Performance & Popularity

Years of research studies show that responsible investing generates returns as good or better than conventional investing, especially over the long term. Decades of practical experience show the same.

Sustainable Investing Guide

Years of research studies show that responsible investing generates returns as good or better than conventional investing, especially over the long term. Decades of practical experience show the same.

How social investing affects performance

Socially responsible investing need not sacrifice returns. In fact, it can enhance returns by identifying risk and opportunities that might not be found otherwise.

Years of research studies show that responsible investing generates returns as good or better than conventional investing, especially over the long term.

For example:

- Bloomberg data compiled in June 2025 found that ESG-focused funds had outperformed the S&P 500 Index for the longest stretch since 2022.

- An MSCI Sustainability Institute analysis in 2024 found that ESG-rated large- and mid-cap funds consistently outperformed their peers over the previous 17 years.

- Morningstar’s 2022 Sustainable Funds US Landscape Report found that “In 2021, most sustainable funds delivered stronger total and risk-adjusted returns … than their respective Morningstar Category indexes.”

- Morgan Stanley’s Institute for Sustainable Investing study analyzed 3,000+ US mutual funds and ETFs, finding that sustainable equity funds outperformed non-ESG funds by a median of 4.3 percent in 2020.

- NYU Stern Center for Sustainable Business conducted a meta-analysis of 1000+ studies from 2015-2020: "59% showed similar or better performance for ESG funds relative to conventional investment approaches while only 14% found negative results.”

To see the actual performance of sustainable investing, look no further than the MSCI KLD 400 Social Index, the very first socially responsible index fund launched by Amy Domini in 1990.

Source: Green Money Journal

The KLD 400 Social Index has consistently outperformed the general index of large and mid-cap US stocks for more than 30 years – showing returns better than the market rate, especially over time.

Learn more about financial performance with sustainable investing from US SIF.

Responsible investing is popular!

Responsible investing has rapidly increased over the past three decades and remains very popular. According to the most recent US Sustainable Investment Forum Trends Report, US assets under management included $6.5 trillion explicitly marketed as ESG or sustainability-focused investments in 2024 – or 1 in 8 dollars invested.

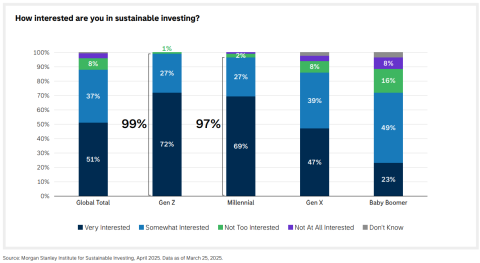

The outlook for responsible investing is strong. The Morgan Stanley Sustainable Signals 2025 report found that 84% of individual investors in the United States and 88% globally are interested in sustainable investing, with almost half in the United States saying they are very interested. This includes a whopping 99% of GenZ investors and 97% of Millennial investors -- suggesting sustainable investing will gain even greater influence in the years to come.

Source: Morgan Stanley Sustainable Signals: Individual Investors 2025

Other studies show that investors and companies are continuing responsible practices despite current political headwinds against responsible investing -- they are just quieter about it.

- BNP Paribas's ESG Survey 2025 surveyed 420 asset owners, assent managers, and private capital on their attitudes and practices related to ESG and sustainable investing. It found 87% reported their ESG and sustainability objectives remained the same, though nearly half said they had not promoted their process or achievements.

- Benevity's 2025 State of Corporate Purpose Report, which surveyed 500 executives on corporate social responsibility, found 92% said their companies are "investing in social impact programs because it's good for business," but 52% said they plan to be less vocal about these activities.

Ready to get started with responsible investing? Learn about responsible investing in stocks, mutual funds, community notes, and more.

Green America is not an investment adviser, nor do we provide financial planning, legal, or tax advice. Nothing in our communications or materials shall constitute or be construed as an offering of financial instruments or as investment advice or investment recommendations.