Insurance on the Front Lines

Property insurance is on the front lines of the climate crisis – yet the largest companies are insuring fossil fuel projects and investing in fossil fuel companies, all while raising rates and dropping policy holders in climate-vulnerable areas.

Find Climate Smart Insurance

Property insurance is on the front lines of the climate crisis – yet the largest companies are insuring fossil fuel projects and investing in fossil fuel companies, all while raising rates and dropping policy holders in climate-vulnerable areas.

Big insurance is canceling policies, raising rates

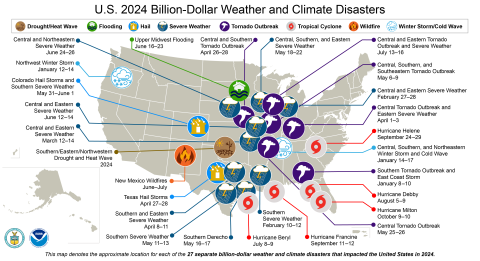

In 2024, the United States experienced 27 weather- and climate-related disasters that each caused $1 billion or more in damages: one drought, one flood, 17 severe storms, 5 tropical cyclones, one major wildfire, and two winter storms, according to the National Oceanic and Atmospheric Administration (NOAA).

The insurance industry stands on the front lines of this crisis. Every time a climate-related fire, flood, or storm damages or destroys a home or business, policyholders expect their insurance company to help foot the bill for repairs and rebuilding.

Over one-third of weather-related insured losses over the last two decades, totaling $600 billion, can be attributed to climate change, according to the 2024 Scorecard from Insure Our Future, a campaign of environmental, consumer, and grassroots organizations that holds the insurance industry accountable for its role in the climate crisis.

In 2023, the world's top 28 property insurance companies paid almost as much in climate-attributed losses ($10.6 billiion) as they collected in premiums ($11.3 billion), Insure Our Future says. Climate-attributed losses account for a growing share of insured weather losses, which means this problem will continue to get worse.

In response, major insurance companies have begun to cancel or restrict coverage in climate-vulnerable areas. Meanwhile, property insurance premiums are rising for everyone. Home insurance rates climbed 40.4% across the United States from 2019 through 2024, according to LendingTree's State of Home Insurance 2025 report -- including over 70% in Colorado, Nebraska, and Utah.

Shockingly, despite clearly increased climate risks, the largest US insurance companies continue to support the chief cause of the climate crisis – the burning of fossil fuels – in two ways:

- By insuring fossil fuel projects

- By investing billions of dollars in fossil fuel companies.

Insuring fossil fuel companies

Without insurance, fossil fuel companies cannot get loans or investments for their notoriously risky projects. This makes insurance the “Achilles heel” of fossil fuel projects.

Unfortunately, only seven North American companies have policies restricting underwriting for coal projects, and just one -- AIG -- has restricted underwriting for oil and gas projects, according to Insure Our Future. Three of the top eight US insurance companies — including Berkshire Hathaway, which owns GEICO and AmGUARD insurance — maintain no policies whatsoever to limit underwriting and investment in fossil fuel projects, whether coal or oil and gas.

Berkshire Hathaway is especially notable: Its subsidiary Berkshire Hathaway Energy owns 11 coal plants outright and has stakes in 18 more. Its railroad company ships coal across the country. The company’s CEO, Warren Buffett, has said climate change should not be a factor in its business decisions.

While it is difficult to find out which companies insure which projects, a recent report from Rainforest Action Network and Public Citizen identified 35 insurance companies underwriting liquified methane export projects across the U.S Gulf South, including Liberty Mutual, AIG, The Hartford, Travelers, Berkshire Hathaway, and Lloyd’s of London. Chubb recently withdrew insurance for these projects.

Investing in fossil fuel companies

Insurance companies do not simply insure fossil fuel projects; they also invest billions of dollars from the premiums we pay into fossil fuel companies, according to the Investing in Climate Chaos database by Urgewald, a German environmental and human-rights NGO.

Berkshire Hathaway invests by far the most in fossil fuels of all US insurance companies, more than $95 billion. It is the 14th largest investor in fossil fuels overall and the top investor in Chevron and Occidental Petroleum.

State Farm has the second-most invested in fossil fuels of any US insurance carrier: $20.6 billion invested in 65 companies, including $10.7 billion in shares and $9.9 billion in bonds. It is the 15th-largest investor in Exxon.

“It seems nonsensical at best—and complicit at worst—for State Farm to carefully factor climate risk from wildfires into its homeowner’s insurance policies, refusing in some cases to provide such policies at all, while apparently ignoring the heightened climate risk that its investment portfolio is helping to create,” Sens. Sheldon Whitehouse (D-RI), Ron Wyden (D-OR), and Bernie Sanders (I-VT) wrote to State Farm in June 2023.

Other high-level investors include USAA, through its investing arm Victory Capital, at over $10 billion; AIG at over $9 billion; Nationwide at almost $7 billion; and Allstate at over $4 billion.

| Insurance Company | Shares (US$) | Bonds (US$) | # of Fossil Fuel Companies Invested In | Total Fossil Fuel Investments (US$) |

| Berkshire Hathaway (parent of GEICO) | $95.4 billion | $0.3 billion | 8 | 95.8 billion |

| State Farm | $10.7 billion | $9.9 billion | 65 | 20.6 billion |

| USAA (through Victory Capital) | $8 billion | $3.2 billion | 282 | 11.2 billion |

| AIG | $1.2 billion | $8.5 billion | 275 | 9.7 billion |

| Nationwide | 0 | $7.2 billion | 77 | 7.2 billion |

| Allstate | $7 million | $4.5 billion | 111 | 4.5 billion |

| Travelers | 0 | $1.9 billion | 49 | 1.9 billion |

| Liberty Mutual | 0 | $1.8 billion | 65 | 1.8 billion |

| The Hartford | $166 million | $1.2 billion | 91 | 1.3 billion |

Investing in Climate Chaos database by Urgewald. Data collected in May 2024. Figures rounded to first decimal.

Ready to find better insurance? Check out Green America’s new Climate Smart Insurance Directory