money to make loans. Community banks and credit unions make loans for community needs such as small businesses. The biggest banks make loans to large customers – including disproportionately the fossil fuel industry.

According to this year’s Banking on Climate Chaos report, the world’s 60 largest banks have plowed a total of $6.9 trillion into fossil fuel companies and projects – almost half of which has gone to fossil fuel expansion, despite warnings from scientists that the world can hold global warming to 1.5°C only with no new coal, oil, or gas projects.

In 2023 alone, these banks committed $705 billion to the fossil fuel industry, of which $347 billion went to companies actively expanding their coal, oil, and gas operations.

Among the dirtiest American banks are:

| Bank Rank | Bank Name | 2023 financing to fossil fuel industry (in billions) | Total financing since Paris Agreement (in billions) |

| 1 | JPMorgan Chase | $ 40.875 | $ 430.926 |

| 2 | Citibank | $ 30.268 | $ 396.331 |

| 3 | Bank of America | $ 33.682 | $ 333.159 |

| 5 | Wells Fargo | $ 30.378 | $ 296.247 |

| 14 | Goldman Sachs | $ 18.818 | $ 184.927 |

| 15 | Morgan Stanley | $ 19.104 | $ 183.547 |

| 25 | PNC Financial Services | $ 12.149 | $ 108.312 |

| 27 | Truist Financial | $ 14.232 | $ 105.352 |

| 28 | US Bancorp | $ 12.779 | $ 97.274 |

| Total for US megabanks | $212.29 | $2,038.80 |

Sector-based data, frontline stories

A key feature of the 2024 Banking on Climate Chaos is its League Tables listing the lending and underwriting of the 60 largest banks not just for the entire fossil fuel industry, but also for selected sectors with high environmental, social, and climate impacts.

These sectors include:

| Fossil fuel sector | Total financing by Top 60 banks (2016-2023) | Number of fossil fuel companies financed |

| Fossil fuel expansion | $3.344 trillion | 873 |

| Gas-fired power | $1.328 trillion | 252 |

| Methane gas import and export | $ 913.156 billion | 129 |

| Coal-fired power | $ 700.008 billion | 456 |

| Fracked oil and gas | $ 653.243 billion | 237 |

| Thermal coal mining (used for heating) | $ 407.675 billion | 211 |

| Tar sands oil | $ 99.187 billion | 37 |

| Ultra deepwater oil and gas | $ 91.301 billion | 65 |

| Arctic oil and gas | $ 46.646 billion | 44 |

| Metallurgical coal mining (used in making steel) | $ 31.973 billion | 48 |

| Amazon oil and gas | $ 11.148 billion | 24 |

The report also contains numerous stories from people on the frontlines of the climate crisis worldwide, such as the Mountain Valley Pipeline, heavily funded by Bank of America, JPMorgan Chase, Wells Fargo, PNC, and BNP Paribas.

This pipeline is slated to run from West Virginia to Virginia with a proposed extension into North Carolina. Grassroots groups such as Protect Our Water, Heritage, Rights (POWHR) and 7 Directions of Service have been fighting it for years – yet its approval was legislated by an amendment to the debt ceiling bill signed by President Biden in 2023 despite over 400 water quality violations so far during the pipeline’s construction. Learn more

Of special note are stories from the frontlines of methane import and export in Southeast Asia, where 29 gigawatts of methane gas power plants have entered operation since 2016 with 139 GW more in the pipeline – resulting in a surge of methane import terminals being built. These projects are funded heavily by two Japanese banks that have climbed the rankings of dirty banks: Mitsubishi UFJ, now at No. 4, Mizuho Financial, now at No. 6. Both banks are also funding LNG export terminals on the U.S. Gulf Coast. Learn more

Even worse, instead of taking steps to clean up their lending, megabanks are backing away from their already weak climate commitments. For example:

- Bank of America and US Bank quietly changed language prohibiting funding of extreme oil and gas projects to a much fuzzier “due diligence” framework.

- JPMorgan Chase – the world’s top funder of fossil fuels -- is now calculating its financed emissions through an “energy mix” target that includes renewable energy – diluting the impact of its fossil fuel financing and making it harder to trace.

- The largest four U.S. banks – JPMorgan Chase, Bank of America, Citi, and Wells Fargo – have all left the Equator Principles, developed 20 years ago to set minimum standards on risks to environment and local communities in countries where they finance oil, gas, coal, and mining projects. Green America was part of the original coalition that pressured these banks to adopt the Equator Principles.

New information, new methodology

This year’s Banking on Climate Chaos report has significantly expanded its data to include information about hundreds of oil, gas, and coal companies compiled in Urgewald’s Global Oil and Gas Exit List and Global Coal Exit List. The data is cross-checked against listings in both Bloomberg LP and the London Stock Exchange Group.

The new methodology also allowed report authors to count bank contributions to fossil fuel companies even if they were not the lead bank lending to or underwriting a project.

The result is a treasure trove of information that allows users to drill down to detailed listings of which banks are funding virtually any oil, gas, or coal operation and by how much each year since 2016. If you know of a fossil fuel operation, you can use the listings at the bottom of the Banking on Climate Chaos website to find out who is bankrolling it.

For example, where I live in Ohio the state legislature recently mandated fracking in our state parks and wildlife areas. By searching the Banking on Climate Chaos data, I was able to find out which banks fund the companies that want to frack these public lands – and, no surprise, the top 9 American banks are prominent on these lists.

Through the Banking on Climate Chaos data, we found that Southwestern Energy has received over $24.6 billion from the largest banks since 2016, Antero Resources over $11.4 billion, Gulfport Energy over $8.3 billion, Ascent Resources over $7.6 billion, Hilcorp Energy over $6.9 billion, EOG over $6 billion, and Encino Acquisition Partners over $3.6 billion. Each of these companies has bid on leases to frack public land in Ohio.

What can you do?

The Banking on Climate Chaos report lifts the hood on funding for fossil fuel companies and projects worldwide. Reading it is eye-opening – but can also be overwhelming. This system is so huge and so entrenched – what can one person do to counteract it?

The answer is simple: Just say no by moving your bank and credit card away from any of the megabanks disproportionately funding fossil fuels and to a mission-driven bank or credit union that builds your own community.

Getting a better bank

- Start by identifying a better bank or credit union. You can use Green America’s Get a Better Bank -- which maps almost 17,000 locations of 3000 community development banks and credit unions nationwide -- or another tool such as Mighty Deposits, Bank.Green, Bank for Good or Better Banking Options.

- Open an account at your new financial institution, then slowly transition your auto deposits and auto payments to your new account. For detailed guidance, check out our 10 Steps to Break Up With Your Megabank and our FAQs.

- Close your old account and let them know why – here's our Sample Break-up Letter to Send to Your Megabank.

For more information, check out our Better Banking webinar.

Taking charge of your credit card

Credit cards are issued by banks or credit unions. The card issuer may not be the same as its brand name. The issuer is who you send your payment to each month. You can usually find the issuer name on the back of the card, sometimes in small print.

If your credit card is issued by one of the megabanks that disproportionately funds fossil fuels, we encourage you to switch to a different card. Even if your card does not have an annual fee and you pay it off in full each month, transaction fees paid by the merchant for each purchase you make go to the bank that issued the card.

If you have switched to a better bank or credit union, your new financial institution may offer a credit card. Be sure to ask who the card issuer is – hundreds of small banks and credit unions issue credit cards through Elan Financial, which is owned by U.S. Bank, a major funder of fossil fuels.

If your better bank or credit union issues its own card, you can use it knowing you are not supporting the fossil fuel industry. But if your new financial institution does not issue its own card, or uses a card issued by a fossil bank, you’ll need to look elsewhere.

Two credit card issuers that are not major investors in the fossil fuel industry are First National Bank of Omaha (FNBO) and TCM Bank, a subsidiary of the Independent Community Bankers of America, which issues the Green America credit card. You can find Green America’s list of Socially and Environmentally Responsible Credit Cards here.

As with better banking, if you switch to a new credit card, be sure to let your old card issuing bank know why.

For more information, check out our Take Charge of Your Card webinar.